If you have $10,000 to invest right now, there are some excellent S&P/ASX 200 Index (ASX: XJO) stocks that can grow that money.

When choosing stocks, I take the view of whether that cash will be invested in companies that will be doing better in 2029 than right now.

Here are two I reckon that are looking pretty damn good at the moment:

Pivoting from cash burner to cash saver

Xero Ltd (ASX: XRO) is an old favourite, but it's a company that continues to adapt well to changing conditions.

The market has very much appreciated the change in direction that chief executive Sukhinder Singh Cassidy has brought over her 13-month tenure.

She has transformed the mindset of the software business from a grow-at-all-costs startup attitude to a more mature controlled-growth strategy. Costs have been cut in an attempt to increase cash flow and margins.

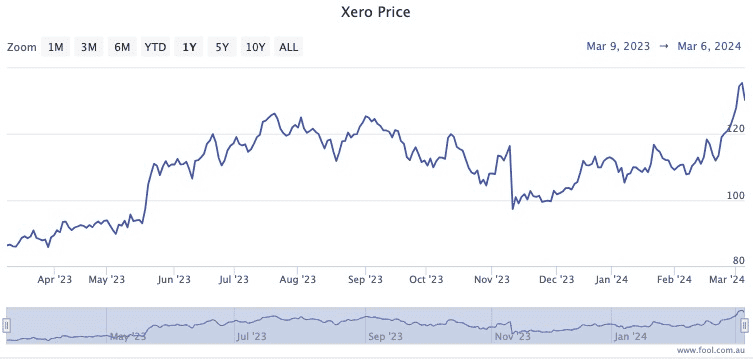

The Xero share price has thus rocketed 70% over the past 12 months.

Singh Cassidy's work is far from done yet though, so I feel like this is one to buy as a long-term investment.

The chances that the New Zealand tech company will be in better shape in five years' time compared to now seems reasonably high.

The ASX 200 shares under attack

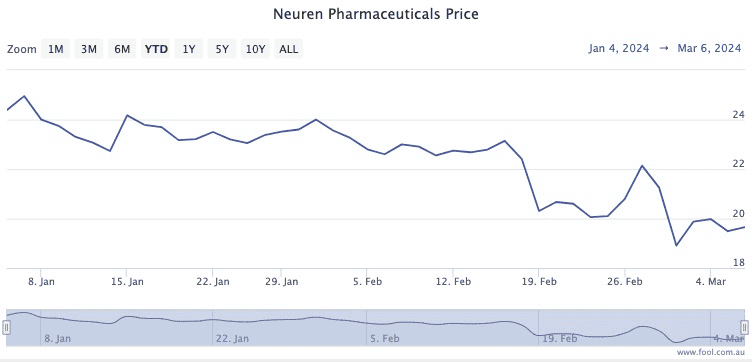

In contrast, Neuren Pharmaceuticals Ltd (ASX: NEU) hasn't started 2024 in the best way.

The ASX 200 biotech shares are now 20% lower than where they started the year.

A short seller report has had much to do with investors fleeing this Australian company, which develops treatments for rare neurological disorders.

Neuren has a business model where its already commercially approved drug, Daybue, is licenced out to US giant Acadia Pharmaceuticals Inc (NASDAQ: ACAD) for sale to the public.

This brings in revenue for Neuren, which it uses to fund its pipeline of drugs under development and testing.

Last month, US short seller Culper Research did not target Neuren specifically but accused Acadia of understating the side effects of Daybue.

However, fund managers are sticking by the embattled ASX 200 share.

While some have reduced their share price predictions, all six analysts currently surveyed on CMC Invest are still rating Neuren as a buy.

Again, with several products under development, the chance that this company will be bigger and better in five years seems pretty decent.