908 Devices Inc (MASS) Q1 2024 Earnings: Narrower Losses and Revenue Growth

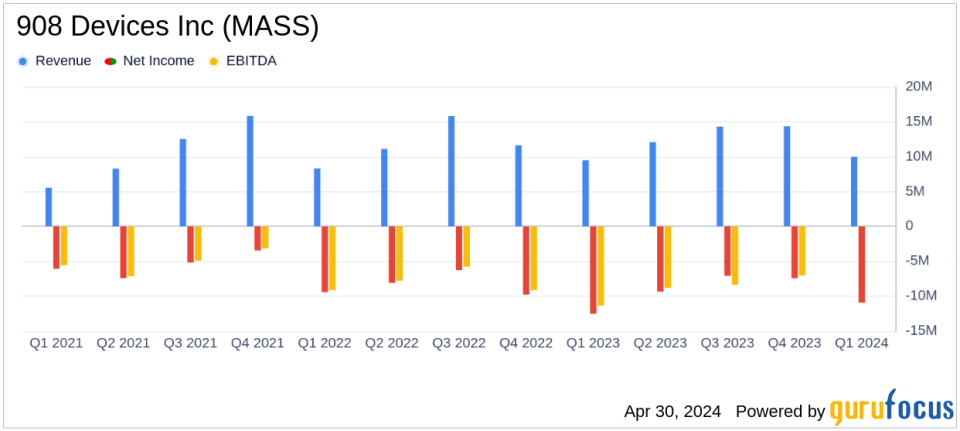

Revenue: Reported $10 million for Q1 2024, marking an 8% year-over-year increase and surpassing the estimated $9.29 million.

Net Loss: Recorded at $10.9 million for Q1 2024, improved from a loss of $12.5 million year-over-year, and was below the estimated loss of $12.10 million.

Earnings Per Share (EPS): Reported a loss of $0.33 per share, an improvement from a loss of $0.39 per share year-over-year, and better than the estimated loss of $0.36 per share.

Gross Margin: Increased to 50% in Q1 2024 from 46% in the same period last year, indicating improved profitability per dollar of revenue.

Operating Expenses: Slightly increased to $17.7 million in Q1 2024 from $17.4 million in the prior year, influenced by costs related to acquisitions and stock-based compensation.

2024 Revenue Outlook: Updated to expect full-year revenue between $63 million and $65 million, reflecting a significant 25% to 29% growth, partly due to contributions from the newly acquired RedWave Technology.

Cash Position: Ended the quarter with $134.2 million in cash, cash equivalents, and marketable securities, maintaining a strong balance sheet with no debt.

On April 30, 2024, 908 Devices Inc (NASDAQ:MASS) disclosed its financial results for the first quarter of 2024, revealing a performance that aligns closely with analyst projections on revenue and surpasses expectations on reduced net losses. The detailed financial outcomes were released in their 8-K filing.

Company Overview

908 Devices specializes in the production of handheld and desktop mass spectrometry devices, which are essential for chemical and biochemical analysis at the point of need. These devices find applications across various sectors including life sciences research, bioprocessing, and forensics, predominantly in the United States but also globally.

Financial Highlights

The first quarter saw 908 Devices achieving a revenue of $10 million, marking an 8% increase year-over-year, primarily driven by a 20% rise in handheld device sales. This performance slightly exceeds the analyst's revenue estimate of $9.29 million. Gross profit also improved, reaching $5.0 million with a gross margin increase from 46% to 50% year-over-year, reflecting enhanced operational efficiency.

Despite these gains, the company reported a net loss of $10.9 million, which, while substantial, represents an improvement from the $12.5 million loss recorded in the same period last year. This loss translates to a net loss per share of $0.33, better than the anticipated $0.36. The reduction in net loss can be attributed to increased gross profits and controlled operating expenses, which included costs related to acquisitions and stock-based compensation.

Operational and Strategic Developments

During the quarter, 908 Devices expanded its product portfolio through the acquisition of RedWave Technology, enhancing its offerings in the forensics space. This strategic move is expected to bolster the company's market position and drive future revenue growth.

Updated 2024 Financial Guidance

Looking ahead, 908 Devices has revised its full-year revenue forecast to between $63.0 million and $65.0 million, representing a significant increase of 25% to 29% over 2023. This updated guidance includes contributions from RedWave Technology, anticipated to add $11 million to the years total.

Financial Position and Future Outlook

As of March 31, 2024, 908 Devices reported having $134.2 million in cash, cash equivalents, and marketable securities, with no outstanding debt. This strong liquidity position, bolstered by strategic acquisitions, positions the company well for sustained growth and movement towards cash flow breakeven.

Conclusion

908 Devices Inc (NASDAQ:MASS) is navigating the complex landscape of the medical devices industry with strategic expansions and a focus on innovation. With improved financial metrics and strategic acquisitions setting the stage, the company is poised for continued growth in 2024. Investors and stakeholders may look forward to potential value gains as the company progresses towards its revised revenue targets and operational efficiencies.

For more detailed insights and ongoing updates, investors are encouraged to follow further announcements and analyses on GuruFocus.com.

Explore the complete 8-K earnings release (here) from 908 Devices Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance