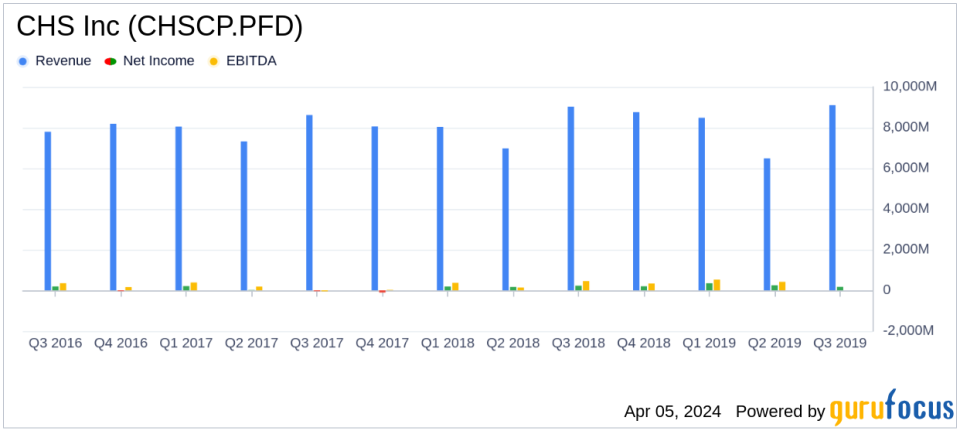

CHS Inc (CHSCP.PFD) Reports Decline in Q2 Earnings Amid Market Shifts

Net Income: $170.3 million, down from $292.3 million in Q2 of the previous fiscal year.

Revenues: Reported at $9.1 billion, a decrease from $11.3 billion in the same quarter last year.

Ag Segment: Earnings rose to $56.9 million, a significant increase from a loss in the prior year.

Energy Segment: Pretax earnings decreased to $51.6 million, reflecting lower refining margins and reduced demand.

Nitrogen Production: Pretax earnings of $37.0 million, down due to decreased market prices.

CHS Inc (NASDAQ:CHSCP.PFD) released its 8-K filing on April 3, 2024, detailing the company's financial performance for the second quarter of the fiscal year 2024, which ended on February 29, 2024. The company, a leading integrated agricultural enterprise, reported a net income of $170.3 million on revenues of $9.1 billion for the quarter. This represents a decrease from the net income of $292.3 million and revenues of $11.3 billion reported in the same period of the previous fiscal year. Over the first six months of fiscal year 2024, CHS Inc has achieved a net income of $693.2 million on revenues of $20.5 billion, compared to the first half of the previous fiscal year's net income of $1.1 billion and revenues of $24.1 billion.

Segment Performance and Market Conditions

The company's Ag segment saw a notable increase in earnings, attributed to stronger agronomy markets and stable grain and oilseed margins. The Energy segment, however, faced challenges with decreased refining margins due to lower market prices and less favorable pricing on heavy Canadian crude oil. The warm winter season also contributed to reduced demand for propane and refined fuels, impacting earnings negatively.

Equity method investments, particularly the CF Nitrogen investment, continued to perform well despite a decrease in pretax earnings due to lower market prices for urea and UAN. The Corporate and Other segment saw a slight decrease in pretax earnings, primarily due to lower equity income from Ventura Foods, which was affected by less favorable market conditions for edible oils.

Financial Tables and Commentary

CHS Inc's president and CEO, Jay Debertin, commented on the results, stating, "The first six months of our fiscal year have delivered overall good financial results." He emphasized the company's diversified portfolio and supply chain investments, which, along with its workforce and technology, have enabled CHS Inc to maintain performance despite market fluctuations.

"Our supply chain investments and well-diversified portfolio, empowered by our people and technology, are helping us perform well as we connect farmers and local cooperatives with the inputs and services they need to help feed the world."

Despite the challenges faced, CHS Inc continues to play a crucial role in the agricultural sector, providing essential services and inputs to farmers and cooperatives globally. The company's commitment to sustainability and community well-being remains a core aspect of its operations.

Outlook and Considerations

While CHS Inc (NASDAQ:CHSCP.PFD) has experienced a downturn in its second-quarter earnings, the company's diversified business model and strategic investments have allowed it to navigate the complex market conditions. Investors and stakeholders will be monitoring how CHS adapts to the ongoing challenges in the energy market, as well as the performance of its Ag and Nitrogen Production segments, which have shown resilience in the current economic climate.

Value investors may find interest in the company's ability to maintain solid earnings in its core Ag segment, which could indicate potential for recovery and growth as market conditions stabilize. As CHS Inc continues to adapt and innovate in response to global trends, it remains a significant player in the agricultural industry with a focus on empowering agriculture and feeding the world.

For detailed financial information and the full earnings report, readers are encouraged to view the company's 8-K filing.

Explore the complete 8-K earnings release (here) from CHS Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance