Clearfield Inc (CLFD) Q2 2024 Earnings: Narrower Loss Than Expected Amid Challenges

Revenue: Reported $36.9 million, exceeding estimates of $31.25 million.

Net Loss: Totaled $5.9 million, below the estimated net loss of $7.89 million.

Earnings Per Share: Recorded at -$0.40, surpassing the estimated -$0.52.

Backlog: Increased to $47.2 million, indicating a sequential rise of 8.6%.

Gross Margin: Declined significantly to 7.7% from 32.8% year-over-year.

Share Repurchase: Increased program authorization from $40 million to $65 million, with $30.4 million available for future repurchases.

Outlook: Expects Q3 net sales between $40 million to $44 million and EPS ranging from -$0.31 to -$0.38.

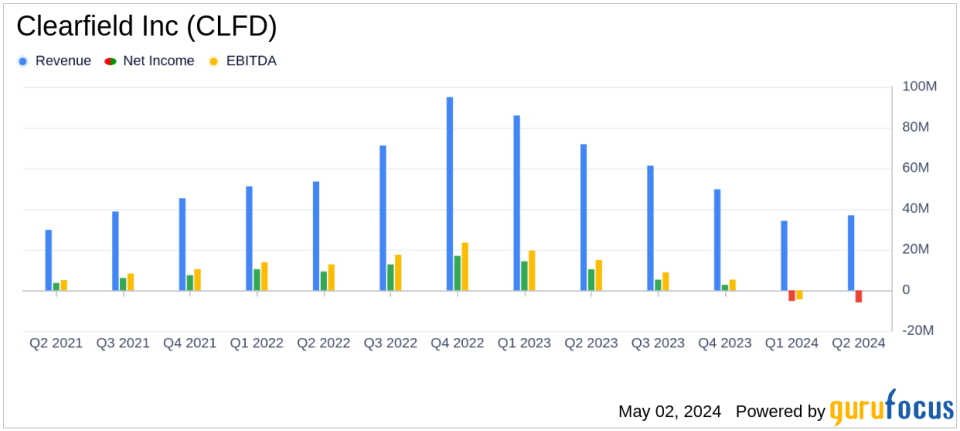

On May 2, 2024, Clearfield Inc (NASDAQ:CLFD) disclosed its financial results for the second quarter of fiscal year 2024, revealing a performance that, while showing a net loss, exceeded analyst expectations in terms of both revenue and earnings per share. The company reported a net loss of $5.9 million or $0.40 per share, against the anticipated $7.89 million loss or $0.52 per share. Revenue stood at $36.9 million, surpassing the forecasted $31.25 million. The full details can be accessed in Clearfield's 8-K filing.

Clearfield Inc, headquartered in Minneapolis, is a prominent player in the design, manufacture, and distribution of fiber management and delivery solutions for communication networks. The company's offerings cater to a diverse range of sectors including telecommunications and data centers, with a significant portion of its revenue generated from the Clearfield segment.

Financial Performance Insights

The second quarter of 2024 was challenging for Clearfield, marked by a 48.6% decline in net sales compared to the same period last year. The gross profit margin significantly decreased to 7.7% from 32.8% in Q2 2023, primarily due to excess production capacity and increased reserves for excess inventory. This downturn reflects the broader industry's struggle with elevated inventory levels, affecting demand.

Operating expenses saw a rise to $12.6 million, constituting 34.1% of net sales, up from 16.0% in the previous year. This increase is part of the company's strategic adjustments amidst ongoing market challenges.

Strategic Moves and Market Outlook

Despite the downturn, Clearfield's management remains optimistic. According to Cheri Beranek, President and CEO, the company is experiencing a gradual recovery, driven by robust demand in the Community Broadband sector. The company anticipates this recovery to continue, aligning with traditional build seasons. This optimism is also reflected in the company's decision to increase its share repurchase program authorization from $40 million to $65 million, signaling confidence in its future growth.

For the upcoming quarter, Clearfield expects net sales to be between $40 million and $44 million, with a projected net loss per share ranging from $0.31 to $0.38. This forecast considers ongoing industry challenges but also hints at a potential stabilization in market conditions.

Investor and Analyst Perspectives

The company's performance, particularly its ability to outperform revenue and earnings estimates, offers a mixed view. On one hand, the significant drop in year-over-year revenue and profit margins highlights the ongoing challenges within the industry. On the other, the better-than-expected results and proactive management strategies, such as the increased share buyback program, provide a basis for cautious optimism among investors and analysts.

Clearfield's strategic focus on aligning orders with deployment schedules and its emphasis on customer collaboration are crucial as it navigates the uncertain terrain. The increase in backlog, up 8.6% sequentially, also serves as a positive indicator of returning demand, although it remains substantially lower compared to the previous year.

As the market conditions evolve, Clearfield's adaptability and strategic initiatives will be key to capitalizing on the long-term growth opportunities in fiber deployment, despite the short-term hurdles posed by industry-wide inventory adjustments.

Explore the complete 8-K earnings release (here) from Clearfield Inc for further details.

This article first appeared on GuruFocus.