Unlocking ASX Trading Success: FORTESCUE LTD – FMG Stock Analysis & Elliott Wave Technical Forecast

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with FORTESCUE LTD – FMG. We have identified that wave (v) may return to FMG to continue pushing higher, but it needs to be monitored closely until the significant high is breached. This would increase confidence and renew the bullish outlook.

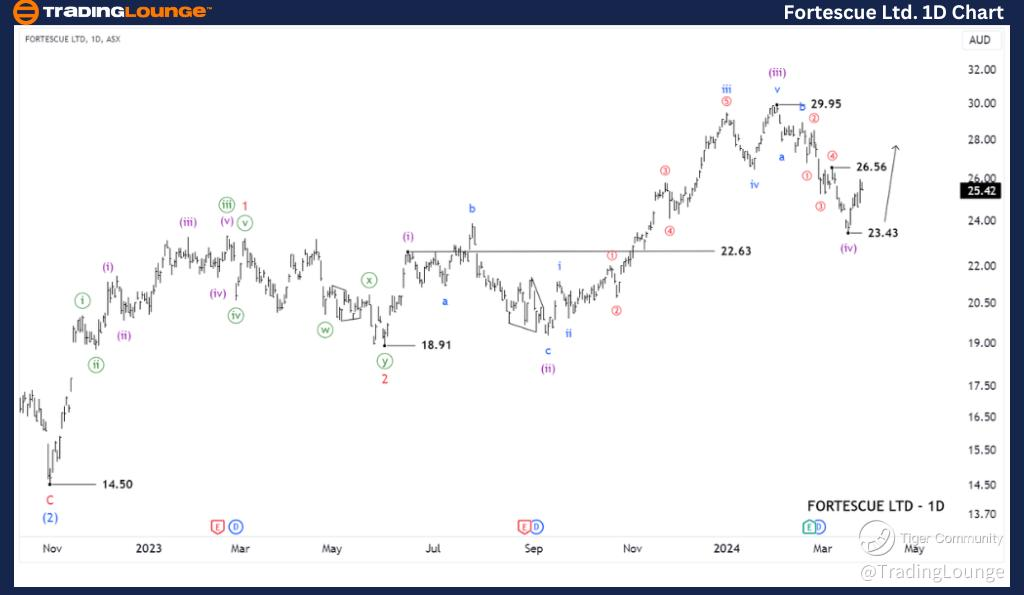

ASX:Fortescue LTD – (FMG) Elliott Wave technical analysis

Function: Major trend (Minuette degree, purple).

Mode: Motive.

Structure: Impulse.

Position: Wave (iv)-purple.

Details: The short-term outlook indicates that waves (i)-purple through (iii)-purple have concluded, so wave (iv)-purple is currently unfolding. It seems that it may have just ended at a low of 23.43. However, it's too early to definitively say this, and a rise above 26.56 would refresh the bullish perspective. Invalidation point: 22.63 Confirmation point: 26.56

ASX: Fortescue LTD – (FMG) Elliott Wave technical analysis

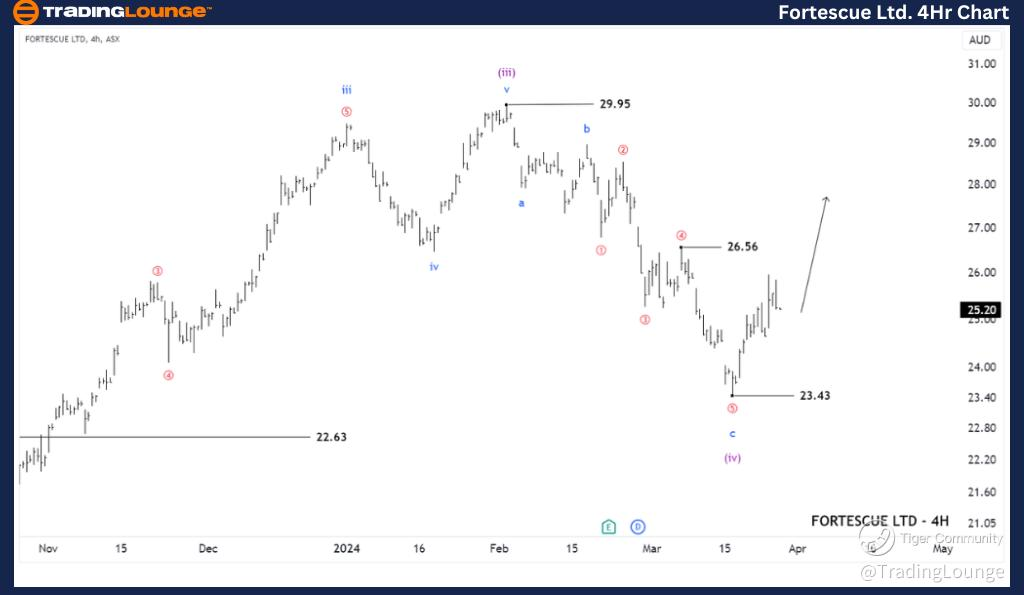

ASX: FORTESCUE LTD – FMG 4-Hour Chart Analysis

Function: Major trend (Minuette degree, purple).

Mode: Motive.

Structure: Impulse wave.

Position: Wave (v)-purple.

Details: The short-term outlook suggests that wave (iv)-purple appears to have bottomed out around 23.43, and wave (v)-purple seems to be unfolding to push higher. However, it's important to note that wave (iv) experienced a significant decline, and it's still too early to confirm what's happening. Therefore, breaking above the recent high at 26.56 would renew the bullish view and increase confidence in the upward trend.

Invalidation point: 23.43

Conclusion

Our analysis, forecast of contextual trends, and short-term outlook for ASX: FORTESCUE LTD – FMG aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing the confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

ASX: Fortescue LTD (FMG) Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

AUD/USD: Extra losses look likely below the 200-day SMA

The bearish tone remained well in place in the risk complex, dragging AUD/USD to fresh multi-day lows in the sub-0.6600 region on the back of the strong bounce in the US Dollar.

EUR/USD puts 1.0800 to the test

The strong data-driven comeback in the Greenback forced EURUSD to revisit the 1.0800 neighbourhood, down for the fourth session in a row and trading at shouting distance from the 200-day SMA (1.0787).

Gold extends slide below $2,350.00

Gold stays on the back foot and trades at its lowest level in over a week below $2,350. The benchmark 10-year US Treasury bond yield rises more than 1% following the stronger-than-forecast PMI data from the US, forcing XAU/USD to stretch lower.

Ethereum reclaims $3,800, lawmakers urge SEC Chair to approve ETH ETF

Ethereum (ETH) bounced back after a brief dip on Thursday as US lawmakers penned a letter to Securities & Exchange Commission (SEC) Chair Gary Gensler, urging him to approve spot ETH ETFs.

Is the Federal Reserve just winging it?

Are the central bankers at the Federal Reserve just winging it? It sure seems that way if you step back and take a long view of their decision-making. Fed officials project this aura of authority.