Dropbox Inc (DBX) Q1 2024 Earnings: Surpasses Revenue Estimates with Strong Profitability

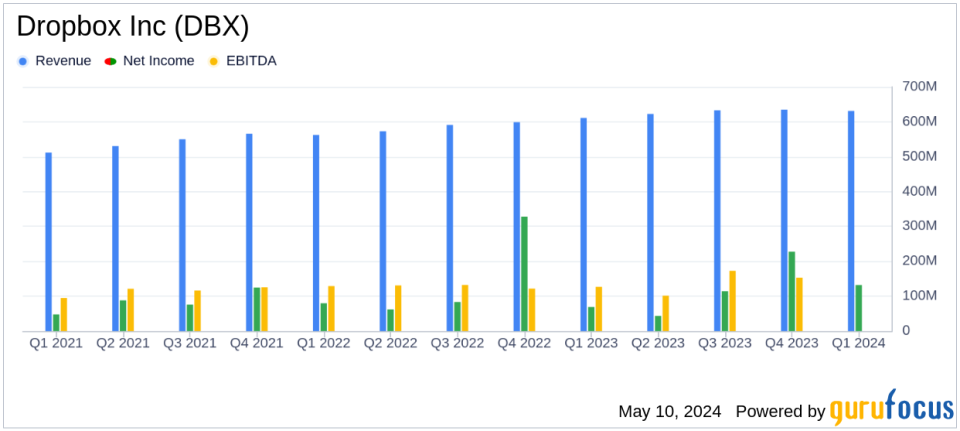

Revenue: $631.3 million, up 3.3% year-over-year, slightly exceeded estimates of $628.67 million.

Net Income: GAAP net income was $132.3 million, significantly below estimates of $169.95 million.

EPS: Non-GAAP diluted net income per share was $0.58, surpassing the estimated $0.50.

Free Cash Flow: Reported at $166.3 million, showing strong liquidity and operational efficiency.

Gross Margin: Non-GAAP gross margin improved to 84.6%, up from 82.4% the previous year, reflecting better cost management.

Operating Margin: Non-GAAP operating margin increased to 36.5% from 28.6% year-over-year, indicating enhanced operational effectiveness.

Paying Users: Grew to 18.16 million from 17.90 million a year earlier, with average revenue per paying user rising to $139.59.

On May 9, 2024, Dropbox Inc (NASDAQ:DBX) released its first-quarter earnings for fiscal year 2024, revealing a notable increase in revenue and profitability. The 8-K filing details a quarter of solid performance underscored by strategic product updates and a focus on AI-powered solutions for distributed work environments.

Company Overview

Founded in 2007, Dropbox is a leader in cloud storage and content collaboration tools. The company has evolved beyond simple cloud storage, offering a suite of services that facilitate secure and efficient data handling and collaboration across various platforms and devices. With over 700 million registered users globally, Dropbox continues to focus on innovation and strategic growth in the evolving digital landscape.

Financial Highlights

Dropbox reported a revenue of $631.3 million for the first quarter, marking a 3.3% increase year-over-year and slightly exceeding the analyst's expectation of $628.67 million. This growth is attributed to both organic strategies and recent product enhancements aimed at improving user experience and security.

The company's GAAP operating margin improved significantly to 22.7% from 13.8% in the previous year, while the Non-GAAP operating margin saw an increase to 36.5% from 28.6%. These margins reflect Dropbox's effective cost management and operational efficiency. Net income also saw a substantial rise, with GAAP net income reaching $132.3 million, up from $69.0 million year-over-year, and Non-GAAP net income growing to $196.7 million from $146.1 million.

Operational Efficiency and User Growth

Dropbox's operational success can be seen in its increased net cash from operating activities, which rose to $175.5 million from $139.9 million in the prior year. The company also reported a healthy free cash flow of $166.3 million, up from $138.0 million, indicating robust financial health and operational efficiency.

The total annual recurring revenue (ARR) reached $2.556 billion, a 3.6% increase year-over-year. The number of paying users grew to 18.16 million from 17.90 million, and the average revenue per paying user increased slightly, indicating successful user retention and monetization strategies.

Strategic Focus and Future Outlook

CEO Drew Houston highlighted the company's commitment to enhancing product offerings through AI and machine learning, aiming to improve distributed work dynamics. The strategic focus remains on disciplined operations and targeted growth initiatives, which are expected to drive future performance and shareholder value.

Dropbox's forward-looking statements suggest a continued emphasis on innovation and market expansion, particularly in AI-driven solutions. The company plans to discuss detailed future guidance in its upcoming conference call and maintains an optimistic outlook on its ability to leverage technology trends.

Conclusion

Dropbox's Q1 2024 results demonstrate a company that is not only growing in terms of revenue and profitability but also strategically positioning itself for future advancements in technology and work dynamics. For investors, Dropbox presents a compelling narrative of growth, innovation, and financial prudence.

For detailed financial figures and future projections, interested parties are encouraged to view the full earnings report and tune into the upcoming investor conference calls detailed on Dropbox's investor relations website.

Explore the complete 8-K earnings release (here) from Dropbox Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance