Vericel Corp (VCEL) Surpasses Q1 Revenue Forecasts with Strong Growth in Core Markets

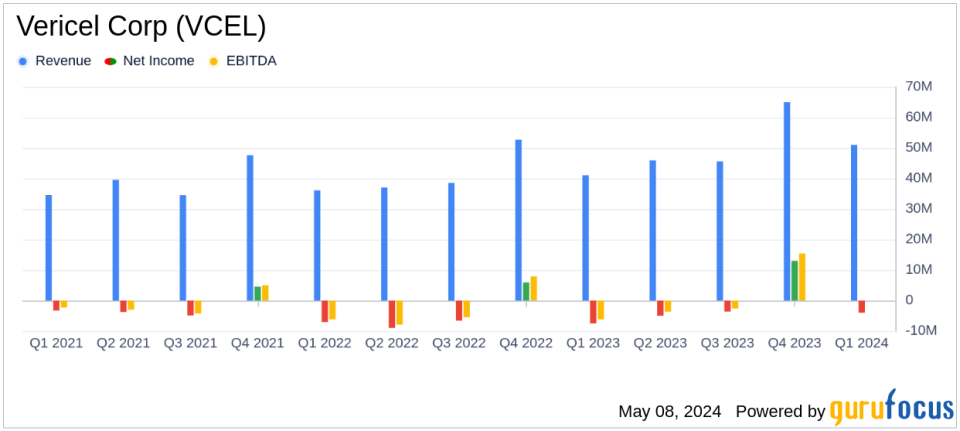

Revenue: Reached $51.3 million, a 25% increase year-over-year, surpassing estimates of $49.07 million.

Net Loss: Reported at $3.9 million, an improvement from a loss of $7.5 million in the previous year, and better than the estimated loss of $5.33 million.

Earnings Per Share: Recorded a loss of $0.08 per diluted share, improving from a loss of $0.16 year-over-year, and greater than the estimated loss of $0.11 per share.

Gross Margin: Increased to 69% from 65% in the previous year, indicating enhanced profitability.

Adjusted EBITDA: Grew significantly by 325% to $7.2 million, reflecting strong operational efficiency.

Full-Year Revenue Guidance: Raised to $238-$242 million from previous guidance of $237-$241 million.

Cash Position: Strong with approximately $148 million in cash, restricted cash, and investments, maintaining a robust balance sheet with no debt.

On May 8, 2024, Vericel Corp (NASDAQ:VCEL) released its 8-K filing, announcing a robust start to the year with significant revenue growth and updated financial projections for 2024. The company, a key player in the biopharmaceutical industry focusing on sports medicine and severe burn care, reported a 25% increase in total revenue, reaching $51.3 million for the first quarter ended March 31, 2024.

Company Overview

Vericel Corp specializes in advanced cell therapies and biologics that address medical needs in sports medicine and severe burn care. The company markets two primary products in the United States: MACI (autologous cultured chondrocytes on porcine collagen membrane) and Epicel (cultured epidermal autografts), alongside NexoBrid, a recent addition for burn care.

Financial Performance Highlights

The first quarter of 2024 saw Vericel achieving record revenues in its MACI product line at $40.2 million, an 18% increase from the previous year, and a 63% increase in burn care revenue which totaled $11.1 million. This includes $10.7 million from Epicel and $0.4 million from NexoBrid. The gross margin improved significantly to 69%, up from 65% in the first quarter of 2023.

Operational and Strategic Developments

Vericel's operational success is reflected in its expanded gross margin and adjusted EBITDA, which grew by 325% to $7.2 million. The adjusted EBITDA margin also saw a substantial increase from 4% to 14%. The company ended the quarter with $148 million in cash, restricted cash, and investments, maintaining a strong financial position with no debt.

Enhanced 2024 Outlook

Encouraged by the strong performance in the first quarter, Vericel has raised its total net revenue guidance for 2024 to a range of $238 to $242 million, up from the previous forecast of $237 to $241 million. The company continues to project a gross margin of approximately 70% and an adjusted EBITDA margin of about 20%.

Management Commentary

"The Company had a very strong start to the year, delivering top-tier revenue growth with significant margin expansion and profitability growth," stated Nick Colangelo, President and CEO of Vericel. "Based on the strength of our core portfolio and the contributions from new product launches, we believe that the Company is very well-positioned for continued high revenue and profit growth in 2024 and beyond."

Financial Statements Insight

The net loss improved to $3.9 million, or $0.08 per diluted share, from a net loss of $7.5 million, or $0.16 per diluted share in the first quarter of 2023. This improvement is a direct result of increased revenue and better cost management. Total operating expenses were $40.8 million, primarily driven by development activities for MACI instruments, increased headcount, and expenses related to a new facility under construction.

Vericel's commitment to innovation and market expansion, particularly with the successful launch and integration of NexoBrid into its product portfolio, positions the company for sustainable growth. The financial adjustments and strategic planning underscore a robust operational framework geared towards long-term profitability and shareholder value.

For detailed financial figures and further information, refer to the full 8-K filing by Vericel Corp.

Explore the complete 8-K earnings release (here) from Vericel Corp for further details.

This article first appeared on GuruFocus.