Chord Energy Corp (CHRD) Q1 2024 Earnings: Strong Performance Amidst Analyst Expectations

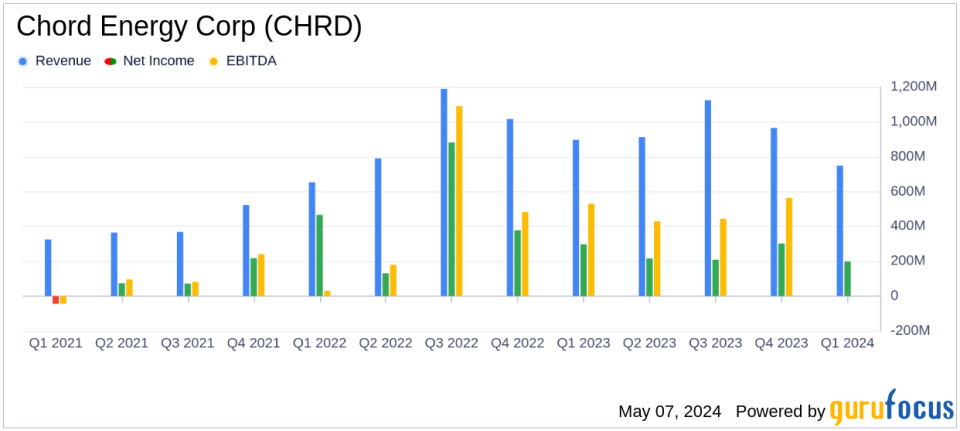

Net Income: Reported at $199.4 million for Q1 2024, falling short of the estimated $205.38 million.

Earnings Per Share (EPS): Achieved $4.65 per diluted share, slightly below the estimated $4.72.

Revenue: Total oil, NGL, and natural gas revenues reached $748.3 million, significantly below the estimated $776.84 million.

Adjusted EBITDA: Recorded at $464.8 million, indicating robust operational efficiency and financial performance.

Adjusted Free Cash Flow: Reported at $199.6 million, demonstrating strong cash generation capabilities.

Dividend Declaration: Announced a base-plus-variable cash dividend of $2.94 per share, reinforcing shareholder returns.

Operational Performance: Oil production volumes of 99.0 MBopd exceeded the high-end guidance, showcasing effective operational management.

On May 7, 2024, Chord Energy Corp (NASDAQ:CHRD), an independent exploration and production company, released its financial and operational results for the first quarter of 2024. The company, known for its operations in the Williston Basin, where it focuses on the development and exploration of crude oil, natural gas, and natural gas liquids, has shared insights into its performance through its 8-K filing.

Operational and Financial Highlights

Chord Energy reported a robust quarter with oil volumes reaching 99.0 MBopd, surpassing the upper end of its guidance. The company demonstrated operational efficiency with a Lease Operating Expense (LOE) of $10.39/BOE, which is below the low-end of its guidance, reflecting strong cost management. The total volumes stood at 168.4 MBoepd. The net income for the quarter was reported at $199.4 million, slightly under the analyst's expectation of $205.38 million. However, the earnings per share of $4.65 were close to the estimated $4.72.

Chord's financial strategy remained robust with a Return of Capital set at $153 million, representing 75% of Adjusted Free Cash Flow. The company also declared a base-plus-variable cash dividend of $2.94 per share of common stock, underscoring its commitment to returning value to shareholders.

Strategic Developments and Future Outlook

The company is on track with its strategic combination with Enerplus, expected to close by May 31, 2024. This merger is anticipated to create a leading operator in the Williston Basin with significant scale and financial strength. Chord Energy's President and CEO, Danny Brown, highlighted the integration capabilities of the company, noting the potential for over $150 million in synergies from the transaction.

For the upcoming quarters, Chord's guidance remains largely unchanged post-merger, with a continued focus on capital discipline and operational efficiency. The company projects to generate approximately $1.9 billion in Adjusted EBITDA and $870 million in Adjusted Free Cash Flow for FY24, maintaining a reinvestment rate of about 50%.

Financial Stability and Investor Confidence

Chord Energy maintains a strong balance sheet with $296.4 million in cash and cash equivalents and a total liquidity of $1.287 billion as of March 31, 2024. The company's careful financial management and strategic planning have positioned it well for sustainable growth and continued investor confidence.

The company's ongoing efforts to enhance shareholder value, coupled with its strategic initiatives and robust financial performance, make it a noteworthy entity in the oil and gas sector. As Chord Energy moves forward with its merger and continues to navigate the complexities of the market, it remains a significant player to watch in the evolving energy landscape.

Conclusion

Chord Energy Corp's first quarter of 2024 reflects a company that is not only managing its resources efficiently but is also strategically poised for future growth. The anticipated synergies from the Enerplus merger and the strong financial results underscore the company's potential in a competitive industry. Investors and stakeholders may look forward to a period of enhanced operational scale and financial robustness post-merger.

Explore the complete 8-K earnings release (here) from Chord Energy Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance