HireRight Holdings Corp (HRT) Q1 2024 Earnings: Misses Revenue Expectations and Reports Net Loss

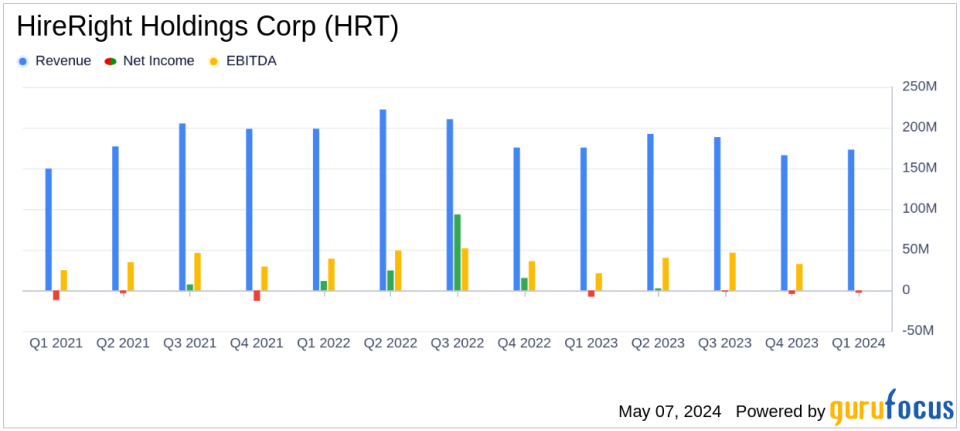

Revenue: Reported $173.2 million, a decrease from $175.4 million in the prior year, falling short of estimates of $177.76 million.

Net Loss: Posted a net loss of $3.3 million, an improvement from a net loss of $7.9 million in the prior year, but above the estimated net income of $15.20 million.

Earnings Per Share: Recorded a diluted loss per share of $0.05, compared to a loss of $0.10 in the prior year, falling short of the estimated earnings per share of $0.21.

Adjusted EBITDA: Increased to $40.3 million from $33.0 million in the prior year, indicating improved operational efficiency.

Liquidity: Ended the quarter with $236.0 million in available capital, including $77.3 million in cash and $158.7 million in available borrowing capacity.

Cash Flow: Cash used in operating activities increased to $9.2 million from $5.0 million in the same period last year, primarily due to expenses related to the Merger Agreement.

HireRight Holdings Corp (NYSE:HRT), a leading provider of background screening services, released its financial results for the first quarter ended March 31, 2024, through its 8-K filing on May 7, 2024. The company reported revenues of $173.2 million, a slight decrease from the $175.4 million recorded in the same period last year, and below the analyst estimates of $177.76 million. The net loss for the quarter was $3.3 million, an improvement from a net loss of $7.9 million in the prior year's first quarter.

About HireRight Holdings Corp

HireRight is a global leader in technology-driven workforce risk management and compliance solutions. The company offers comprehensive services including background screening, verification, identification, monitoring, and drug and health screening through a unified global platform. This integration into customers human capital management systems allows for efficient hiring, onboarding, and monitoring processes. In 2023, HireRight processed over 95 million screens for around 37,000 customers worldwide.

Financial Highlights and Challenges

The company's adjusted EBITDA for the quarter was $40.3 million, up from $33.0 million in the same quarter last year, indicating improved operational efficiency. However, HireRight faced challenges with increased expenses related to a merger agreement, which contributed to a net cash used in operating activities of $9.2 million, compared to $5.0 million in the previous year. This financial strain underscores the impact of strategic decisions on liquidity and cash flow.

Strategic Initiatives and Market Position

HireRight's President and CEO, Guy Abramo, highlighted the company's focus on margin expansion and customer satisfaction. Abramo emphasized HireRights unique position in providing compliance solutions through its global platform, which continues to attract new global customers and expand market share despite competitive pressures.

Were pleased with our performance during the first quarter and our ongoing progress delivering on controllable initiatives focused on margin expansion and customer satisfaction, said HireRight President and CEO Guy Abramo.

Analysis of Financial Statements

The balance sheet shows a decrease in cash and cash equivalents from $123.4 million at the end of December 2023 to $77.3 million by March 2024. This reduction is primarily due to cash used in operating and financing activities, including significant payments for a tax receivable agreement liability and debt repayments. The company's total assets stood at $1.5 billion, with liabilities amounting to $1.04 billion, indicating a solid asset base but also substantial obligations.

Outlook and Forward-Looking Statements

Despite the current challenges, HireRight remains optimistic about its strategic initiatives aimed at enhancing operational efficiencies and expanding its customer base. The company's ability to adapt to the evolving industry landscape and regulatory environment will be crucial for its long-term success.

For detailed financial figures and further information, visit HireRight's official website or contact their investor relations team.

This summary provides a clear view of HireRight Holdings Corp's financial health and strategic direction, reflecting its ongoing efforts to navigate a complex market environment effectively.

Explore the complete 8-K earnings release (here) from HireRight Holdings Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance