Silgan Holdings Inc. (SLGN) Q1 2024 Earnings: Mixed Results Amid Market Challenges

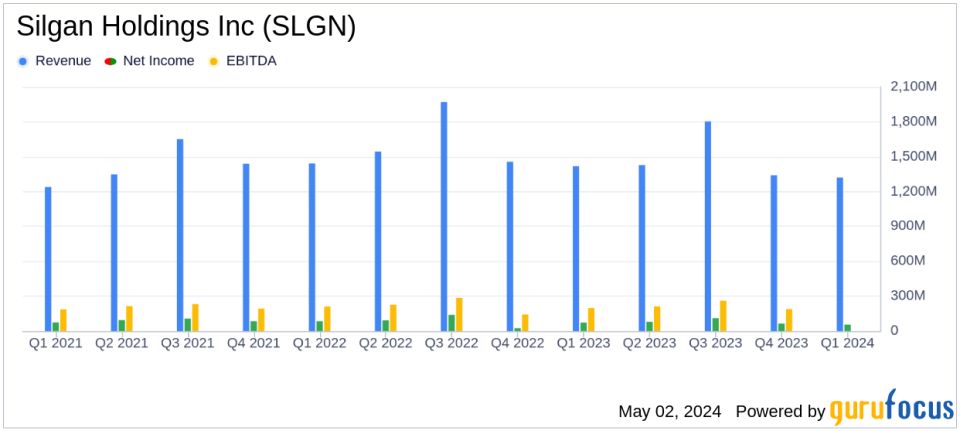

Reported Revenue: $1.32 billion for Q1 2024, down 7% year-over-year, falling short of the estimated $1.373 billion.

Net Income: Achieved $55.2 million, below the estimated $68.09 million and down from $72.0 million in Q1 2023.

Earnings Per Share (EPS): Recorded at $0.52, below the estimated $0.65.

Adjusted EPS: $0.69, above the basic EPS, reflecting adjustments for specific financial items.

Cost Reduction: Progressed towards a $50 million cost reduction goal, with $20 million savings expected in 2024.

Full-Year Outlook: Reaffirmed adjusted EPS forecast for 2024 in the range of $3.55 to $3.75.

Free Cash Flow: Projected to be approximately $375 million for 2024, up from $356.7 million in 2023.

Silgan Holdings Inc. (NYSE:SLGN) disclosed its financial outcomes for the first quarter of 2024 on May 1, 2024, through its 8-K filing. The company, a dominant supplier of sustainable rigid packaging solutions for consumer goods, reported a net income of $55.2 million, translating to an earnings per share (EPS) of $0.52. Adjusted for specific items, the EPS stood at $0.69, surpassing the analyst estimate of $0.65. However, revenue fell to $1.32 billion from $1.42 billion in the same quarter last year, missing the estimated $1.37 billion.

Company Overview

Silgan Holdings manufactures approximately half of the metal food containers in North America. Its major customers include well-known names like Campbell Soup, Nestle, and Del Monte. Besides its metal container segment, Silgan operates in plastic dispensers and containers for personal and healthcare products, along with a closures business that produces metal and plastic lids and caps.

Financial Performance and Challenges

Despite a decrease in net sales, primarily due to lower volumes and reduced raw material costs, Silgan demonstrated resilience in its adjusted earnings. The company's strategic adjustments and a robust $50 million cost reduction program contributed to the EPS exceeding expectations. Silgan's President and CEO, Adam Greenlee, highlighted the diverse portfolio and strategic initiatives that bolstered the company's performance amidst challenging market conditions, including accelerated customer destocking activities.

Segment-wise, the Dispensing and Specialty Closures saw an 8% drop in sales due to significant declines in high-volume closures for food and beverage markets. The Metal Containers segment also experienced an 8% decrease in sales, attributed to continued customer destocking. However, the Custom Containers segment showed stability with a slight decrease in sales but a marginal increase in adjusted EBIT.

Financial Statements Insights

The income statement reflects the challenges faced with a decrease in gross profit and increased rationalization charges. The balance sheet shows a healthy cash position despite a decrease from the previous year, and the cash flow statement indicates significant cash used in operations, primarily due to changes in working capital components like trade accounts receivable and inventories.

Outlook and Forward Guidance

Looking ahead, Silgan confirms its full-year 2024 adjusted EPS forecast to range between $3.55 and $3.75, reflecting a potential 7% increase at the midpoint compared to 2023. The company anticipates improved volumes across all segments and projects a free cash flow of approximately $375 million, up from $356.7 million in 2023. For Q2 2024, Silgan expects adjusted EPS to range from $0.82 to $0.92, indicating optimism for continued growth.

Conclusion

While Silgan Holdings Inc. navigated a tough quarter with a strategic focus on cost management and operational efficiency, the mixed financial results underscore the ongoing challenges in the packaging industry. However, the company's proactive measures and positive outlook suggest a stable path forward. Investors and stakeholders will likely watch closely how Silgan balances market pressures with its robust business model and cost strategies in the upcoming quarters.

For detailed financial figures and further information, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Silgan Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance