Progyny Inc (PGNY) Q1 2024 Earnings: Mixed Results Amid Market Challenges

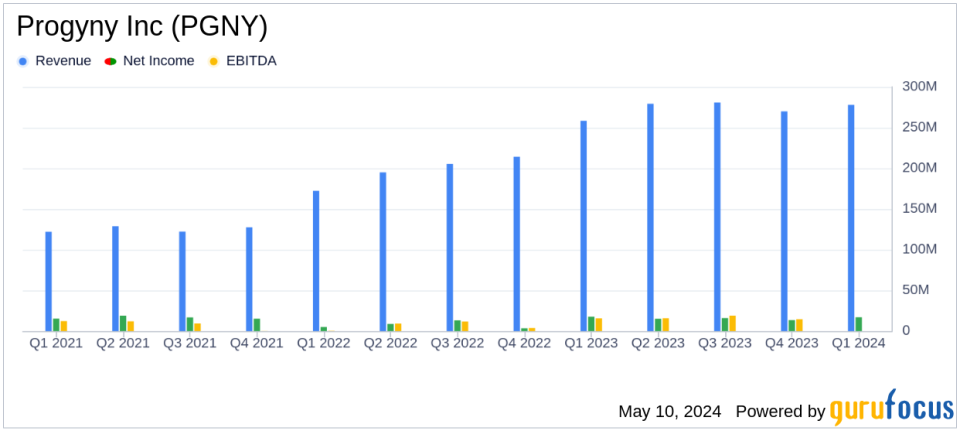

Revenue: $278.1 million, up 7.6% year-over-year from $258.4 million, falling short of estimates of $289.46 million.

Net Income: $16.9 million, a decrease from $17.7 million in the prior year, exceeding estimates of $16.46 million.

Earnings Per Share (EPS): Reported at $0.17 per diluted share, down from $0.18 year-over-year, surpassing the estimated $0.13.

Gross Margin: Slightly decreased to 22.4% from 22.7% in the prior year period.

Adjusted EBITDA: Increased to $50.3 million from $46.4 million, with the margin improving to 18.1% from 17.9%.

Operating Cash Flow: Increased to $25.7 million from $21.0 million in the prior year period.

Share Buyback: More than 720,000 shares repurchased under the buyback program initiated in February.

Progyny Inc (NASDAQ:PGNY), a leader in fertility and family building benefits solutions, disclosed its financial outcomes for the first quarter of 2024 on May 9, 2024, through its 8-K filing. The company reported a revenue of $278.1 million, aligning with analyst expectations and marking a 7.6% increase from the previous year's $258.4 million. However, net income slightly decreased to $16.9 million from $17.7 million in Q1 2023, resulting in earnings per diluted share of $0.17, compared to $0.18 a year earlier.

Company Overview

Based in New York, Progyny Inc specializes in providing comprehensive fertility and family building benefits solutions. The company's services are designed to support employers across various industries, offering treatments and access to a network of high-quality fertility specialists.

Financial Performance and Market Dynamics

The first quarter saw Progyny grappling with challenges such as a modest dip in March utilization rates, influenced by national discussions on fertility treatments and access to maternal healthcare. CEO Pete Anevski highlighted the impact of the Alabama Supreme Court ruling and a temporary unfavorable treatment mix shift on the company's revenue growth. Despite these hurdles, Progyny anticipates an acceleration in revenue growth for the remainder of 2024, bolstered by a robust sales pipeline and strategic partnerships.

Strategic Financial Movements

Progyny's financial health was supported by an increase in gross profit to $62.4 million, up from $58.6 million in the prior year, and a slight improvement in Adjusted EBITDA margin to 18.1%. The company also demonstrated its commitment to shareholder returns by purchasing over 720,000 shares as part of its buyback program initiated in February 2024.

Operational Highlights and Future Outlook

With 451 clients and an expanding coverage to 6.7 million lives by year-end, Progyny continues to strengthen its market position. The company's operational strategy is reflected in its robust cash flow from operations, which increased to $25.7 million from $21.0 million in the prior year period. Looking ahead, Progyny has adjusted its full-year 2024 revenue forecast to between $1,230 million and $1,270 million, with projected net income ranging from $68.4 million to $75.4 million.

Investor and Analyst Perspectives

During the earnings call, CFO Mark Livingston and CEO Pete Anevski provided insights into Progyny's strategic initiatives and financial health. The management's commentary underscored a cautious yet optimistic outlook for the remainder of the year, focusing on expanding client base and enhancing operational efficiencies.

In summary, while Progyny Inc faced some operational challenges in Q1 2024, its strategic initiatives and strong market positioning continue to support its growth trajectory. Investors and analysts will be watching closely how the company navigates the evolving healthcare landscape and capitalizes on its growth opportunities in the upcoming quarters.

Conference Call and Additional Information

Progyny will host a detailed discussion of its quarterly results and outlook in a conference call on May 9, 2024. Further details can be accessed through the company's Investor Relations website.

For more detailed financial analysis and future updates on Progyny Inc, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Progyny Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance