The Joint Corp (JYNT) Q1 2024 Earnings: Revenue Grows, Surpassing Analyst Projections

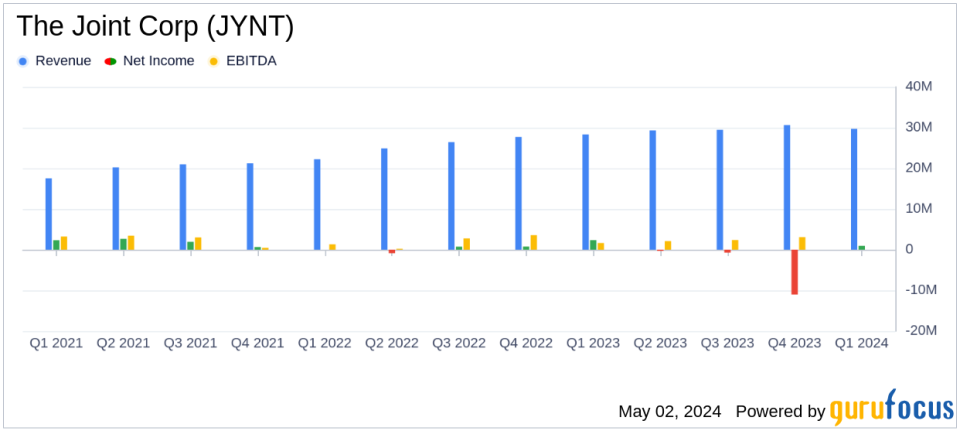

Revenue: Reached $29.7 million in Q1 2024, a 5% increase from $28.3 million in Q1 2023, slightly surpassing estimates of $29.5 million.

Net Income: Reported at $947,000 in Q1 2024, a significant decrease from $2.3 million in Q1 2023, but surpassed the estimated net loss of $0.06 million.

Earnings Per Share (EPS): Achieved $0.06 per diluted share, surpassing the estimated EPS of -$0.01.

System-wide Sales: Grew by 9% to $126.3 million, indicating robust franchisee performance.

Adjusted EBITDA: Increased to $3.5 million from $2.0 million in Q1 2023, reflecting improved operational efficiency.

Clinic Expansion: Increased total clinic count to 954, including 23 new franchised clinics opened during the quarter.

Franchise Development: Sold 15 franchise licenses, tripling sales compared to the previous quarter and demonstrating strong franchisee interest.

The Joint Corp (NASDAQ:JYNT) released its 8-K filing on May 2, 2024, unveiling its financial results for the first quarter of 2024. The company reported a revenue of $29.7 million, a 5% increase compared to Q1 2023, and surpassing the estimated revenue of $29.59 million. Notably, The Joint Corp also reported a net income of $947,000, significantly higher than the estimated net loss of $0.06 million.

The Joint Corp, a national operator and franchisor of chiropractic clinics, continues to expand its reach and services across the United States. The company operates through two segments: Corporate Clinics and Franchise Operations, with the majority of revenue generated from the Corporate Clinics segment.

Performance Highlights and Strategic Initiatives

During the first quarter, The Joint Corp achieved several milestones that underscore its growth trajectory and operational efficiency. The company opened 23 new franchised clinics, bringing the total count to 954 clinics as of March 31, 2024. This expansion is part of its broader strategy to increase accessibility to chiropractic care. Additionally, the sale of 15 franchise licenses, a significant increase from the previous quarter, indicates robust interest in its franchising opportunities.

The company's strategic efforts are further highlighted by its refranchising initiatives and the engagement of an investment bank specializing in these transactions. This move is aimed at accelerating the refranchising process, thereby enhancing value creation for stakeholders.

Financial Analysis

The Joint Corp's financial strength is evident in its improved bottom-line results, with an operating income of $1.1 million compared to an operating loss in the same quarter the previous year. The net income of $947,000 this quarter marks a substantial improvement, although it is lower than the $2.3 million reported in Q1 2023, which included significant employee retention credits.

Cost management has been effective, as evidenced by a reduction in selling and marketing expenses and a significant decrease in depreciation and amortization expenses, which fell by 37% due to the ongoing refranchising efforts. General and administrative expenses remained stable, reflecting the company's ability to control costs while expanding its clinic network.

Outlook and Guidance

The Joint Corp reiterated its 2024 guidance, expecting system-wide sales to be between $530 and $545 million, with system-wide comp sales anticipated to be in the mid-single digits. The company also projects to open between 60 and 75 new franchised clinics, excluding the impact of refranchised clinics.

In conclusion, The Joint Corp's first quarter results demonstrate solid financial and operational performance, with revenue growth and strategic expansions setting a positive tone for 2024. The company's focus on increasing clinic accessibility and enhancing franchisee engagement continues to drive its success in the competitive healthcare services market.

For more detailed information and to stay updated on The Joint Corp's financial performance and strategic initiatives, investors and interested parties are encouraged to visit the Investor Relations section on The Joint Corp's website.

Explore the complete 8-K earnings release (here) from The Joint Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance