Viavi Solutions Inc (VIAV) Faces Challenges in Q3 Fiscal 2024, Misses Revenue and EPS Estimates

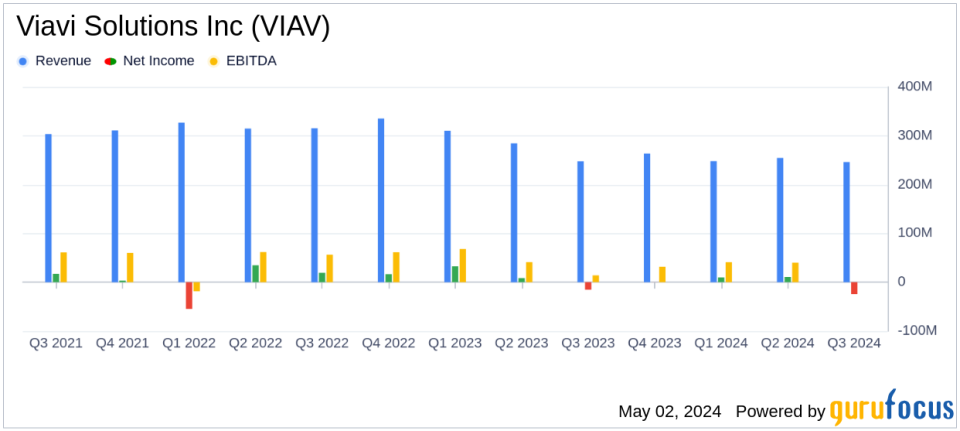

Revenue: Reported at $246.0 million, down 0.7% year-over-year, below estimates of $249.08 million.

Net Income: GAAP net loss of $(24.6) million, compared to a net loss of $(15.4) million in the same quarter last year, and below the estimated net income of $16.60 million.

Earnings Per Share (EPS): GAAP diluted EPS at $(0.11), a decrease from $(0.07) year-over-year, and non-GAAP diluted EPS at $0.06, below the estimated $0.07.

Operating Margin: GAAP operating margin fell to (4.8)%, down 400 basis points year-over-year; Non-GAAP operating margin was 9.3%, down 210 basis points from the previous year.

Gross Margin: Non-GAAP gross margin reported at 57.9%, a decrease of 180 basis points year-over-year.

Cash Flow: Generated $19.5 million of cash flows from operations during the quarter.

Future Outlook: Expects Q4 FY2024 net revenue to be between $246 million to $258 million and non-GAAP EPS between $0.06 to $0.08.

On May 2, 2024, Viavi Solutions Inc (NASDAQ:VIAV) disclosed its financial results for the third quarter of fiscal year 2024 through its 8-K filing. The company, a global provider of network test, monitoring, and assurance solutions, reported a net revenue of $246.0 million, which represents a slight decrease of 0.7% year-over-year and falls short of the analyst's expectation of $249.08 million. Non-GAAP diluted earnings per share (EPS) also came in below expectations at $0.06, compared to the estimated $0.07.

Company Overview

Viavi Solutions Inc operates primarily through three segments: Network Enablement, Service Enablement, and Optical Security and Performance Products. The company's solutions are crucial for various high-demand industries, including telecommunications, aerospace, and government sectors, particularly in light management technologies.

Quarterly Financial Performance

The third quarter saw Viavi grappling with several challenges, particularly in its service providers and enterprise customer segments. According to VIAVI's President and CEO, Oleg Khaykin, the company's performance was impacted by lower Network and Service Enablement (NSE) volume and an unfavorable product mix, which led to revenues and earnings landing at the lower end of their guidance. The GAAP operating margin significantly declined to (4.8)%, a 400 basis point decrease from the previous year, primarily due to increased operating expenses and lower revenue.

Segment and Regional Breakdown

Revenue from Network Enablement slightly decreased by 0.1% year-over-year, while Service Enablement saw a more substantial decline of 28.7%. However, the Optical Security and Performance Products segment grew by 8.1%, indicating some areas of strength within the company. Geographically, revenue distribution was fairly even across the Americas, Asia-Pacific, and EMEA, highlighting VIAVI's global operational footprint.

Balance Sheet and Cash Flow

As of March 30, 2024, Viavi reported having $486.1 million in total cash, short-term investments, and restricted cash. The company generated $19.5 million in cash flows from operations during the quarter, which reflects its ability to maintain liquidity in a challenging market environment.

Forward Outlook

For the fourth quarter of fiscal 2024, Viavi expects net revenue to be between $246 million and $258 million, with non-GAAP EPS projected to be between $0.06 and $0.08. These projections suggest a cautious outlook, likely factoring in the ongoing market challenges and strategic responses to them.

Investor and Analyst Perspectives

Despite the setbacks in Q3, Viavi's strategic position in essential technology sectors and its global reach provide a solid foundation for recovery and growth. However, investors and analysts might remain watchful of how the company navigates its operational challenges and capitalizes on the growth in optical security and performance products.

For a deeper dive into Viavi Solutions Incs financial health and operational strategies, and to stay updated on their progress including detailed financial metrics and expert analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Viavi Solutions Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance