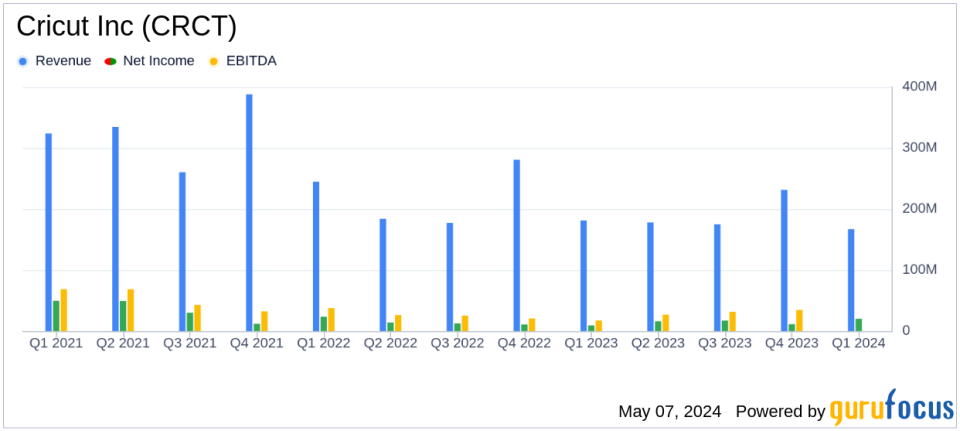

Cricut Inc (CRCT) Q1 2024 Earnings: Surpasses Net Income Expectations Amid Revenue Decline

Revenue: $167.4 million, down 8% from Q1 2023, falling short of estimates of $173.71 million.

Net Income: $19.6 million, up 116% from Q1 2023, significantly exceeding estimates of $12.74 million.

Earnings Per Share (EPS): $0.09, surpassing estimates of $0.06.

Gross Margin: Improved to 54.7% from 42.3% in Q1 2023.

Operating Income: $25.2 million, representing 15.1% of total revenue, a substantial increase from 5.8% in Q1 2023.

Dividends and Buybacks: Announced a special dividend of $0.40 per share and a recurring semi-annual dividend of $0.10 per share, alongside a new $50 million stock repurchase program.

Cash Flow: Generated $56.7 million in cash from operations, up from $34.2 million in the previous quarter, highlighting strong operational efficiency.

On May 7, 2024, Cricut Inc (NASDAQ:CRCT) disclosed its first quarter financial results through an 8-K filing, revealing a mix of challenges and triumphs. The company, known for its innovative creativity platform that transforms ideas into professional-looking crafts, reported a revenue of $167.4 million for Q1 2024, marking an 8% decrease from the previous year. However, it notably exceeded expectations with a net income of $19.6 million, a substantial 116% increase compared to Q1 2023.

Financial Performance Overview

Cricut's latest earnings highlight a period of profitability despite a downturn in total revenue. The company's platform revenue saw a modest growth of 3%, amounting to $78.3 million, while product revenue experienced a sharper decline of 15%, totaling $89.1 million. The international revenue slightly decreased by 3% year-over-year but increased as a percentage of total revenue, indicating a broadening global reach.

The gross margin improved significantly to 54.7% from 42.3% in Q1 2023, driven by lower inventory write-offs and an increase in high-margin subscription revenues. Operating income more than doubled to $25.2 million, representing 15.1% of total revenue, up from 5.8% in the prior year. This improvement underscores Cricut's ability to manage costs effectively while continuing to invest in growth opportunities.

Strategic Capital Allocations and Shareholder Returns

Reflecting confidence in its financial health and commitment to shareholder returns, Cricut's board of directors approved several capital allocation initiatives. These include a special dividend of $0.40 per share and a recurring semi-annual dividend of $0.10 per share, both payable in July 2024. Additionally, the company authorized a new $50 million stock repurchase program, following the completion of a similar program last year.

Operational Highlights and Future Outlook

Cricut ended the quarter with 2.8 million paid subscribers, a 3% increase from the previous year, and launched Cricut Value Materials, aimed at enhancing competitiveness in online marketplaces. With over 5.95 million active users, the company is focused on deepening user engagement through its platform.

Despite the revenue decline, Cricut's substantial increase in net income and strategic capital allocations illustrate its resilience and adaptability in a fluctuating market. The company remains debt-free with $282 million in cash and equivalents, positioning it well for sustained growth and innovation in the creative technology space.

Investor and Analyst Perspectives

From an investment standpoint, Cricut's ability to significantly boost its net income amidst a revenue decline is commendable. The company's strategic focus on high-margin subscription services and efficient cost management contribute to its robust profitability metrics. These factors, combined with proactive shareholder return policies, make Cricut an intriguing prospect for value investors interested in long-term growth and stability.

For detailed financial figures and future projections, stakeholders are encouraged to view the full earnings release and participate in the upcoming webcast and conference call.

Explore the complete 8-K earnings release (here) from Cricut Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance