Madison Square Garden Sports Corp. Reports Fiscal Q3 Earnings: A Detailed Analysis

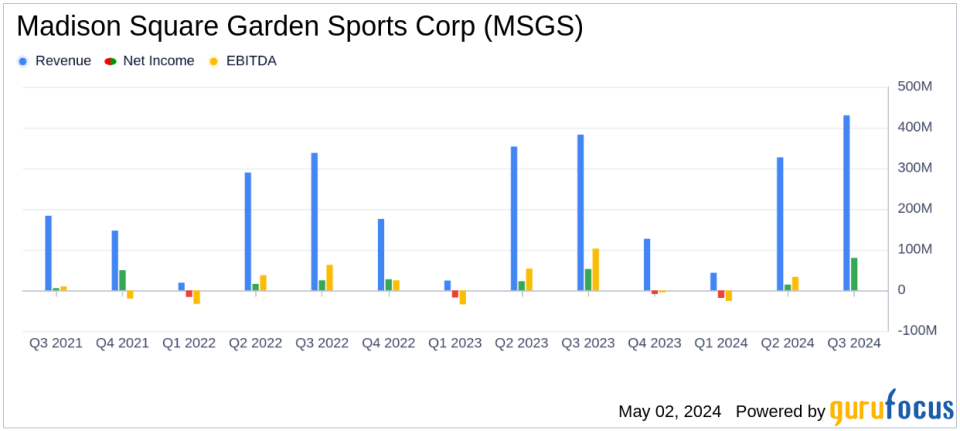

Revenue: $430.0 million, up by 12% year-over-year, surpassing estimates of $420.74 million.

Net Income: $37.9 million, below the estimated $62.04 million.

Earnings Per Share (EPS): $1.57 diluted, below the estimated $2.60.

Operating Income: $79.7 million, a decrease of 2% from the previous year.

Adjusted Operating Income: Increased by 3% to $88.7 million compared to the prior year.

Direct Operating Expenses: Rose by 14% to $273.0 million, reflecting higher team personnel compensation and other costs.

Selling, General and Administrative Expenses: Increased by 25% to $76.4 million, mainly due to higher employee compensation and related benefits.

On May 2, 2024, Madison Square Garden Sports Corp. (NYSE:MSGS) unveiled its financial outcomes for the fiscal third quarter ended March 31, 2024, through its 8-K filing. The company, a prominent player in the live sports and entertainment industry, reported a notable increase in revenue, although its operating income slightly declined.

Financial Highlights

For the quarter, MSGS posted revenues of $430.0 million, a 12% increase from the previous year's $382.7 million, surpassing the analyst's revenue estimate of $420.74 million. This growth was primarily fueled by higher ticket-related revenues, suite revenues, and sales from food, beverages, and merchandise, alongside increased local media rights fees. Notably, the New York Knicks played five additional home games compared to the prior year, significantly contributing to the revenue uptick.

However, operating income saw a slight decrease of 2%, amounting to $79.7 million compared to $81.8 million in the prior year, primarily due to increased direct operating expenses and higher selling, general, and administrative costs. Adjusted operating income, which excludes certain non-cash and one-time items, rose by 3% to $88.7 million.

Operational and Market Challenges

While MSGS experienced growth in several revenue streams, the company also faced increased costs. Direct operating expenses rose by 14% to $273.0 million, driven by higher team personnel compensation and provisions for league revenue sharing and NBA luxury tax. Selling, general, and administrative expenses also surged by 25%, reflecting higher employee compensation linked to executive management transitions.

The company's performance is critical as it directly impacts its ability to sustain profitability and maintain a competitive edge in the highly dynamic entertainment and sports market. The increased expenses underscore the challenges MSGS faces in managing costs while striving to enhance its revenue streams.

Strategic Initiatives and Future Outlook

Madison Square Garden Sports Corp. continues to leverage its iconic sports teams, the Knicks and Rangers, to drive growth. The launch of the 2024-25 season ticket renewal initiative has already shown strong demand, indicating robust fan engagement and potential future revenue stability. Executive Chairman James L. Dolan expressed confidence in the company's strategic direction and its ability to generate long-term shareholder value, highlighted by both teams' successful qualification for the playoffs.

As MSGS moves forward, the focus will likely remain on enhancing fan experiences and expanding revenue channels while managing operational costs effectively. The company's ability to adapt to market conditions and optimize its business operations will be crucial in sustaining its growth trajectory and profitability.

Conclusion

In summary, Madison Square Garden Sports Corp.'s fiscal third-quarter performance reflects a solid operational execution with significant revenue growth, albeit coupled with challenges in managing rising expenses. The company's strategic initiatives appear well-positioned to capitalize on the ongoing enthusiasm for its sports franchises, supporting its vision for long-term financial success.

Explore the complete 8-K earnings release (here) from Madison Square Garden Sports Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance