Watts Water Technologies Surpasses Q1 Earnings Estimates with Record Results

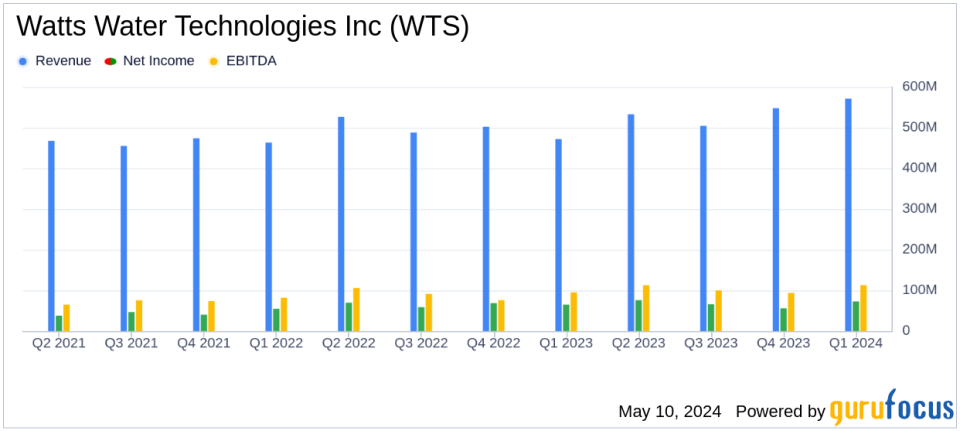

Revenue: Reported at $570.9 million, marking a 21% increase year-over-year, below estimates of $590.14 million.

Net Income: Achieved $72.6 million, up 12% from the prior year, falling short of the estimated $78.13 million.

Earnings Per Share (EPS): Recorded at $2.17 on a diluted basis, below the estimated $2.36.

Adjusted EPS: Reported at $2.33, reflecting a 21% increase year-over-year and slightly below the estimated $2.36.

Gross Profit: Increased to $267.5 million from $218.1 million in the previous year, indicating improved profitability.

Operating Income: Grew to $96.7 million, up from $84.7 million, showing stronger operational efficiency.

Dividends: Declared at $0.36 per share, up from $0.30 per share in the previous year, demonstrating a commitment to returning value to shareholders.

On May 8, 2024, Watts Water Technologies Inc (NYSE:WTS) announced a robust start to the year, reporting record results for the first quarter of 2024 that exceeded analyst expectations. The detailed earnings report, disclosed in their 8-K filing, highlights significant growth in sales, net income, and earnings per share (EPS).

Watts Water Technologies Inc, a leading global manufacturer of plumbing, heating, and water quality products, has demonstrated remarkable financial resilience and operational excellence. The company's comprehensive product portfolio addresses critical areas such as water safety, energy efficiency, and water conservation, catering to both residential and commercial markets predominantly in the Americas and EMEA (Europe, the Middle East, and Africa).

Financial Performance Highlights

For the quarter ended March 31, 2024, Watts Water Technologies reported a 21% increase in sales to $570.9 million, up from $471.7 million in the first quarter of 2023. This growth significantly outpaced the estimated revenue of $590.14 million. Net income also saw a healthy rise, reaching $72.6 million, a 12% increase from the previous year's $64.7 million, and surpassing the estimated net income of $78.13 million. Diluted net income per share rose to $2.17, compared to $1.93 in the same period last year, aligning closely with the estimated earnings per share of $2.36.

Adjusted earnings per share, which accounts for special items, stood at $2.33, showing a robust increase of 21% from $1.92 in the first quarter of 2023. This performance underscores the company's effective management and strategic initiatives, which have continued to enhance shareholder value.

Operational and Strategic Developments

CEO Robert J. Pagano Jr. expressed satisfaction with the quarter's outcomes, attributing the success to the dedication of the Watts team and effective integration of recent acquisitions such as Bradley Corporation, Josam Company, and Enware. These integrations are progressing well, strengthening Watts' market position and enhancing its product offerings.

The company's operational strength is further evidenced by its robust cash flow, which supports strategic investments, shareholder returns, and long-term corporate strategies. This financial flexibility has prompted Watts to raise its full-year 2024 outlook, with organic sales growth now expected to range from -4% to +1%, and adjusted operating margin projected between 17.1% to 17.7%.

Challenges and Market Outlook

Despite the positive performance, Watts Water Technologies remains cautious about macro-economic conditions and market volatility. The company is well-prepared to navigate potential challenges with its strong balance sheet, strategic planning, and continued focus on innovation and market expansion.

The upcoming annual meeting of stockholders, scheduled for May 22, 2024, is expected to further outline the companys strategy and outlook for the remainder of the year.

In conclusion, Watts Water Technologies Inc's first quarter results not only demonstrate a solid start to 2024 but also highlight the company's capacity to exceed market expectations and adapt strategically to evolving market dynamics. Investors and stakeholders may look forward to sustained growth and profitability as the company continues to execute its strategic initiatives effectively.

Explore the complete 8-K earnings release (here) from Watts Water Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance