Faro Technologies Inc (FARO) Q1 Earnings: Mixed Results Amidst Revenue Growth and Net Loss ...

Revenue: Reported at $84.2 million, slightly above the estimated $81.07 million, meeting analyst expectations.

Earnings Per Share (EPS): Reported GAAP loss per share of $(0.38), significantly above the estimated $(0.12); Non-GAAP EPS was $0.09, surpassing the high end of guidance.

Net Loss: Reported a net loss of $7.3 million, deeper than the estimated net loss of $2.19 million.

Gross Margin: Improved to 51.4% from 46.7% year-over-year, reflecting operational efficiencies.

Operating Cash Flow: Generated $6.6 million, indicating strong cash management and operational efficiency.

Adjusted EBITDA: Stood at $5.6 million, or 6.6% of revenue, a significant improvement from a negative $5.5 million in the previous year.

Future Outlook: Expects Q2 revenue between $79 million and $87 million, with projected gross margins ranging from 50.5% to 52.0%.

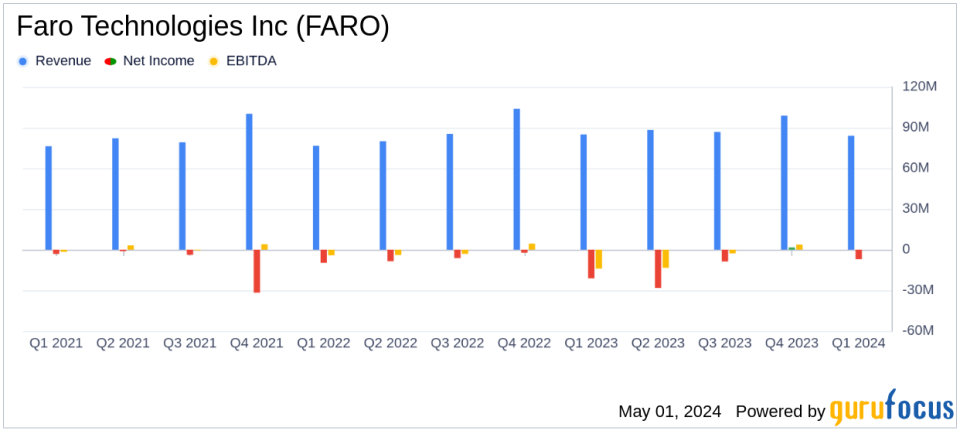

Faro Technologies Inc (NASDAQ:FARO) released its 8-K filing on May 1, 2024, detailing the financial outcomes for the first quarter ended March 31, 2024. Despite surpassing revenue forecasts with a reported $84.2 million against an estimated $81.07 million, the company faced a net loss of $7.3 million, which was a significant deviation from the anticipated net loss of $2.19 million.

Faro Technologies Inc, a pioneer in 4D digital reality solutions, has been instrumental in bridging the digital and physical worlds through its advanced technology offerings. The company's solutions cater to a wide range of industries, enhancing precision and efficiency in 3D measurement and imaging.

Financial Performance Overview

The first quarter saw FARO achieving a revenue of $84.2 million, a slight decrease of 1% year-over-year but still at the upper end of the company's guidance range. This performance indicates resilience despite challenging market conditions. The gross margin improved significantly to 51.4% from 46.7% in the prior year, reflecting better cost management and operational efficiency.

However, the company reported a GAAP net loss of $7.3 million, or $(0.38) per share, compared to a net loss of $21.2 million, or $(1.12) per share, in the previous year. On a non-GAAP basis, net income was $1.7 million, or $0.09 per share, which is an improvement from a non-GAAP net loss of $7.1 million, or $(0.38) per share, year-over-year.

Operating expenses were reduced significantly to $48.6 million from $58.3 million in the prior year period, demonstrating effective cost control and restructuring outcomes. Adjusted EBITDA stood at $5.6 million, or 6.6% of total sales, a notable recovery from a negative $5.5 million in the previous year.

Strategic Initiatives and Market Positioning

President & CEO Peter Lau commented on the results, stating, "Were pleased with our strong start to the year, with our first quarter financial performance providing a solid foundation from which we expect to continue to invest in our strategic initiatives within our core markets." This reflects the company's focus on leveraging its strong market position to drive future growth.

The company's balance sheet remains robust with cash, cash equivalents, and short-term investments totaling $99.3 million as of March 31, 2024, an increase from $96.3 million at the end of 2023. This financial stability is crucial as FARO continues to navigate the evolving market dynamics and invests in innovation.

Looking Ahead

For the second quarter of 2024, FARO anticipates revenue to be in the range of $79 to $87 million with a gross margin between 50.5% and 52.0%. The company expects its operating expenses to range between $46 and $48 million. The projected net loss per share ranges from ($0.43) to ($0.23), with non-GAAP net loss to net income per share expected to be between $(0.08) and $0.12.

The company's forward-looking statements highlight its strategic plans to enhance operational effectiveness and market reach. As FARO continues to innovate and optimize its operations, the focus remains on returning to profitability and sustaining long-term growth.

In conclusion, while FARO's Q1 results present a mixed financial picture, the company's strategic initiatives and market adaptations provide a hopeful outlook for achieving its aspirational financial goals in the upcoming quarters.

Explore the complete 8-K earnings release (here) from Faro Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance