Some ASX dividend shares are predicted to pay very large dividend yields within the next few years. In an era of higher interest rates, I think it's fair that investors want to receive higher yields than a few years ago.

However, not every high yield is appealing. Some businesses cannot sustain a high payout, while others have cyclical payouts.

Sometimes buying a cyclical ASX share during the weak part of a cycle can be a smart idea, as the dividend can bounce (back) strongly. With that in mind, these two ASX shares look appealing to me after their declines.

Accent Group Ltd (ASX: AX1)

This ASX retail share is the distributor of a number of global shoe brands including CAT, Dr Martens, Henleys, Herschel, Hoka, Kappa, Merrell, Skechers, Timberland, Ugg and Vans. This company also has its own businesses like Glue Store, The Athlete's Foot, Stylerunner, Trybe and Nude Lucy.

The Accent share price is down around 15% since 14 February 2024 and it has dropped 22% from April 2023.

It's understandable why the company has fallen — sales are currently challenged in this higher cost-of-living situation. But I don't think we're going to see tricky conditions forever, meaning this lower share price is appealing.

According to Commsec, the ASX dividend share is projected to pay an annual dividend per share of 14.3 cents in FY26, which translates into a grossed-up dividend yield of 10.2%.

I think a key part of the company's growth outlook is its growing store count – that's helping grow its scale. The business also has an impressive e-commerce offering, it has grown its online sales significantly over the past four years – I think being a leader with online shopping is important as more people choose to shop online over time.

Centuria Office REIT (ASX: COF)

This is a real estate investment trust (REIT) which owns a portfolio of office buildings across Australia.

A much smaller percentage of its properties are in the Melbourne and Sydney CBDs than some investors may expect. The Sydney and Melbourne CBDs are where the vacancy rates are highest in Australia, and therefore are the danger areas for potential big valuation cuts and much lower rent.

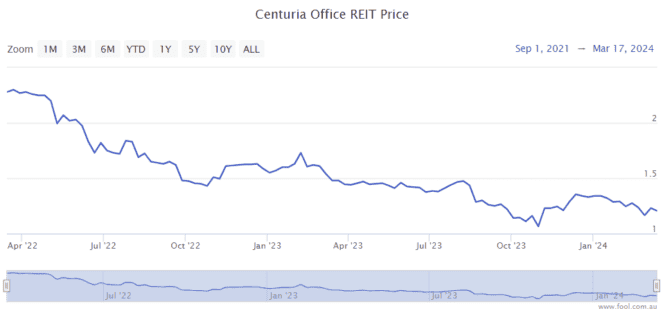

Despite that, the Centuria Office REIT share price is down more than 50% from September 2021. I don't know how much the ASX dividend share's properties are going to fall in value during this cycle, but I think the 50% fall more than makes up for it.

In the first half of FY24, the portfolio occupancy rate was 96.2%, and the weighted average lease expiry (WALE) was 4.4 years.

Almost 80% of its rental income is derived from government, multinational businesses and listed companies. To me, that means high-quality tenants.

It's expected to pay a distribution per unit of 12.1 cents in FY26, which is a distribution yield of around 10%.