Tom Gayner's Strategic Moves in Q1 2024: A Deep Dive into Stericycle Inc's Significant Reduction

Insights into the Investment Shifts of a Veteran Investor

Tom Gayner (Trades, Portfolio), the Co-Chief Executive Officer of Markel Corporation, has recently made notable adjustments to his investment portfolio according to the 13F filing for the first quarter of 2024. With a career that began at Markel in 1990, Gayner has developed a robust investment philosophy focusing on businesses with strong returns, reputable management, and effective capital re-investment strategies. His extensive experience includes roles at Davenport & Co of Virginia and PriceWaterhouseCoopers LLP, and he holds positions on several influential boards, reflecting his deep commitment to integrity and growth in investments.

New Additions to the Portfolio

Tom Gayner (Trades, Portfolio) introduced five new stocks to his portfolio this quarter. Noteworthy among them are:

Air Products & Chemicals Inc (NYSE:APD), with 15,000 shares valued at $3.63 million, making up 0.04% of the portfolio.

The Hershey Co (NYSE:HSY), comprising 9,500 shares, which represent about 0.02% of the portfolio, valued at $1.85 million.

Insperity Inc (NYSE:NSP), with 16,876 shares also accounting for 0.02% of the portfolio, totaling $1.85 million.

Significant Increases in Existing Positions

Gayner also increased his stakes in 42 stocks, with significant boosts in:

Deere & Co (NYSE:DE), adding 26,000 shares, bringing the total to 823,800 shares, marking a 3.26% increase in share count and impacting the portfolio by 0.11%, valued at $338.37 million.

LPL Financial Holdings Inc (NASDAQ:LPLA), with an additional 27,905 shares, resulting in a total of 454,291 shares, a 6.54% increase in share count, valued at $120.02 million.

Complete Exits

In the first quarter of 2024, Tom Gayner (Trades, Portfolio) completely exited his position in:

International Flavors & Fragrances Inc (NYSE:IFF), selling all 23,000 shares, which had a -0.02% impact on the portfolio.

Major Reductions

Notable reductions include:

Stericycle Inc (NASDAQ:SRCL), where Gayner reduced his holdings by 630,700 shares, resulting in a -94.32% decrease in shares and a -0.34% impact on the portfolio. The stock traded at an average price of $50.31 during the quarter and has seen a -5.18% return over the past three months and -6.88% year-to-date.

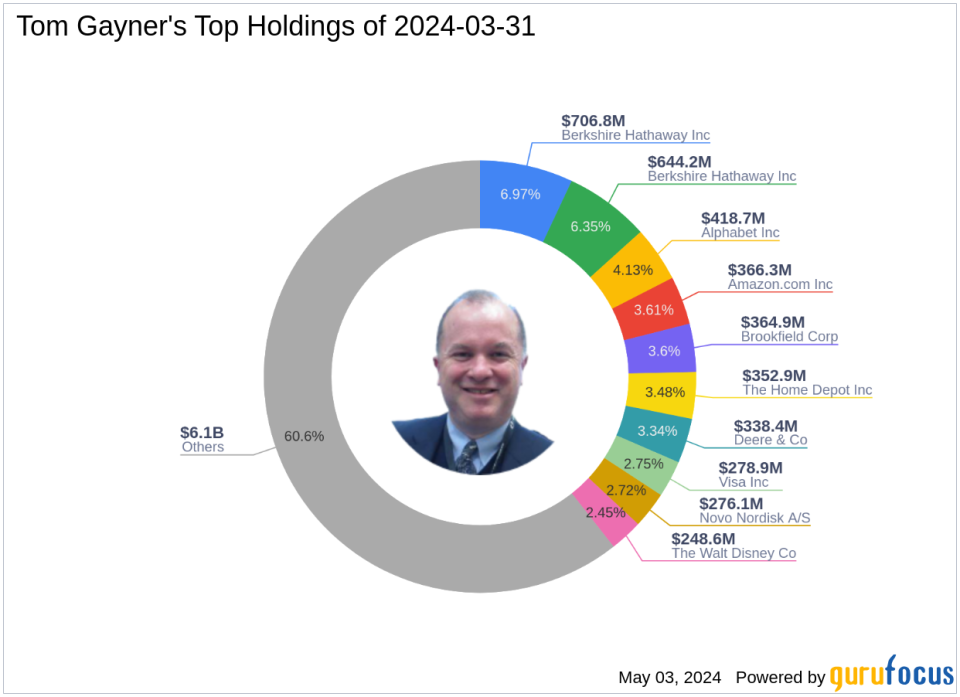

Portfolio Overview

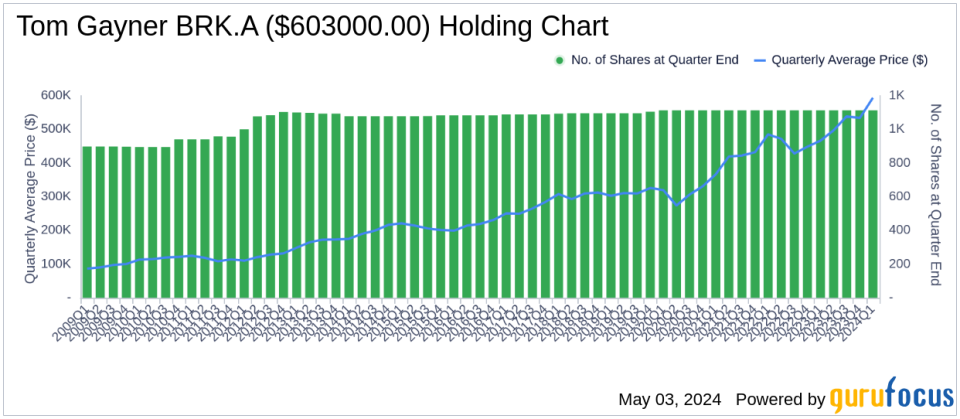

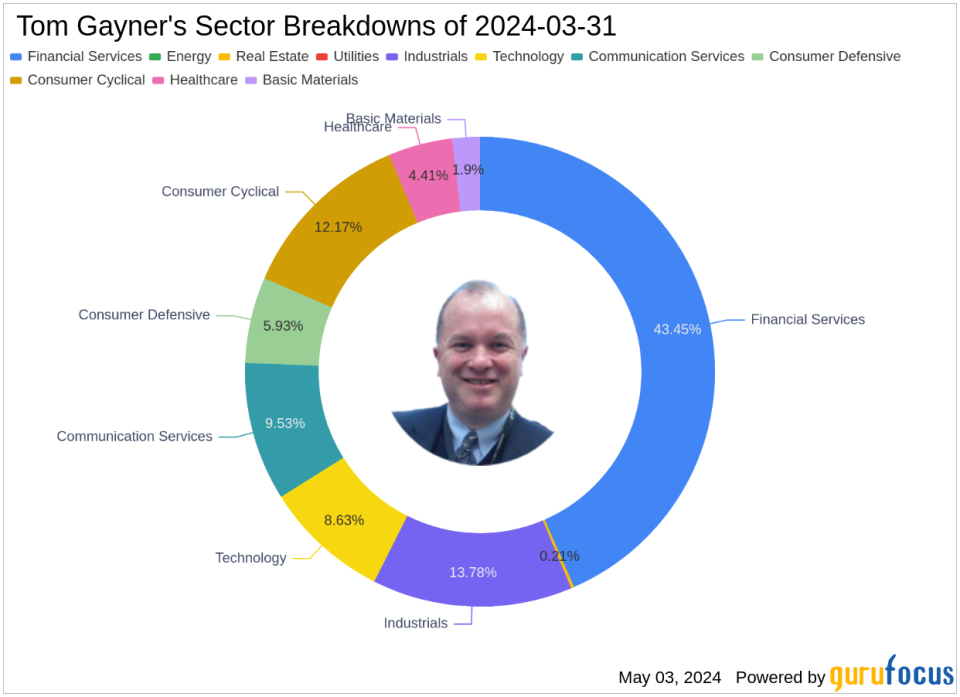

As of the first quarter of 2024, Tom Gayner (Trades, Portfolio)'s investment portfolio includes 133 stocks. The top holdings are notably concentrated in several sectors, with significant stakes in Berkshire Hathaway Inc (BRK.A and BRK.B), Alphabet Inc (NASDAQ:GOOG), Amazon.com Inc (NASDAQ:AMZN), and Brookfield Corp (NYSE:BN). These investments are spread across diverse industries, including Financial Services, Industrials, and Technology, demonstrating Gayner's strategic approach to portfolio diversification.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance