News Corp (NASDAQ:NWSA) Misses Q1 Sales Targets

Global media and publishing company News Corp (NASDAQ:NWSA) missed analysts' expectations in Q1 CY2024, with revenue flat year on year at $2.42 billion. It made a GAAP profit of $0.05 per share, down from its profit of $0.09 per share in the same quarter last year.

Is now the time to buy News Corp? Find out in our full research report.

News Corp (NWSA) Q1 CY2024 Highlights:

Revenue: $2.42 billion vs analyst estimates of $2.45 billion (1% miss)

EPS: $0.05 vs analyst expectations of $0.08 (41.1% miss)

Gross Margin (GAAP): 48.9%, up from 47.4% in the same quarter last year

Free Cash Flow of $422 million, up from $7.71 million in the previous quarter

Market Capitalization: $14.08 billion

Established in 2013 after a restructuring, News Corp (NASDAQ:NWSA) is a multinational conglomerate known for its news publishing, broadcasting, digital media, and book publishing.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

Sales Growth

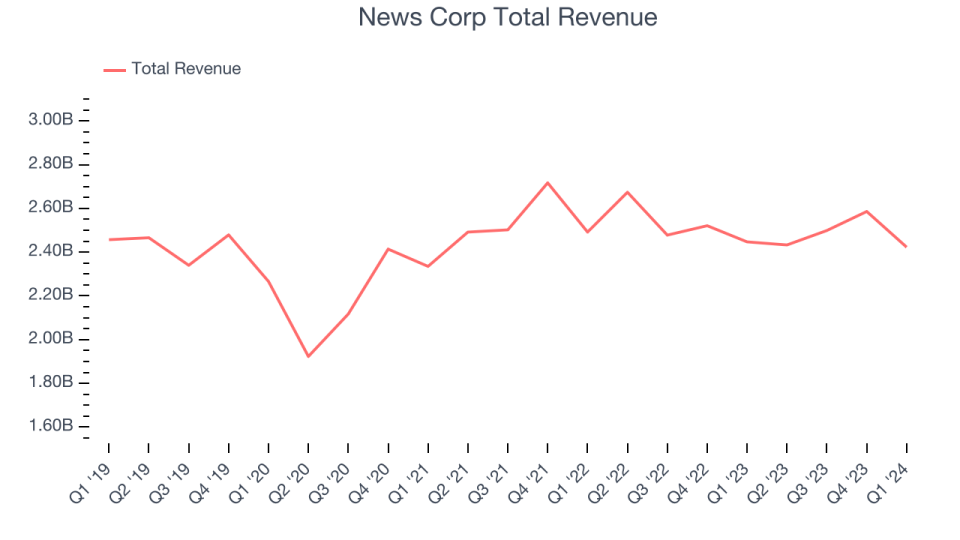

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. News Corp's revenue was flat over the last five years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. News Corp's recent history shows a reversal from its five-year trend as its revenue has shown annualized declines of 1.3% over the last two years.

We can better understand the company's revenue dynamics by analyzing its three most important segments: Dow Jones, News Media, and Book Publishing, which are 22.5%, 21.9%, and 20.9% of revenue. Over the last two years, News Corp's Dow Jones revenue (media subsidiary) averaged 8.6% year-on-year growth while its News Media (general media) and Book Publishing (general publishing) revenues averaged declines of 3.7% and 3%.

This quarter, News Corp missed Wall Street's estimates and reported a rather uninspiring 1% year-on-year revenue decline, generating $2.42 billion of revenue. Looking ahead, Wall Street expects sales to grow 3.4% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

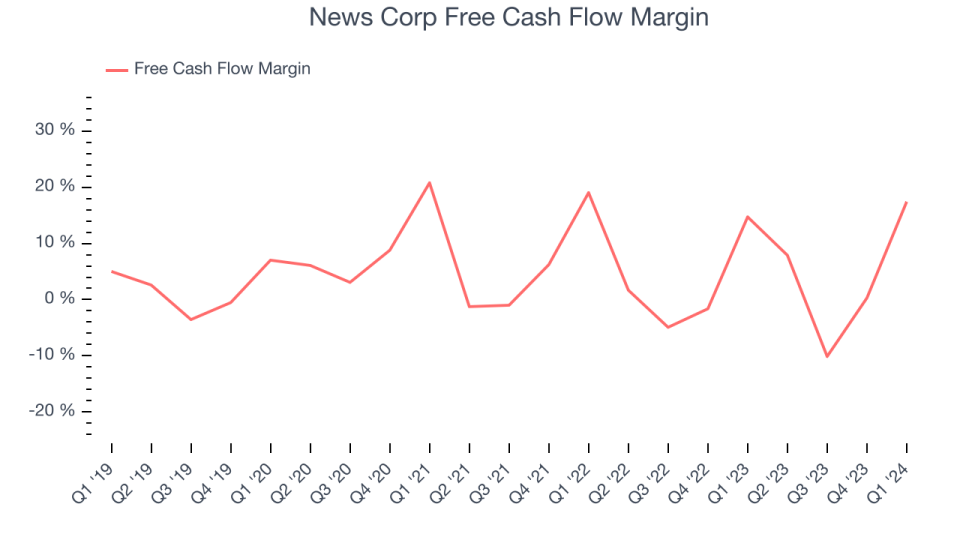

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, News Corp has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 3%, subpar for a consumer discretionary business.

News Corp's free cash flow came in at $422 million in Q1, equivalent to a 17.4% margin and up 17.2% year on year.

Key Takeaways from News Corp's Q1 Results

We struggled to find many strong positives in these results. Its EPS missed and its News Media revenue fell short of Wall Street's estimates. Overall, this was a bad quarter for News Corp. The company is down 1.2% on the results and currently trades at $23.85 per share.

News Corp may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance