Light & Wonder Inc Surpasses Quarterly Revenue Expectations with Robust Growth Across All ...

Consolidated Revenue: $756 million, a 13% increase year-over-year,

surpassingnot meeting estimates of $792.76 million.Net Income: $82 million, significantly up from $27 million in the prior year,

exceedingbelow estimates of $88.61 million.Earnings Per Share (EPS): Details not provided in the text, comparison to estimated EPS of $0.95 not possible.

Free Cash Flow: Increased to $93 million from $74 million year-over-year, indicating strong earnings and cash generation capabilities.

Gaming Segment Revenue: Grew by 14% to $476 million, driven by a 30% increase in Gaming machine sales.

SciPlay and iGaming Revenues: Both segments achieved quarterly revenue records with 11% and 14% growth respectively, demonstrating robust performance in digital offerings.

Capital Expenditures: Rose to $66 million from $53 million in the prior year, reflecting continued investment in operational growth.

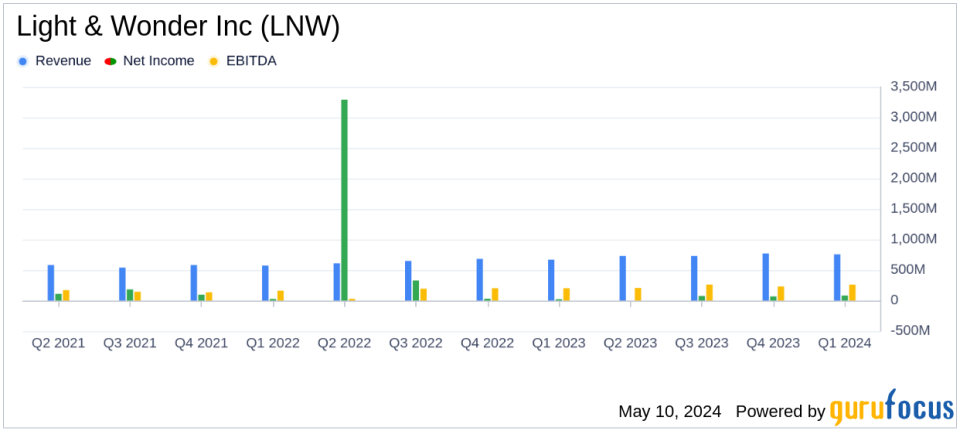

On May 8, 2024, Light & Wonder Inc (NASDAQ:LNW) released its 8-K filing, announcing a significant 13% year-over-year increase in consolidated revenue for the first quarter ended March 31, 2024. This marks the 12th consecutive quarter of revenue growth, highlighting the company's strong performance across its diverse business segments.

Company Overview

Light & Wonder Inc, a leading manufacturer of electronic gaming machines and a major player in the gaming industry, operates globally across various jurisdictions. The company competes with giants like International Game Technology and Aristocrat Leisure. Light & Wonder's portfolio includes SciPlay, which contributes significantly to its revenue through mobile social casino games, and an emerging iGaming business that provides digital content to real-money gaming providers.

Financial Highlights and Segment Performance

The company reported a robust total revenue of $756 million for the quarter, up from $670 million in the previous year, driven by strong sales in gaming machines and record revenues in SciPlay and iGaming segments. Notably, gaming revenue soared to $476 million, a 14% increase, primarily due to a 30% growth in gaming machine sales. SciPlay's revenue increased by 11% to $206 million, and iGaming revenue grew by 14% to $74 million, both setting new quarterly records.

Net income for the quarter was impressive at $82 million compared to $27 million in the prior year, reflecting higher revenue and consistent margin strength. The company also reported a Consolidated Adjusted EBITDA of $281 million, up 13% year-over-year, and a free cash flow of $93 million, indicating strong cash generation capabilities.

Strategic Initiatives and Capital Management

President and CEO Matt Wilson highlighted the ongoing momentum and the impact of strategic initiatives, including key hardware and content launches planned for the year. CFO Oliver Chow emphasized the company's healthy financial trajectory and mentioned the continuation of the share repurchase program, with $25 million returned to shareholders during the quarter.

Light & Wonder's leverage remained well within management targets with a net debt leverage ratio of 3.0x. The company's commitment to strategic capital allocation and its robust product portfolio are expected to drive sustainable growth.

Operational and Market Challenges

Despite the positive outcomes, Light & Wonder faces challenges such as market competition, regulatory changes, and economic conditions that could impact its operational and financial performance. The company's ability to maintain its growth momentum amidst these challenges will be crucial for long-term success.

Conclusion

Light & Wonder Inc's first-quarter results demonstrate a solid start to 2024, with significant revenue growth and strong operational performance across all business segments. The company's strategic initiatives and effective capital management are likely to support its continued success in the competitive gaming industry landscape.

For detailed insights and further information, investors and stakeholders are encouraged to view the full earnings report and financial statements available through the SEC and ASX filings.

Explore the complete 8-K earnings release (here) from Light & Wonder Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance