Sturm Ruger & Co Inc (RGR) Misses Q1 Earnings Expectations, Declares Dividend

Revenue: $136.8 million, down from $149.5 million in the previous year, falling short of estimates of $153.40 million.

Net Income: $7.08 million, significantly below the previous year's $14.35 million and estimates of $14.92 million.

Earnings Per Share (EPS): 40, compared to 81 a year ago, fell short of the estimated 84.

Dividend: Declared a quarterly dividend of 16 per share, payable on June 7, 2024.

Operational Efficiency: Undertook a reduction in force resulting in severance expenses of $1.5 million, expected to save approximately $9 million annually.

Inventory Management: Notable reduction in finished goods inventory and distributor inventory levels.

Strategic Initiatives: Executed business reorganization to enhance long-term efficiency and productivity.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

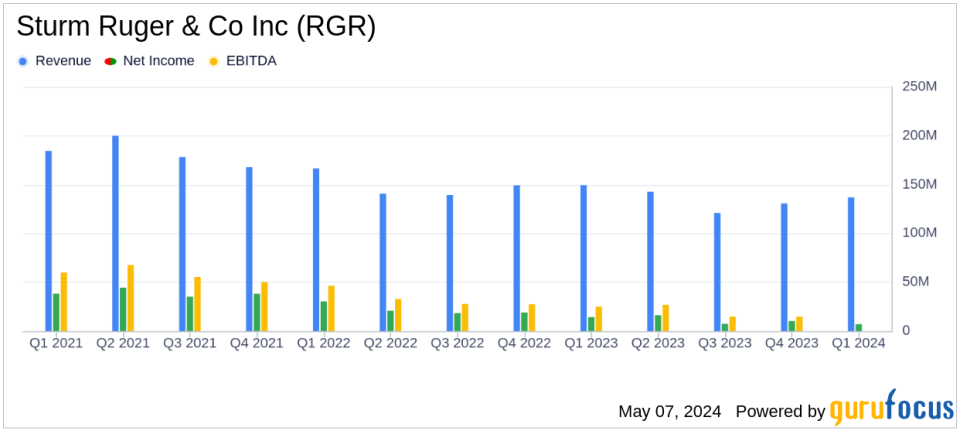

On May 7, 2024, Sturm Ruger & Co Inc (NYSE:RGR) released its 8-K filing, detailing the financial outcomes for the first quarter of 2024. The company reported diluted earnings of $0.40 per share on net sales of $136.8 million, which fell short of the anticipated earnings per share of $0.84 and estimated revenue of $153.40 million. In comparison, the first quarter of 2023 saw significantly higher earnings of $0.81 per share on net sales of $149.5 million.

Sturm Ruger & Co Inc, a leading manufacturer in the firearms industry, is known for its robust product offerings under the Ruger and Marlin brands. The company operates primarily through its firearms segment, which contributes the majority of its revenue, while also maintaining a smaller castings segment.

Financial and Operational Highlights

The first quarter saw a decrease in both revenue and earnings per share, attributed to a general decline in the firearms market despite strong demand for several of Sturm Ruger's product families. CEO Christopher J. Killoy highlighted the company's strategic adjustments, including a workforce reduction that led to a severance expense of $1.5 million but is expected to yield annual savings of approximately $9 million.

In terms of financial health, Sturm Ruger declared a quarterly dividend of $0.16 per share, payable on June 7, 2024, which represents about 40% of its net income. This decision aligns with the company's policy of distributing a portion of its earnings back to shareholders.

Detailed Financial Analysis

The balance sheet as of March 30, 2024, shows total assets at $384.977 million, a slight decrease from $398.817 million at the end of 2023. The company's liabilities and stockholders' equity also saw minor adjustments, maintaining a stable financial structure.

The income statement reveals a gross profit of $29.403 million for Q1 2024, down from $38.486 million in the same period the previous year. Operating income also decreased to $7.531 million from $17.021 million. These reductions reflect the challenges faced in the market and operational costs.

Sturm Ruger's cash flow statement indicated a modest increase in cash and cash equivalents, ending the quarter at $15.807 million compared to $15.174 million at the beginning of the period. This is reflective of careful management of operating activities and investments.

Market and Future Outlook

Despite the downturn in Q1 2024, Sturm Ruger is focusing on strategic initiatives to bolster production and efficiency. The company's efforts to adapt to market demands and optimize operations are pivotal as it navigates the fluctuating landscape of the firearms industry.

Investors and stakeholders are encouraged to review the detailed financial statements and listen to the upcoming webcast on May 8, 2024, for a deeper insight into the company's strategies and expectations for the coming quarters.

For further information and to access the complete Quarterly Report on Form 10-Q, please visit the SEC website or the official Ruger website.

Explore the complete 8-K earnings release (here) from Sturm Ruger & Co Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance