RB Global Inc. (RBA) Q1 2024 Earnings: Strong Growth and Positive Adjustments in Financial Outlook

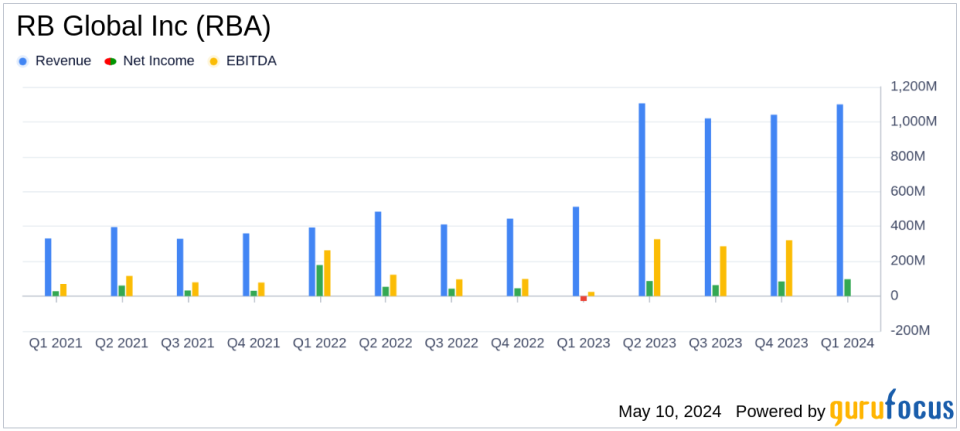

Total Revenue: Reached $1.1 billion, up 108% year-over-year, surpassing the estimate of $998.31 million.

Net Income: Increased to $107.4 million, falling short of the quarterly estimate of $117.69 million.

Earnings Per Share (EPS): Reported at $0.53, falling short of the estimated $0.70.

Adjusted EBITDA: Rose to $331.0 million, marking a 150% increase from the previous year.

Service Revenue: Grew by 147% to $849.1 million, driven by robust performance in the automotive sector.

Gross Transaction Value (GTV): Surged by 115% to $4.1 billion, reflecting strong sales growth across sectors.

Dividend: Announced a quarterly cash dividend of $0.27 per common share, payable on June 20, 2024.

RB Global Inc. (NYSE:RBA), a leader in the auction and sale of industrial and commercial assets, announced its first quarter earnings for 2024 on May 9, revealing substantial growth and upward revisions in its financial projections. The detailed earnings can be accessed through RB Global's recent 8-K filing.

RB Global operates the world's largest auction for heavy equipment, with a significant presence in over 12 countries through more than 40 live auction sites and various online platforms such as IronPlanet and Marketplace-E. The company's diverse operations cover a wide range of sectors including construction, agriculture, and transportation.

Financial Performance Highlights

The first quarter of 2024 was marked by a remarkable increase in Gross Transaction Value (GTV), which soared by 115% year-over-year to $4.1 billion, including a significant contribution from IAA. Total revenue followed suit, jumping by 108% to reach $1.1 billion. This includes $588.6 million from IAA, underscoring the successful integration of this acquisition into RB Global's operations.

Service revenue experienced a dramatic rise of 147% compared to the previous year, totaling $849.1 million, with $516.9 million attributed to IAA. The company also reported a substantial increase in net income available to common stockholders, which surged by 384% to $97.1 million. Diluted earnings per share saw a significant rise, increasing by 289% to $0.53, while adjusted diluted earnings per share grew by 58% to $0.90.

Operational and Strategic Developments

RB Global's operational success in Q1 2024 was driven by robust performance across its sectors, particularly in automotive and commercial construction. The automotive sector alone saw a GTV increase of 537%, demonstrating the company's strong market position and operational efficiency. The increase in service revenue take rate to 20.8%, up from 18.1% the previous year, reflects a higher average buyer fee rate and growth in marketplace services revenue.

The company's strategic focus on integrating IAA has yielded considerable financial benefits, contributing significantly to the revenue and earnings growth. This integration aligns with RB Global's goal of expanding its digital and global footprint in the marketplace for commercial assets and vehicles.

Updated Financial Outlook and Investor Confidence

Encouraged by the strong performance in the first quarter, RB Global has revised its 2024 financial outlook upwards. Adjusted EBITDA expectations have been raised from the previous range of $1,170 million to $1,230 million, to a new range of $1,200 million to $1,260 million. This adjustment reflects the company's confidence in its operational capabilities and market strategy.

RB Global's commitment to shareholder returns remains strong, as evidenced by the declaration of a quarterly cash dividend of $0.27 per common share, payable in June 2024. This move, coupled with participation in upcoming investor conferences, signals the company's proactive approach in engaging with the investor community and reinforcing confidence in its financial health and strategic direction.

Conclusion

RB Global's first quarter results for 2024 highlight a period of significant financial and operational success, characterized by robust growth in revenues and earnings, effective integration of strategic acquisitions, and a positive revision of financial forecasts. These achievements not only demonstrate RB Global's strong market position but also its ability to adapt and thrive in a dynamic economic environment. Moving forward, the company appears well-positioned to sustain its growth trajectory and continue delivering value to its shareholders.

For further details on RB Global's financial performance and strategic initiatives, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from RB Global Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance