Enbridge Inc (ENB) Q1 2024 Earnings: Surpasses EPS Forecasts with Strategic Expansion

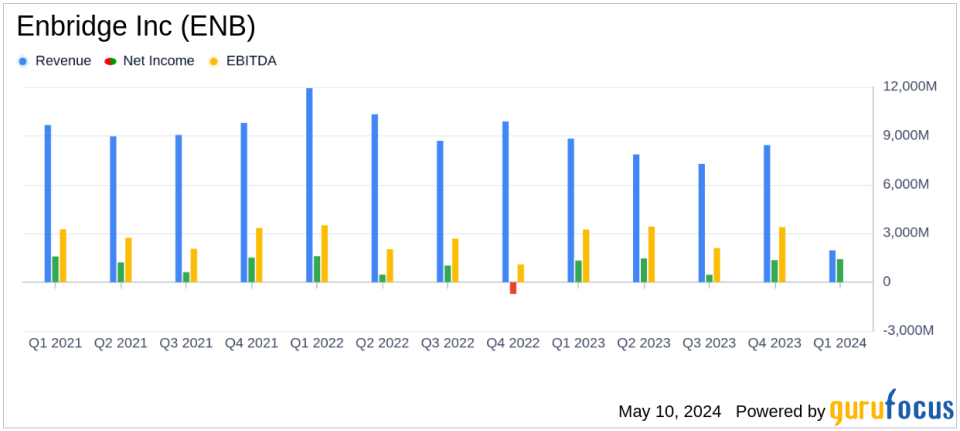

Adjusted Earnings: Reported at $1.955 billion, surpassing the estimated $1.726 billion, marking an increase from the previous year.

Adjusted Earnings Per Share: Achieved $0.92, exceeding the estimated $0.85, reflecting an 8% increase year-over-year.

Adjusted EBITDA: Reached $4.954 billion, an 11% increase from the previous year's $4.468 billion.

Distributable Cash Flow: Grew to $3.463 billion, up 9% from $3.180 billion in the previous year, driven by strong operational performance.

GAAP Earnings: Fell to $1.419 billion from $1.733 billion year-over-year, influenced by non-operating factors including a significant derivative fair value loss.

Revenue and Net Income: Specific figures for quarterly revenue and net income were not disclosed, focusing instead on adjusted earnings metrics.

Strategic Developments: Advanced key projects including the acquisition of The East Ohio Gas Company and approvals for Mainline Tolling Settlement, enhancing infrastructure and market position.

On May 10, 2024, Enbridge Inc (NYSE:ENB) disclosed its first-quarter financial results for 2024, delivering a robust performance with significant strategic advancements. The company, a key player in the North American energy sector, owns and operates an extensive network of pipelines transporting hydrocarbons across the US and Canada, alongside a regulated natural gas utility and a growing portfolio in renewable energy projects.

Enbridge's earnings report, detailed in its 8-K filing, highlights a quarter of record financial results and reaffirms its financial guidance for 2024. The company reported first-quarter GAAP earnings of $1.4 billion, or $0.67 per common share, an increase from the previous year's $0.86 per share. Adjusted earnings rose to $2.0 billion, or $0.92 per common share, surpassing analyst expectations of $0.60 per share.

Financial Performance and Strategic Developments

Enbridge's adjusted EBITDA for the quarter stood at $5.0 billion, up 11% from $4.5 billion in the previous year, driven by high utilization across its operations and recent strategic acquisitions, including the notable purchase of The East Ohio Gas Company. This acquisition aligns with Enbridges expansion strategy, enhancing its footprint in the US gas utilities sector.

The company also highlighted the closure of its divestiture of interests in Alliance Pipeline and Aux Sable, fetching $3.1 billion, which was strategically reinvested into acquisitions and debt reduction. Additionally, Enbridge has made significant progress in its renewable energy and natural gas projects, which are expected to contribute positively to its mid-term financial outlook.

Challenges and Market Adaptations

Despite facing challenges such as fluctuating market demands and regulatory adjustments, Enbridge has demonstrated resilience by maintaining strong operational performance and advancing its strategic priorities. The approval of the Mainline Tolling Settlement by the Canada Energy Regulator marks a significant regulatory success, ensuring stable and predictable revenue streams from its mainline system operations.

Outlook and Strategic Priorities

Looking ahead, Enbridge remains committed to its long-term strategy of delivering shareholder value through stable, utility-like earnings. The company's focus on disciplined capital allocation and low-risk growth opportunities is expected to support sustained financial performance and shareholder returns.

President and CEO Greg Ebel expressed confidence in the company's strategic direction, stating, "We are on track to achieve our full-year EBITDA and DCF per share guidance, supported by strong operational performance and execution." This sentiment underscores Enbridge's robust foundational strategies and operational excellence.

In conclusion, Enbridge's first-quarter results for 2024 not only exceeded earnings expectations but also highlighted the company's strategic agility in navigating market dynamics and regulatory environments. With a series of successful acquisitions and project advancements, Enbridge is well-positioned to maintain its growth trajectory and strengthen its market leadership in the energy sector.

Explore the complete 8-K earnings release (here) from Enbridge Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance