National Bank of Canada And Two More Dividend Stocks For Reliable Income

Amidst a backdrop of fluctuating inflation trends and cautious monetary policy signals from the U.S. Federal Reserve, the Canadian market remains a point of focus for investors seeking stability through dividend stocks. As global economic dynamics influence market sentiments, dividend-paying stocks in Canada may offer a semblance of predictable income in uncertain times.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.55% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.12% | ★★★★★★ |

Secure Energy Services (TSX:SES) | 3.53% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.46% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.79% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.30% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.98% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.00% | ★★★★★☆ |

Sun Life Financial (TSX:SLF) | 4.30% | ★★★★★☆ |

Acadian Timber (TSX:ADN) | 6.51% | ★★★★★☆ |

Click here to see the full list of 35 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

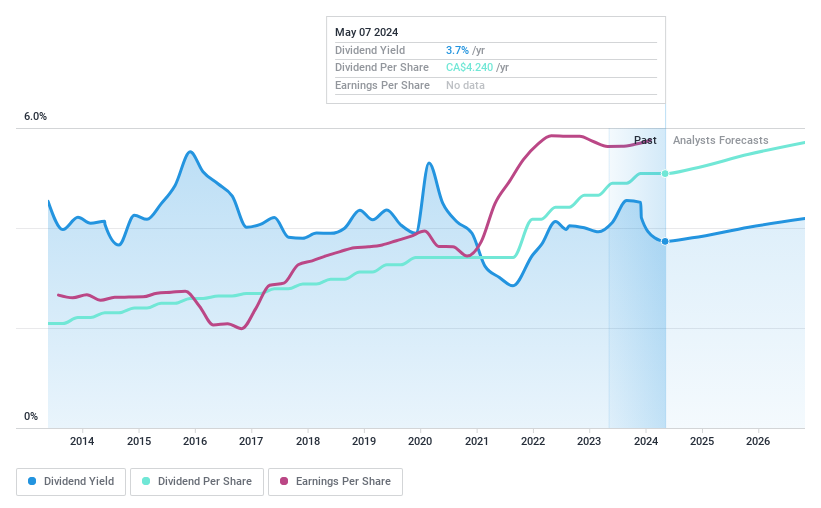

National Bank of Canada

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank of Canada offers a range of financial services to individuals, businesses, institutional clients, and governments both in Canada and globally, with a market capitalization of approximately CA$38.61 billion.

Operations: National Bank of Canada generates revenue through three primary segments: Wealth Management (CA$2.54 billion), Personal and Commercial Banking (CA$4.32 billion), and Financial Markets, excluding U.S. Specialty Finance and International (CA$2.66 billion), along with U.S. Specialty Finance and International contributing CA$1.10 billion.

Dividend Yield: 3.7%

National Bank of Canada maintains a stable dividend with a 3.73% yield, underpinned by a conservative payout ratio of 42.5%, ensuring dividends are well-covered by earnings. Despite this, its yield trails the top quartile of Canadian dividend stocks, which stands at 6.41%. The bank's revenue is projected to grow by 8.49% annually, supporting future dividend sustainability with an anticipated payout ratio of 46.5% in three years. Recent strategic moves include a €500 million fixed-income offering and stable board leadership additions promising governance continuity and expertise expansion.

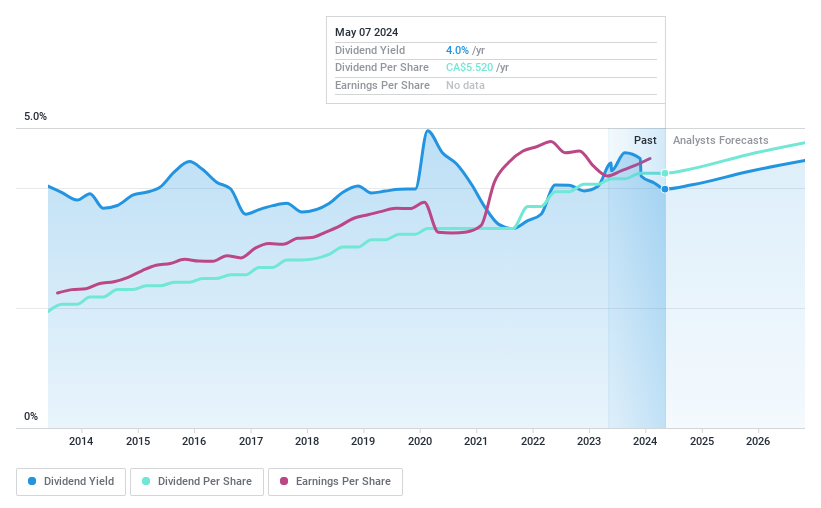

Royal Bank of Canada

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Royal Bank of Canada, with a market capitalization of CA$196.05 billion, operates globally as a diversified financial services company.

Operations: Royal Bank of Canada generates revenue through various segments including Personal & Commercial Banking (CA$20.56 billion), Wealth Management (CA$17.25 billion), Capital Markets (CA$10.19 billion), and Insurance (CA$5.88 billion).

Dividend Yield: 4%

Royal Bank of Canada offers a modest dividend yield of 3.98%, which is lower than the top quartile in the Canadian market at 6.41%. Its dividends are well-supported by earnings, with a stable payout ratio of 50.1% that is expected to remain consistent over the next three years at 50.9%. Over the past decade, RY's dividends have shown stability and growth, reflecting its reliable payment history. Despite trading 29.3% below estimated fair value, recent legal settlements related to price-fixing allegations in the SSA Bond market indicate potential reputational risks, although RY has denied wrongdoing.

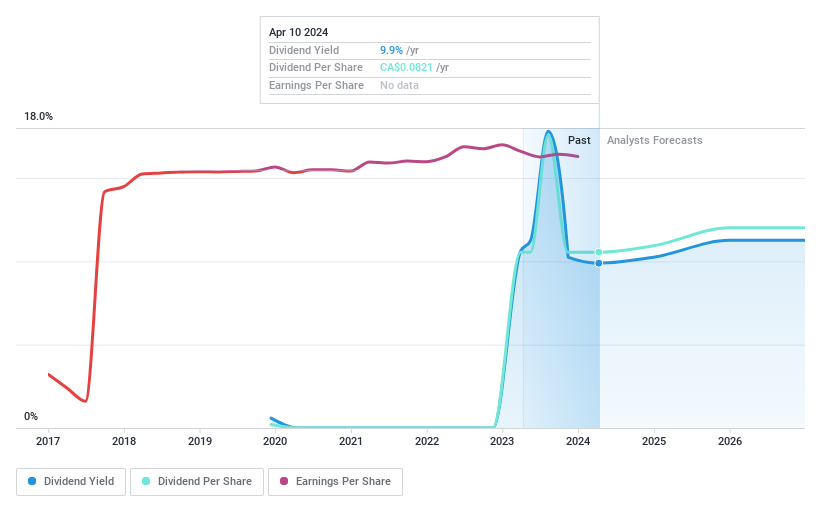

PetroTal

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PetroTal Corp. is a company focused on the development and exploration of oil and natural gas in Peru, South America, with a market capitalization of approximately CA$759.39 million.

Operations: PetroTal Corp. generates its revenue primarily from the exploration and production of oil and gas, amounting to CA$286.26 million.

Dividend Yield: 9.9%

PetroTal's dividend yield of 9.92% ranks in the top 25% of Canadian dividend payers, supported by a payout ratio of 48.9% and a cash payout ratio of 41.9%, indicating that dividends are well-covered by both earnings and cash flow. Despite this, the company has an unstable dividend track record with volatile payments over its short four-year history of dividend distribution. Additionally, profit margins have declined from last year, posing potential concerns for future sustainability. Recent executive changes with Camilo McAllister joining as CFO could influence strategic financial management moving forward.

Delve into the full analysis dividend report here for a deeper understanding of PetroTal.

The valuation report we've compiled suggests that PetroTal's current price could be quite moderate.

Taking Advantage

Access the full spectrum of 35 Top Dividend Stocks by clicking on this link.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:NA TSX:RY and TSX:TAL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance