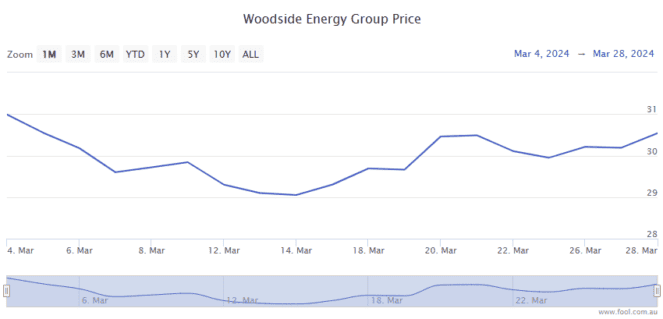

The Woodside Energy Group Ltd (ASX: WDS) share price declined for much of the first half of March before reversing course to climb for most of the second half.

Shares in the S&P/ASX 200 Index (ASX: XJO) energy stock ended February trading for $30.36. When the closing bell sounded on March, shares were swapping hands for $30.50 apiece, up a tepid 0.05% for the month.

Of course, that's not factoring in Woodside's 92 cents per share, fully franked dividend.

The stock traded ex-dividend on 7 March. Eligible investors can expect that passive income payout to hit their bank accounts tomorrow, 4 April.

If we add that back into the Woodside share price, the accumulated value of the ASX 200 energy stock gained 3.5% in March.

What happened over the month?

On the energy front, the Woodside share price enjoyed some tailwinds from a fast-rising oil price.

Brent crude kicked off March trading for US$84 per barrel. At the end of the month, that same barrel was trading for US$89, up 6%.

March also saw the company hold a presentation on its Climate Transition Action Plan (CTAP).

CEO Meg O'Neill told investors the CTAP aims to steer Woodside profitably through the global energy transition.

"I firmly believe Woodside is built to thrive through the energy transition," O'Neill said.

She added, "Our climate strategy is integrated throughout our corporate strategy as we provide the energy our customers need today and into a lower carbon future."

What's next for the Woodside share price?

Barring any new significant energy project updates or potential acquisition news, the biggest factors impacting the Woodside share price in the month ahead will be oil and gas prices.

And not just the spot prices. The medium-term outlook for energy prices will also have an influence on ASX 200 investors' decisions on whether or not to buy Woodside stock.

Despite Brent crude oil prices up 17% in 2024 and running at five-month highs, I believe that the energy bull run has a way to go yet.

Why?

First, we're almost certainly at the end of the rate-tightening cycle in both Australia and the United States.

The US, the world's top economy, is the biggest player here. With the Federal Reserve eyeing at least two interest rate cuts this year, that could spur the economy and energy demand.

And that increased demand would come at a time of likely reduced supply, with the Organization of the Petroleum Exporting Countries (OPEC+) and its allies' production cuts expected to be extended at least through the middle of this year.

Adding to that, we have Ukrainian drones attacking Russian oil refineries atop the escalating conflict in the oil-rich Middle East.

Any supply disruptions on either front could also send energy prices, and the Woodside share price, significantly higher.