ACV Auctions (NASDAQ:ACVA) Posts Better-Than-Expected Sales In Q1 But Quarterly Guidance Underwhelms

Online used car auction platform ACV Auctions (NASDAQ:ACVA) reported Q1 CY2024 results topping analysts' expectations , with revenue up 21.8% year on year to $145.7 million. On the other hand, next quarter's revenue guidance of $156 million was less impressive, coming in 1.2% below analysts' estimates. It made a GAAP loss of $0.13 per share, down from its loss of $0.11 per share in the same quarter last year.

Is now the time to buy ACV Auctions? Find out in our full research report.

ACV Auctions (ACVA) Q1 CY2024 Highlights:

Revenue: $145.7 million vs analyst estimates of $144 million (1.2% beat)

EPS: -$0.13 vs analyst expectations of -$0.09 (44% miss)

Revenue Guidance for Q2 CY2024 is $156 million at the midpoint, below analyst estimates of $157.9 million

The company reconfirmed its revenue guidance for the full year of $617.5 million at the midpoint

Gross Margin (GAAP): 26.8%, up from 20.3% in the same quarter last year

Free Cash Flow of $34.39 million is up from -$33.83 million in the previous quarter

Marketplace Units: 174,631, up 23,068 year on year

Market Capitalization: $2.93 billion

“We are very pleased with our strong first quarter results with revenue at the high-end of our guidance range, strong year-over-year margin expansion, and Adjusted EBITDA at the high-end of guidance range, resulting in our first profitable quarter as a public company, on a non-GAAP basis,” said George Chamoun, CEO of ACV.

Founded in 2014, ACV Auctions (NASDAQ:ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

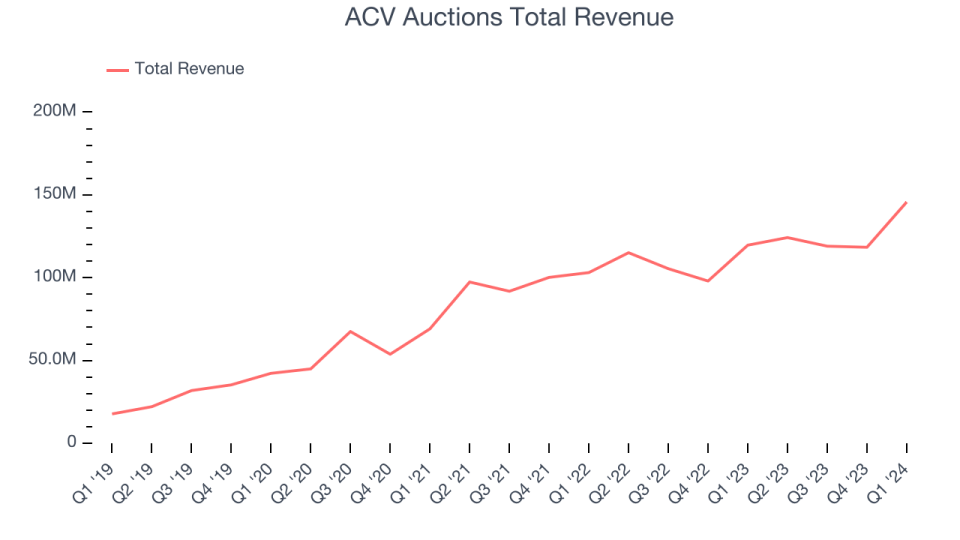

Sales Growth

ACV Auctions's revenue growth over the last three years has been very strong, averaging 33.2% annually. This quarter, ACV Auctions beat analysts' estimates and reported decent 21.8% year-on-year revenue growth.

Guidance for the next quarter indicates ACV Auctions is expecting revenue to grow 25.6% year on year to $156 million, improving from the 7.9% year-on-year increase it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 28.5% over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

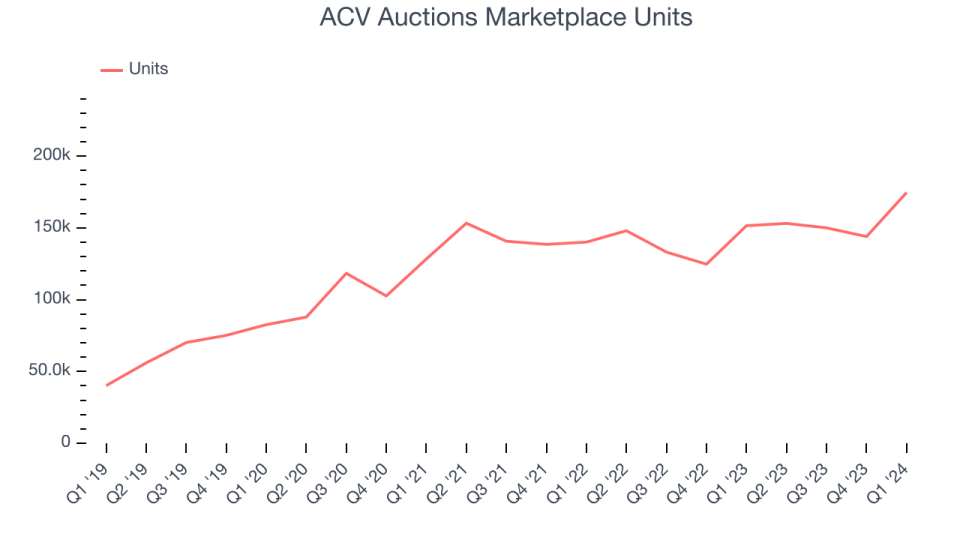

Usage Growth

As an online marketplace, ACV Auctions generates revenue growth by increasing both the number of units on its platform and the average order size in dollars.

Over the last two years, ACV Auctions's units sold, a key performance metric for the company, grew 4.5% annually to 174,631. This growth lags behind the hottest consumer internet apps.

In Q1, ACV Auctions added 23,068 units sold, translating into 15.2% year-on-year growth.

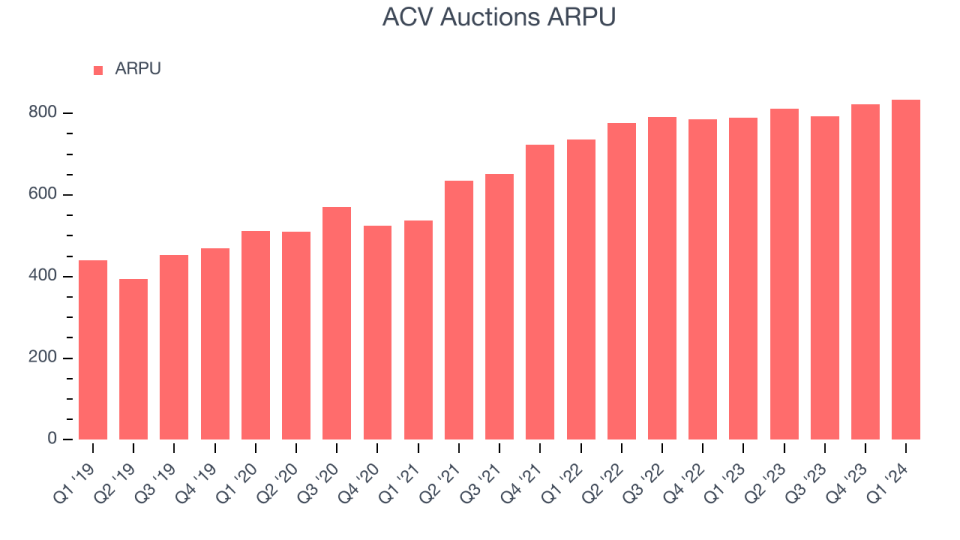

Revenue Per Unit

Average revenue per unit (ARPU) is a critical metric to track for consumer internet businesses like ACV Auctions because it measures how much the company earns in transaction fees from each unit. Furthermore, ARPU gives us unique insights as it's a function of a user's average order size and ACV Auctions's take rate, or "cut", on each order.

ACV Auctions's ARPU growth has been strong over the last two years, averaging 9.3%. The company's ability to increase prices while growing its units sold demonstrates its platform's value, as its units continue to spend more each year. This quarter, ARPU grew 5.7% year on year to $834.27 per unit.

Key Takeaways from ACV Auctions's Q1 Results

It was great to see ACV Auctions increase its number of units this quarter, helping it beat analysts' revenue expectations. We were also glad its full-year revenue guidance came in higher than Wall Street's estimates, though the company expects next quarter to be slightly softer. Turning to the bad news, its EPS fell significantly short of projections. Overall, this was a mediocre quarter for ACV Auctions. The stock is flat after reporting and currently trades at $17.32 per share.

So should you invest in ACV Auctions right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.