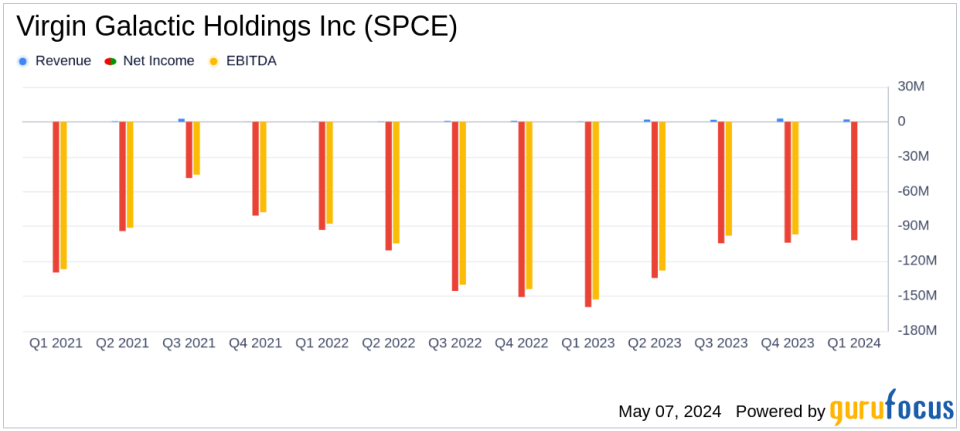

Virgin Galactic Q1 2024 Earnings: Narrowing Losses Amidst Rising Revenues

Revenue: Reported $2 million, a significant increase from $0.4 million in Q1 2023, surpassing the estimate of $1.92 million.

Net Loss: Recorded at $102 million, an improvement from a net loss of $159 million in the previous year, but still above the estimated net loss of $105.33 million.

Earnings Per Share (EPS): Reported at -$0.25, better than the previous year's -$0.57, yet better than the estimated -$0.29.

Operating Expenses: Totaled $113 million, down from $164 million in Q1 2023, indicating improved operational efficiency.

Free Cash Flow: Improved slightly to -$126 million from -$139 million in the same quarter last year.

Cash Position: Ended the quarter with $867 million in cash, cash equivalents, and marketable securities, providing a robust financial buffer.

Capital Expenditures: Increased to $13 million from $3 million in Q1 2023, reflecting ongoing investments in infrastructure and technology.

On May 7, 2024, Virgin Galactic Holdings Inc (NYSE:SPCE) disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company, a pioneer in aerospace and space travel, reported a net loss of $102 million, a significant improvement from a $159 million loss in the same quarter the previous year. This performance nearly aligns with analyst expectations, which anticipated a net loss of $105.33 million.

Company Overview

Virgin Galactic Holdings Inc is at the forefront of human spaceflight for private individuals and researchers. The company not only develops but also manufactures advanced air and space vehicles. With a focus on providing transformative multi-day experiences, which include views of Earth from space and several minutes of weightlessness, Virgin Galactic operates from Spaceport America in New Mexico.

Financial Performance Insights

The company's revenue for the quarter stood at $2 million, driven by commercial spaceflight and membership fees, marking a substantial increase from $0.4 million in the prior year's quarter. This figure surpasses the analyst's revenue estimate of $1.92 million. The total operating expenses were significantly reduced to $113 million from $164 million year-over-year, contributing to the reduced net loss.

The cash position remains robust with $867 million in cash, cash equivalents, and marketable securities as of March 31, 2024. Despite a challenging environment, the company managed to generate $7.3 million in gross proceeds through the issuance of 5.1 million shares of common stock, showcasing continued investor confidence.

Operational Highlights and Future Outlook

CEO Michael Colglazier highlighted the upcoming 'Galactic 07' mission scheduled for June 8, 2024, and provided updates on the Delta Class spaceships, which are on track for commercial service in 2026. The VMS Eve is also expected to support an increased flight rate of up to 125 flights per year, aiming for an annualized revenue run-rate of $450 million with the first two Delta Class spaceships.

Looking ahead to the second quarter of 2024, Virgin Galactic anticipates revenues of approximately $3.5 million and projects free cash flow to be between $(110) million and $(120) million. These forward-looking statements reflect the company's expectations and are subject to uncertainties.

Strategic Developments

The company is progressing well with the construction of a spaceship final assembly facility in Arizona, expected to open in summer 2024. This facility will play a crucial role in scaling up production in line with the company's growth trajectory.

Analysis and Investor Implications

Virgin Galactic's Q1 results demonstrate a strategic narrowing of losses and a boost in revenue, signaling a potentially stabilizing financial path as it gears up for increased commercial activities. The alignment of its financial results with analyst estimates and the significant reduction in operating expenses could build investor confidence in its operational efficiency and long-term viability.

For detailed financial figures and operational updates, investors and interested parties are encouraged to refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Virgin Galactic Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance