BWX Technologies Inc. (BWXT) Q1 2024 Earnings: Surpasses Revenue and EPS Estimates

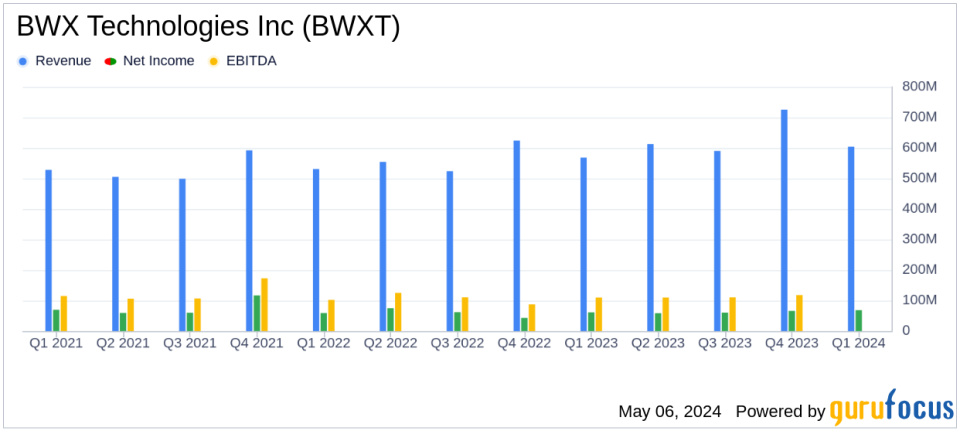

Revenue: Reported $604.0 million, up 6% year-over-year, surpassing estimates of $599.91 million.

Net Income: Achieved $68.5 million, an increase of 12% year-over-year, exceeding estimates of $62.39 million.

Earnings Per Share (EPS): Delivered $0.75 GAAP EPS and $0.76 non-GAAP EPS, both surpassing the estimated $0.69.

Operating Income: Consolidated operating income rose to $93.0 million, a 6% increase from the previous year.

Adjusted EBITDA: Grew to $115.2 million, marking a 4% increase from the prior year's $110.7 million.

Free Cash Flow: Reported $2.6 million, significantly improved from a negative $42.8 million in the previous year.

Dividends: Paid $22.4 million in dividends, reflecting a 3% increase year-over-year, maintaining a quarterly dividend of $0.24 per share.

BWX Technologies Inc. (NYSE:BWXT) disclosed its first quarter 2024 financial results on May 6, 2024, revealing a performance that exceeded analyst expectations on both top and bottom lines. The company reported a revenue of $604.0 million and net income of $68.5 million, surpassing the estimated figures of $599.91 million and $62.39 million respectively. Diluted GAAP EPS for the quarter stood at $0.75, outperforming the anticipated $0.69. These results were detailed in BWXT's recent 8-K filing.

BWX Technologies Inc., headquartered in Lynchburg, Virginia, is a prominent player in the aerospace and defense industry, specializing in the manufacture and service of nuclear components. The company operates primarily through two segments: Government Operations and Commercial Operations, with a significant portion of its revenue generated in the United States.

Operational Highlights and Future Outlook

The first quarter saw BWXT achieving a 6% increase in revenue year-over-year, with significant contributions from both government and commercial operations. The Government Operations segment, which includes production of naval nuclear components and microreactors, reported a revenue increase of 6%. Commercial Operations, boosted by higher sales in nuclear field services and medical sectors, saw a 7% rise in revenue. This segment's operating income notably surged by 468%, primarily due to improved margins in medical sales.

President and CEO Rex D. Geveden commented on the quarter's achievements, stating,

We started 2024 with solid operating results in each of our business segments, both financially and strategically. Our recent announcement to expand capacity at our Cambridge manufacturing facility not only enhances our position in the global markets but also highlights the robust growth opportunities we see in commercial nuclear power."

Financial Performance Analysis

The company's operating income increased by 6% to $93.0 million, driven by higher income in Commercial Operations and reduced corporate expenses. Adjusted EBITDA also saw a 4% increase to $115.2 million. The non-GAAP EPS of $0.76, up from $0.70 in the same quarter the previous year, reflects an effective management of operational costs and strategic investments.

BWXT's cash flow from operations stood at $33.0 million, a significant improvement from a cash outflow in the previous year, demonstrating effective capital management and operational efficiency. The firm also continued its shareholder return policy, paying out $22.4 million in dividends.

Strategic Moves and Market Positioning

BWXT reaffirmed its 2024 financial guidance, projecting a non-GAAP EPS range of $3.05 to $3.20 and aiming for higher revenue and adjusted EBITDA. The company's strategic expansions, particularly the Cambridge manufacturing plant, are set to enhance its capabilities in serving the global CANDU and small modular reactor markets, positioning BWXT at the forefront of nuclear technology innovation.

The company's robust quarterly performance, coupled with strategic expansions and a strong market positioning, underscores BWXT's potential for sustained growth. Investors and stakeholders may look forward to BWXT's continued execution on its strategic initiatives and operational excellence, which are likely to drive further financial success in the upcoming quarters.

For detailed financial figures and future projections, interested parties are encouraged to view the full earnings release and additional financial documents available on the BWXT Investor Relations website.

Explore the complete 8-K earnings release (here) from BWX Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance