MetLife Inc. (NYSE:MET), a Strong Buy-rated S&P 500 stock (SPX), is an attractive bet in the insurance sector. MetLife provides a range of financial services, including insurance, annuities, employee benefits, and asset management to individual and institutional customers. Its operations span across 40 markets in the U.S., Asia, Latin America, Europe, and the Middle East. In the past year, MET shares have gained 32.7%.

MetLife’s Q1 Results

For the three months ending March 31, 2024, MetLife’s adjusted earnings per share (EPS) jumped 20.4% year-over-year to $1.83, but missed the consensus estimates by $0.01. Meanwhile, total revenues rose 4.3% to $16.06 billion, with Premiums, fees, and other revenues growing 4% and Net investment income increasing 17% compared to Q1 FY23.

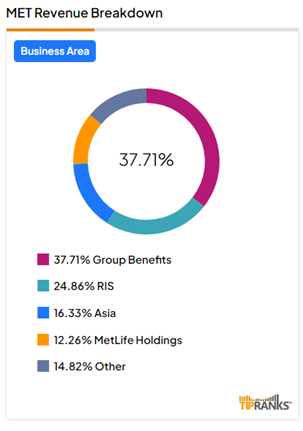

As per the segmental breakdown shown below, MetLife earns a majority of its revenue from Group Benefits, followed by the Retirement and Income Solutions (RIS) business. MetLife’s Group Benefits business includes life insurance, dental, group short- and long-term disability, individual disability, accidental death and dismemberment (AD&D) insurance, vision, and accident & health insurance, prepaid legal plans, and pet insurance.

In Q1 FY24, adjusted premiums, fees and other revenues increased 5% year-over-year to $6.33 billion for Group Benefits and grew 25% to $813 million for the RIS segment.

MetLife Strengthens Shareholders’ Rewards

MetLife continues to strengthen its shareholder rewards with higher dividends and stock buybacks. Along side the Q1 results, MetLife’s board approved a new share repurchase plan of up to $3 billion. The new plan adds to existing $600 million in share repurchases remaining under the current plan at the end of April 2024. In Q1, MetLife repurchased $1.2 billion in stock and another $330 million in April.

Likewise, on April 23, MetLife’s Board hiked its quarterly cash dividends by 4.8% to $0.545 per share, reflecting a current yield of 2.96%, above the sector average.

A Look at the Bulls vs. Bears Scenario

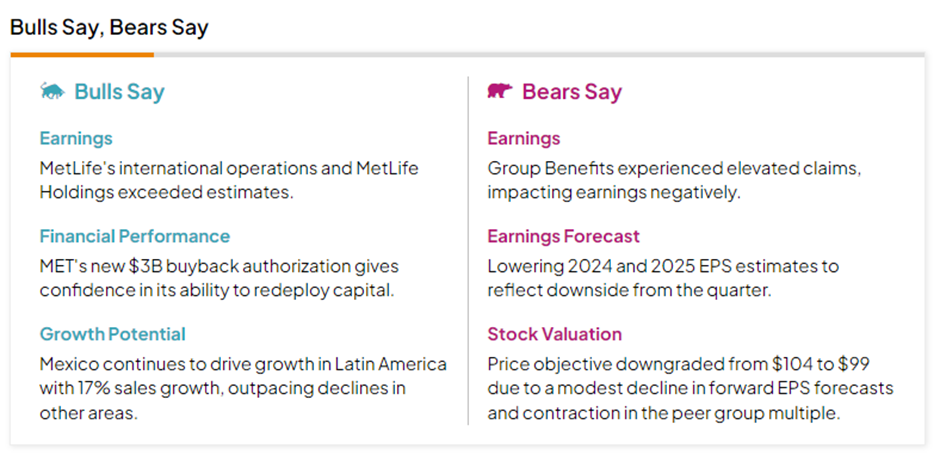

As per the data aggregated by TipRanks on the differing views on MET stock, the Bulls are encouraged by the company’s International operations and MetLife Holdings’ performance, which exceeded expectations. They are also impressed by the new share buyback plan that gives greater confidence in MetLife’s financial stability.

On the other hand, the Bears are discouraged by the higher claims experienced in the Group Benefits segment. Also, some analysts have reduced their FY24-25 EPS forecasts and lowered their price targets to reflect pressure in certain businesses in MET’s most recent quarterly results.

Is MetLife a Good Stock to Buy Now?

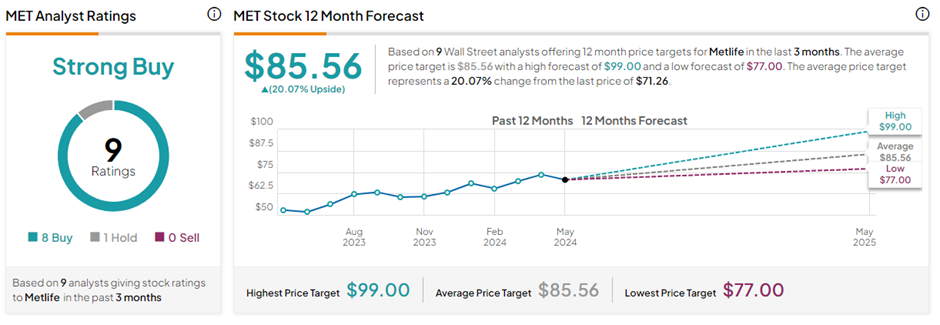

With eight Buys versus one Hold rating, MET stock has a Strong Buy consensus rating on TipRanks. The average MetLife price target of $85.56 implies 20.1% upside potential from current levels.

Key Takeaways

MetLife is one of the oldest, well-established life insurance companies with several other lucrative financial operations. The company has increased its common stock quarterly dividend at a CAGR (compound annual growth rate) of 8.7% since 2011. Given its focus on returning greater capital to shareholders via buybacks and dividends and analysts’ optimistic view of the stock, MET seems to be an interesting insurance play for investors to consider.