SunOpta (NASDAQ:STKL) Delivers Impressive Q1, Guides For Strong Full-Year Sales

Plant-based food and beverage company SunOpta (NASDAQGS:STKL) beat analysts' expectations in Q1 CY2024, with revenue down 18.3% year on year to $182.8 million. The company's full-year revenue guidance of $700 million at the midpoint also came in 2.3% above analysts' estimates. It made a non-GAAP profit of $0.02 per share, down from its profit of $0.04 per share in the same quarter last year.

Is now the time to buy SunOpta? Find out in our full research report.

SunOpta (STKL) Q1 CY2024 Highlights:

Revenue: $182.8 million vs analyst estimates of $168.9 million (8.3% beat)

EPS (non-GAAP): $0.02 vs analyst expectations of $0.02 (in line)

The company lifted its revenue guidance for the full year from $685 million to $700 million at the midpoint, a 2.2% increase

Gross Margin (GAAP): 17.4%, up from 15.2% in the same quarter last year

Free Cash Flow was -$2.28 million compared to -$4.42 million in the previous quarter

Sales Volumes were up 23.5% year on year

Market Capitalization: $679.2 million

“SunOpta’s first quarter performance was defined by excellent revenue growth across our portfolio of products, customers, and channels, which continue to see healthy, broad-based demand,” said Brian Kocher, Chief Executive Officer of SunOpta.

Committed to clean-label foods, SunOpta (NASDAQGS:STKL) is a sustainability-focused food and beverage company specializing in the sourcing, processing, and packaging of natural and organic products.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

SunOpta is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

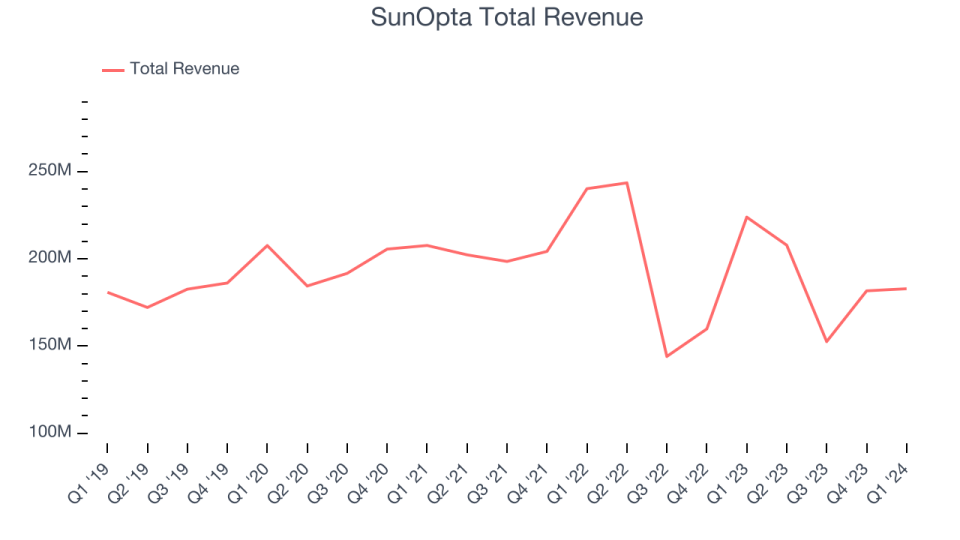

As you can see below, the company's revenue has declined over the last three years, dropping 2.8% annually. This is among the worst in the consumer staples industry, where demand is typically stable.

This quarter, SunOpta's revenue fell 18.3% year on year to $182.8 million but beat Wall Street's estimates by 8.3%. Looking ahead, Wall Street expects revenue to decline 3.4% over the next 12 months.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

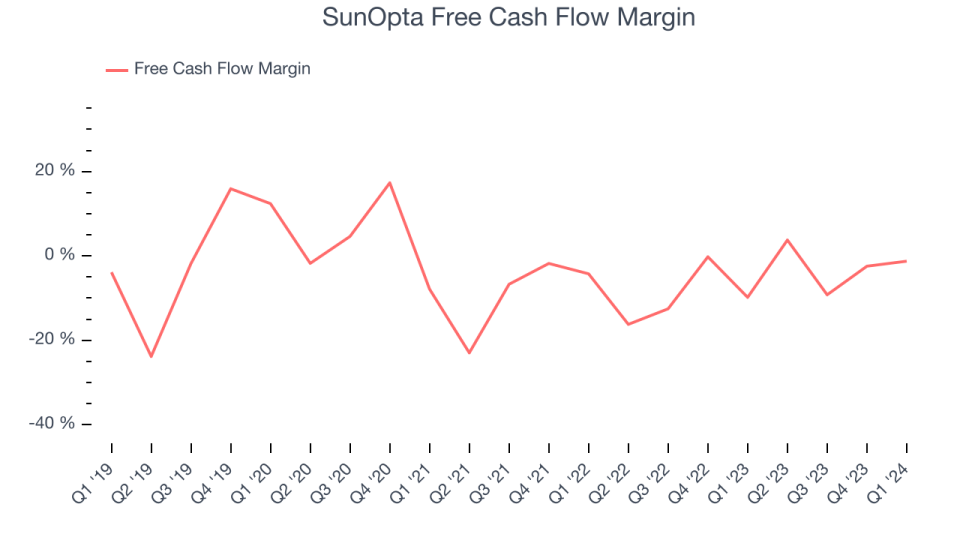

SunOpta burned through $2.28 million of cash in Q1, representing a negative 1.2% free cash flow margin. The company increased its cash burn by 89.6% year on year.

Over the last two years, SunOpta's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer staples sector, averaging negative 6.2%. However, its margin has averaged year-on-year increases of 8.6 percentage points over the last 12 months, showing the company is at least improving.

Key Takeaways from SunOpta's Q1 Results

We were impressed by how significantly SunOpta blew past analysts' revenue expectations this quarter. We were also glad its full-year revenue guidance came in higher than Wall Street's estimates. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 3.7% after reporting and currently trades at $5.85 per share.

SunOpta may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.