1 Ridiculously Cheap Stock I Wouldn't Touch With a 10-Foot Pole

Finding bargains in the stock market is the foundation of value investing. As the theory goes, undervalued stocks will rise to their intrinsic value given enough time.

But cheap can mean so many things, and it tends to be quite subjective. Bank stocks, for example, generally trade at much lower valuations than other stocks, and growth companies can boast high price tags, even when they're generating steep losses.

Then, there's the question of whether or not a "cheap" stock is an opportunity or a value trap. Peloton Interactive (NASDAQ: PTON) stock is trading at a price-to-sales ratio below 0.5. That's low for any company, and it could hint at an incredible opportunity if Peloton can return to growth. However, its recovery is far from certain.

Where Peloton went wrong

Peloton sells premium connected fitness equipment and paid subscriptions to digital content. Its equipment includes stationary bikes, treadmills, and other exercise machines that connect to live and recorded classes.

The company's sales skyrocketed when fitness enthusiasts flocked to home exercise options early in the pandemic, but that was also when its problems started. Multiple years of triple-digit top-line growth were capped off by an incredible fiscal 2021 when revenue surged 120%. This surging demand led Peloton to invest heavily in its infrastructure, including plans to open the company's first U.S. production facility at a cost of $400 million.

But the perfect market conditions for connected fitness didn't last. As COVID-related restrictions eased and demand leveled off, Peloton was left with a large, messy operation.

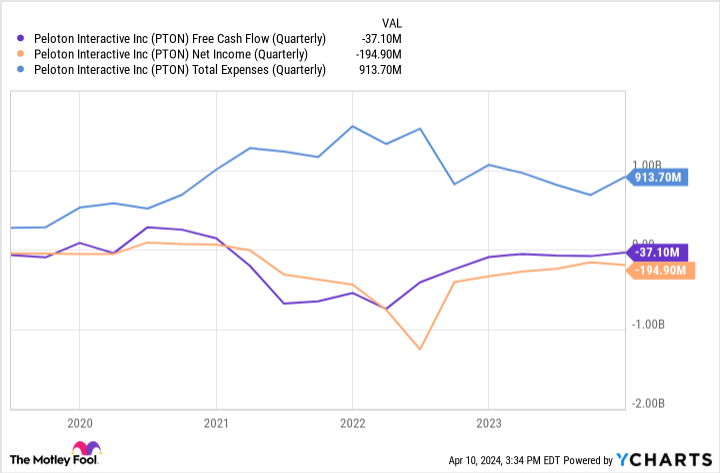

The company brought in a new CEO to take the reins and right-size the business. The U.S. factory was scrapped, and management announced multiple rounds of layoffs. However, Peloton still hasn't been able to return to growth after eight straight quarters of declining revenue.

Management has experimented with several initiatives. Most notably, Peloton has been moving away from a hardware-focus (the fitness equipment) to a software-as-a-service (SaaS) model by promoting its high-margin paid app, which doesn't require Peloton equipment. In the fiscal 2024 second quarter (ended Dec. 31), paid app subscriptions fell 16% year over year, though overall subscription revenue still rose 3%.

Peloton has also started selling on third-party platforms like Dick's Sporting Goods and Amazon. Units sold through these channels increased 74% year over year in the fiscal second quarter. Its Bike rental business is also thriving, and management is guiding for it to more than double in the current fiscal year.

Peloton's original product was its exercise bike, but its treadmill models are benefiting from the larger size of that market (about double the size of the bike market, according to management). Demand for Peloton's treadmills has been stronger than expected too.

One of management's goals was to become free cash flow positive in fiscal 2024, though that milestone is now being pushed back to the fiscal fourth quarter. The company also expects revenue growth to finally return in the same quarter.

Can Peloton ever recover?

If you think about how the fitness scene might look 10 years from now, it's likely to include a lot of digital and personalized content. That's what Peloton is all about. It has a first-mover's advantage here, and with profitability on the horizon, leadership can focus on finding a way forward.

Despite this progress, the company's performance doesn't justify the risk, even at this price. There are still too many unknowns.

If management hits its fiscal 2024 cash flow and growth targets, Peloton stock could see a lift. But I'd rather have greater clarity on its outlook before even considering the stock, even if it means paying a higher price.

Should you invest $1,000 in Peloton Interactive right now?

Before you buy stock in Peloton Interactive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Peloton Interactive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Peloton Interactive. The Motley Fool has a disclosure policy.

1 Ridiculously Cheap Stock I Wouldn't Touch With a 10-Foot Pole was originally published by The Motley Fool