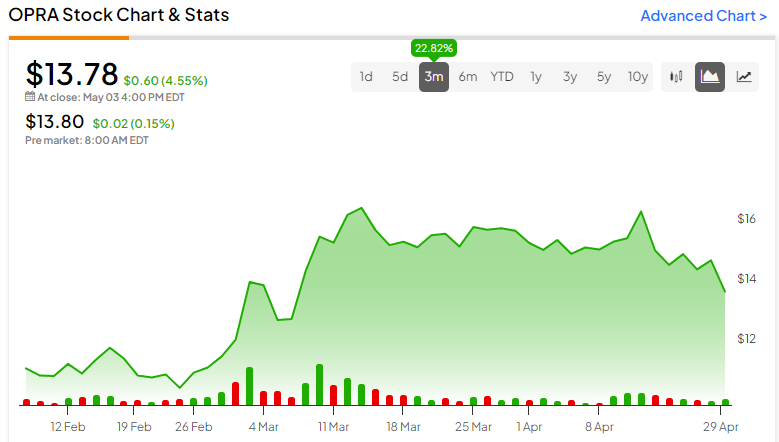

Opera (NASDAQ:OPRA) recently reported earnings on April 25 that slightly exceeded expectations. Unlike the previous quarter, when references to artificial intelligence (AI) sparked a strong rally in the stock, the company’s comments regarding investing substantially in a new AI project have frustrated some investors, who expected more significant improvement in Q2 revenue and earnings guidance. The stock has shed 9.64% over the past month. However, shares continue to trade at a relative discount, and the long-term case remains unchanged, with management raising guidance for the year.

Deviating from Third-Party Signals and Cookies

Opera is a global web browser technology company with Windows, iOS, Android, and Linux products. The company’s distinctive approach deviates from the traditional reliance on third-party signals and cookies, opting instead for enhanced privacy with an inside browser-based ad platform. The ads account for 60% of the company’s overall revenue.

The company also enjoys brand recognition among a desirable niche with Opera GX, its gaming-centric product, which sports a growing user base of 27.8 million and touts an annualized revenue run rate close to $100 million.

Opera continues to enhance its platform with Artificial Intelligence (AI) offerings as it seeks to maintain an edge in the field. Among Opera’s most notable strides is the completion of its green energy-powered AI data center in Iceland and the introduction of its AI features drop project, which grants Opera One developer-build users access to the latest AI developments. The company continues to innovate rapidly, with new features introduced frequently.

Opera’s Recent Financial Performance & Outlook

Opera has reported a solid start to 2024 with a 17% year-over-year increase in Q1 revenue of $101.9 million, successfully surpassing expectations. Major contributing factors include a growing user base in high-revenue regions and advertising and search revenues rising by 21% and 14%, respectively. Furthermore, EPS of $0.17 beat expectations of $0.16.

Based on the solid start to the year, management raised its revenue guidance. For the second quarter, the revenue projection is $107 to $109 million, indicating a robust 15% year-over-year growth at the midpoint. For the full year, revenue is expected to be between $454 and $465 million, with the midpoint representing an increase of 16% over 2023.

Is OPRA Stock a Buy?

Analysts following the company have been bullish on the stock. For instance, TD Cowen analyst Lance Vitanza recently issued a Buy rating on OPRA shares, setting a price target at $25, citing the company’s improving revenue and profitability.

Overall, Opera is rated a Strong Buy based on the recommendations and 12-month price targets four Wall Street analysts have issued over the past three months. The average price target for OPRA stock is $22.00, which represents a 59.65% upside from current levels.

The stock trades at the lower end of its 52-week range of $10.30-$28.58 and looks relatively undervalued. The P/E ratio of 7.4x sits well below the Communication Services sector average of 20.3x and the Internet Content & Information industry average of 23.3x.

Opera Continues to Gain Momentum and Market Share

Opera continues to gain momentum and market share while it expands its AI investment. The stock trades at a discount and offers intriguing upside potential, making it a compelling tech opportunity for value investors.