IGM Biosciences Inc (IGMS) Q1 2024 Earnings: Aligns with EPS Projections Amidst Clinical ...

Revenue: Reported Q1 2024 collaboration revenue of $0.5 million, falling short of the estimated $0.76 million.

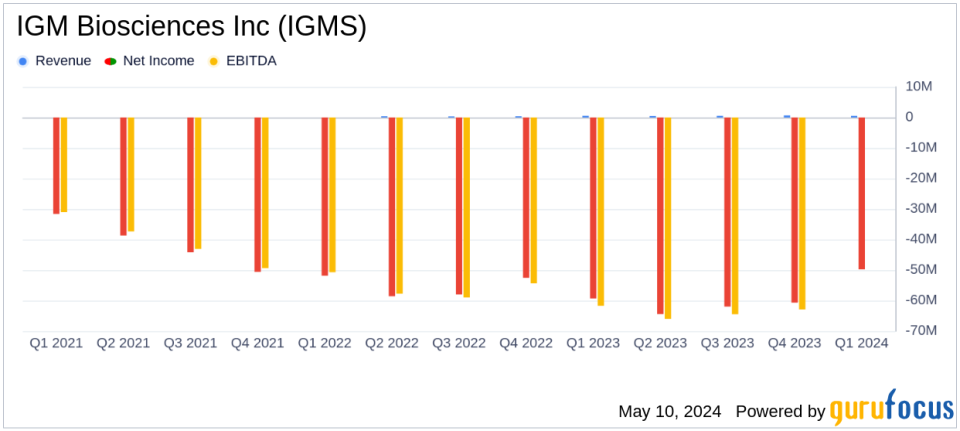

Net Loss: Q1 2024 net loss stood at $49.8 million, or -$0.83 per share, slightly above the estimated net loss of $50.28 million and EPS of -$0.83.

R&D Expenses: Research and Development expenses decreased to $43.8 million in Q1 2024 from $50.9 million in Q1 2023.

G&A Expenses: General and Administrative expenses reduced to $10.5 million in Q1 2024 from $13 million in the same quarter the previous year.

Cash Position: Cash and investments as of March 31, 2024, were $293.8 million, down from $337.7 million at the end of 2023.

2024 Financial Guidance: Expects full-year 2024 GAAP operating expenses between $210 million to $220 million and collaboration revenue of approximately $63 million.

Future Outlook: Anticipates ending 2024 with approximately $180 million in cash and investments, sufficient to fund operations into the second quarter of 2026.

IGM Biosciences Inc (NASDAQ:IGMS) disclosed its financial outcomes for the first quarter ended March 31, 2024, along with updates on its clinical pipeline, in its recent 8-K filing. The company, known for its pioneering work in engineered IgM antibodies aimed at treating cancer and autoimmune diseases, reported a net loss of $49.8 million, or $0.83 per share, aligning closely with analyst expectations.

About IGM Biosciences Inc

IGM Biosciences operates as a clinical-stage biotechnology firm focusing on the creation and development of IgM antibody therapeutics. Its innovative IgM antibody technology platform is designed to produce advanced treatments for cancer, infectious diseases, and autoimmune and inflammatory diseases. The company's notable product candidates include Aplitabart targeting colorectal cancer, Imvotamab for severe rheumatoid arthritis, and IGM-2644, a bispecific T cell engaging antibody for autoimmune diseases.

Financial Performance Overview

The company's financial health showed a net loss reduction from the previous year's $59.3 million, or $1.33 per share, to $49.8 million, or $0.83 per share, reflecting tighter control over operating expenses and ongoing R&D efforts. Research and Development (R&D) expenses were reported at $43.8 million, down from $50.9 million in the same quarter last year, indicating more efficient use of resources. General and Administrative (G&A) expenses also saw a decrease to $10.5 million from $13.0 million. These reductions contribute significantly to the company's strategic financial management amidst extensive clinical trials.

Clinical Pipeline Progress

The company achieved notable milestones in its clinical development programs. Enrollment targets were surpassed in the randomized colorectal cancer trial of Aplitabart, and the first dose cohort in the Imvotamab rheumatoid arthritis trial was completed. Such advancements not only demonstrate the potential of IGM Biosciences' pipeline but also enhance its credibility and investor confidence in its clinical strategies.

Future Outlook and Guidance

Looking ahead, IGM Biosciences anticipates full-year 2024 GAAP operating expenses to be between $210 million and $220 million, which includes significant non-cash stock-based compensation. The company expects to recognize substantial collaboration revenue of approximately $63 million for the full year, primarily from its strategic alliance with Sanofi. This forecasted revenue stems from the $150 million upfront payment received in 2022, which will bolster the financial position but not affect the cash balance. By the end of 2024, cash and investments are projected to stand at around $180 million, providing a runway extending into the second quarter of 2026.

Strategic Implications and Investor Insights

The financial and operational updates from IGM Biosciences underscore its commitment to advancing its clinical pipeline while maintaining fiscal prudence. The alignment of its Q1 2024 EPS with analyst estimates reflects a balanced approach to managing expansive clinical trials and stringent financial controls. For investors, these insights are crucial as they highlight both the potential clinical successes and the strategic financial stewardship of the company, positioning IGM Biosciences as a noteworthy entity in the biotechnology landscape.

For more detailed information and continuous updates on IGM Biosciences Inc, please visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from IGM Biosciences Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance