W.P. Carey Inc (WPC) Q1 2024 Earnings: Surpasses Net Income Expectations, Misses on Revenue ...

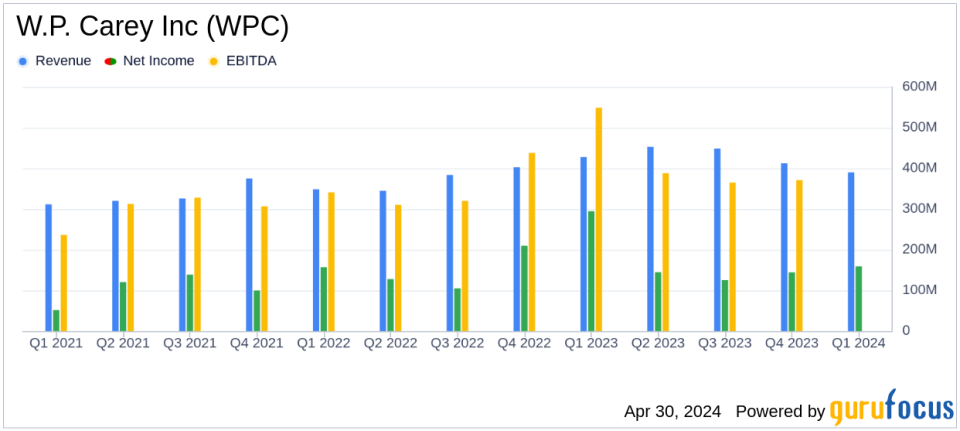

Net Income: $159.2M, a significant decrease of 45.9% from the previous year's $294.4M, falling short of the estimated $120.62M.

Earnings Per Share (EPS): Reported at $0.72, surpassing the estimated $0.53.

Revenue: Totaled $389.8M, down 8.9% year-over-year from $427.8M, below the estimated $398.31M.

Adjusted Funds from Operations (AFFO) Per Share: Recorded at $1.14, indicating a decrease from the previous year's $1.31 per diluted share.

Dividend: Quarterly cash dividend declared at $0.865 per share, maintaining an annualized rate of $3.46 per share.

Investment and Disposition Activity: Completed investment volume of $374.5M and disposed of properties generating $889.2M in gross proceeds during the quarter.

Occupancy Rate: Improved to 99.1%, up from 98.1% at the end of the previous quarter.

On April 30, 2024, W.P. Carey Inc (NYSE:WPC), a prominent net lease real estate investment trust, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a net income of $159.2 million, significantly surpassing the analyst's estimate of $120.62 million. However, the revenue for the quarter stood at $389.8 million, falling short of the expected $398.31 million.

W.P. Carey Inc is renowned for its ownership of high-quality, operationally critical commercial real estate, primarily in the U.S., Western Europe, and Northern Europe. The company's portfolio mainly consists of single-tenant industrial, warehouse, and retail properties. Historically, W.P. Carey has derived the majority of its income from its Real Estate division through long-term lease agreements.

Quarterly Financial Highlights

The company's earnings per share (EPS) for the quarter was $0.72, significantly higher than the estimated $0.53. Adjusted Funds from Operations (AFFO) per diluted share was reported at $1.14, reflecting a strategic focus despite a 13.0% decrease from the previous year's $1.31, mainly due to the impact of the NLOP Spin-Off and the Office Sale Program.

W.P. Carey's real estate investment activities remained robust, with $374.5 million in investments completed year to date, including significant dispositions under the Office Sale Program totaling $410.5 million. The company also highlighted a contractual same-store rent growth of 3.1%, showcasing its ability to enhance value in its core operations.

Strategic Developments and Balance Sheet Strength

CEO Jason Fox emphasized the productive start to the year, stating,

We've had a productive start to the year, closing $375 million of investments and building a strong deal pipeline, which positions us well in relation to our investment guidance."

This positions the company to potentially benefit from its strategic exits from non-core office assets and concentrated efforts on high-yield properties.

Subsequent to the quarter end, W.P. Carey repaid $500 million of 4.6% Senior Unsecured Notes due 2024, reflecting its prudent capital management and strong liquidity position, which stood at $2.8 billion as of March 31, 2024.

Operational Challenges and Forward Outlook

Despite the strong financial metrics, the company faced challenges such as a decrease in total revenues by 8.9% compared to the same period last year, primarily due to strategic dispositions and the spin-off of office properties. However, the company affirms its 2024 AFFO guidance of between $4.65 and $4.75 per diluted share, indicating confidence in its operational strategy and future performance.

As W.P. Carey continues to navigate through its strategic realignment, focusing on high-quality industrial and retail properties, it remains well-positioned to leverage its robust capital structure and investment acumen to enhance shareholder value in the evolving real estate market.

For more detailed information about W.P. Carey Inc's financial performance and strategic initiatives, investors and stakeholders are encouraged to review the full earnings release available on the company's website.

Explore the complete 8-K earnings release (here) from W.P. Carey Inc for further details.

This article first appeared on GuruFocus.