F&G Annuities & Life Inc (FG) Q1 2024 Earnings: Misses EPS Estimates, Shows Robust ...

Net Earnings: Reported $111 million for Q1 2024, a significant recovery from a net loss of $195 million in Q1 2023, below the estimated $124.50 million.

Earnings Per Share (EPS): Achieved $0.88 per diluted share, below the estimated $1.01, improving from a loss of $1.56 per share in the previous year's quarter.

Adjusted Net Earnings: Increased to $108 million or $0.86 per share in Q1 2024 from $61 million or $0.49 per share in Q1 2023.

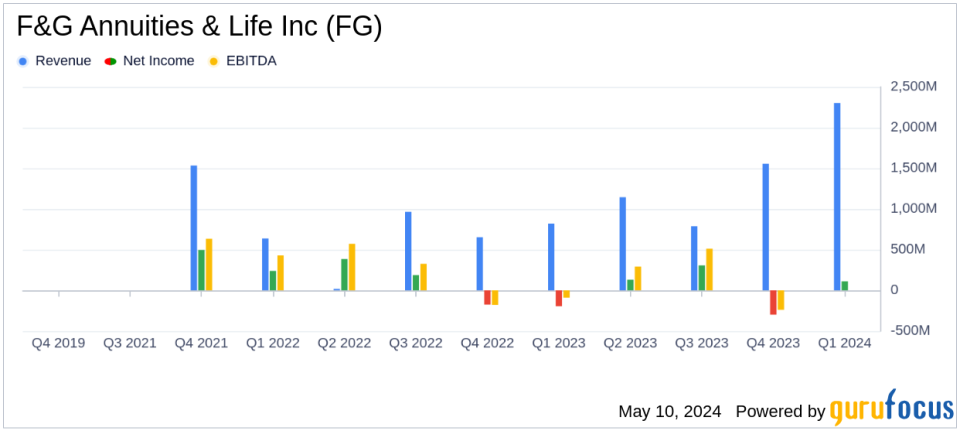

Revenue: Total revenue reached $1,569 million, showing robust growth from $869 million in Q1 2023, surpassing the estimated $1,167.50 million.

Assets Under Management (AUM): Grew by 10% to a record $49.8 billion as of March 31, 2024, up from $45.3 billion in the prior year quarter.

Gross Sales: Increased by 6% to $3.5 billion in Q1 2024, driven by strong retail channel sales and robust institutional market sales.

Dividends: Paid common dividends of $0.21 per share, totaling $26 million during the quarter.

F&G Annuities & Life Inc (NYSE:FG) released its 8-K filing on May 8, 2024, detailing the financial results for the first quarter ended March 31, 2024. The company, a prominent provider of insurance solutions, reported a significant turnaround with net earnings of $111 million, or $0.88 per diluted share, a stark contrast to the net loss of $195 million, or $1.56 per share, in the same quarter of the previous year.

Company Overview

F&G Annuities & Life Inc operates through its subsidiaries, offering a diverse portfolio of insurance products including fixed indexed annuities, multi-year guarantee annuities, immediate annuities, and indexed universal life insurance. The company also provides institutional clients with funding agreements and pension risk transfer solutions.

Financial Highlights and Performance Metrics

The reported earnings included $17 million of net favorable mark-to-market effects and were offset by $14 million of other unfavorable items. When adjusted for these factors, the adjusted net earnings were $108 million, or $0.86 per share, improving from $61 million, or $0.49 per share in Q1 2023. This growth was underpinned by a robust increase in gross sales which totaled $3.5 billion, marking a 6% year-over-year increase, driven by strong performance in both retail and institutional channels.

Assets under management (AUM) saw a notable increase to $49.8 billion as of March 31, 2024, up 10% from $45.3 billion in the prior year, reflecting new business flows and stable retention. The company also highlighted a record $58.0 billion in AUM before flow reinsurance, up 18% from the previous year.

Balance Sheet and Capital Management

The balance sheet remained robust with total equity attributable to common shareholders, excluding accumulated other comprehensive income (AOCI), standing at $5.2 billion. The book value per common share, excluding AOCI, was $41.10 as of March 31, 2024, showing a slight increase from $40.42 at the end of 2023.

During the quarter, F&G paid common dividends of $0.21 per share totaling $26 million. Additionally, a significant capital infusion was noted with a $250 million investment from Fidelity National Financial, Inc. (FNF), aimed at supporting asset growth.

Strategic Insights and Forward Outlook

Chris Blunt, President and CEO of F&G, expressed confidence in the company's trajectory, citing record AUM and strong sales growth. He emphasized the potential of the newly launched RILA product to significantly contribute to future sales, supported by strong distribution partnerships.

Analysis and Industry Context

Despite the positive turnaround in net earnings and growth in AUM, F&G's earnings per share of $0.88 missed the analyst estimate of $1.01 per share for the quarter. However, the company's strategic initiatives and robust asset management suggest a strong foundation for sustained growth. The insurance industry, characterized by its competitive and dynamic nature, continues to evolve with increasing focus on diversified investment portfolios and strategic capital management, areas where F&G is positioning itself strongly.

This comprehensive performance, coupled with strategic investments and product expansions, aligns F&G Annuities & Life Inc well for leveraging upcoming market opportunities, despite the slight miss on EPS expectations for the quarter.

Conclusion

F&G Annuities & Life Inc's first quarter of 2024 reflects a resilient operational and financial posture, marked by significant recovery in net earnings and strategic capital enhancements. As the company continues to execute its growth strategies, it remains a noteworthy entity in the insurance sector for investors and market watchers.

Explore the complete 8-K earnings release (here) from F&G Annuities & Life Inc for further details.

This article first appeared on GuruFocus.