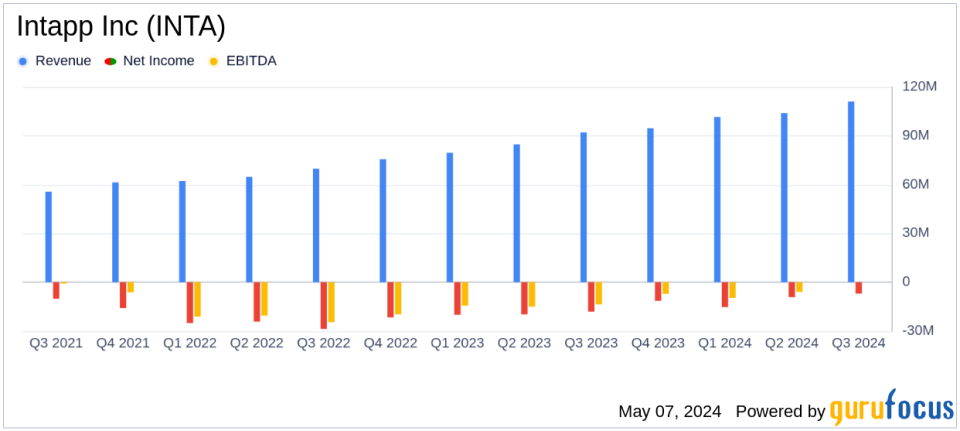

Intapp Inc (INTA) Surpasses Analyst Revenue Forecasts in Q3 Fiscal Year 2024

SaaS and support revenue: $80.8 million, a 22% increase year-over-year.

Total revenue: $110.6 million, up 20% year-over-year, surpassing the estimate of $108.23 million.

Cloud ARR: $274.2 million, marking a 33% increase year-over-year.

Total ARR: $382.7 million, a 21% year-over-year increase.

GAAP net loss: $(6.9) million, significantly narrowed from $(18.1) million year-over-year.

Non-GAAP net income: $11.2 million, a substantial increase from $2.2 million in the prior year.

Non-GAAP diluted net income per share: $0.14, exceeding the estimate of $0.07.

On May 7, 2024, Intapp Inc (NASDAQ:INTA), a leader in AI-powered solutions for professional advisory and legal firms, released its third-quarter financial results for fiscal year 2024, detailing significant revenue growth and strategic advancements. The company's 8-K filing reveals a robust performance with total revenue reaching $110.6 million, a 20% increase year-over-year, surpassing the estimated $108.23 million.

Company Overview

Intapp Inc specializes in cloud-based software solutions tailored for the professional and financial services industry. The company primarily operates in the United States but also maintains a significant presence in the United Kingdom and other global markets. Intapp's technology suite is designed to address the dynamic client, investor, and regulatory demands faced by firms in sectors such as private capital, investment banking, legal, accounting, and consulting.

Financial Highlights and Performance Metrics

The third quarter saw a notable 22% increase in SaaS and support revenue, amounting to $80.8 million. The Cloud Annual Recurring Revenue (ARR) also grew impressively by 33% to $274.2 million, indicating strong customer retention and new business acquisition. Total ARR reached $382.7 million, up 21% from the previous year, with Cloud ARR now representing 72% of the total.

Despite these gains, Intapp reported a GAAP operating loss of $7.4 million, which is an improvement from the $18.2 million loss in the same quarter of the previous year. The non-GAAP operating profit stood at $11.2 million, a significant increase from $2.9 million year-over-year. This improvement reflects effective cost management and operational efficiency.

Strategic Business Movements

Intapp has been actively expanding its market footprint and product offerings. The launch of new AI capabilities such as Intapp Assist for DealCloud has been met with strong market reception. Furthermore, the acquisition of AI software company delphai marks a strategic step in enhancing the company's data analytics capabilities.

During the quarter, Intapp added several high-profile clients and received accolades for DealCloud, underscoring its influence and reputation in the technology and professional services sectors.

Outlook for Fiscal Year 2024

Looking ahead, Intapp provided an optimistic outlook for the fourth quarter and the full fiscal year. The company expects SaaS and support revenue between $83.5 million to $84.5 million for the fourth quarter and forecasts total revenue for the fiscal year to be between $427.0 million and $428.0 million. This guidance reflects continued confidence in the company's growth trajectory and market strategy.

Conclusion

Intapp Inc's third-quarter results not only demonstrate robust financial growth but also strategic positioning for sustained success in the evolving market landscape. The company's focus on AI-driven solutions and strategic acquisitions are set to further enhance its offerings and market position. For investors and stakeholders, Intapp represents a compelling entity at the intersection of technology and professional services, with a clear path toward continued growth and innovation.

For more detailed information and analysis, visit Intapps investor relations website or access the full earnings report and supplementary financial presentations.

Explore the complete 8-K earnings release (here) from Intapp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance