Do Acesian Partners' (Catalist:5FW) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Acesian Partners (Catalist:5FW). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Acesian Partners

How Fast Is Acesian Partners Growing Its Earnings Per Share?

In the last three years Acesian Partners' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, Acesian Partners' EPS catapulted from S$0.0081 to S$0.016, over the last year. It's not often a company can achieve year-on-year growth of 95%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Acesian Partners is growing revenues, and EBIT margins improved by 9.4 percentage points to 28%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

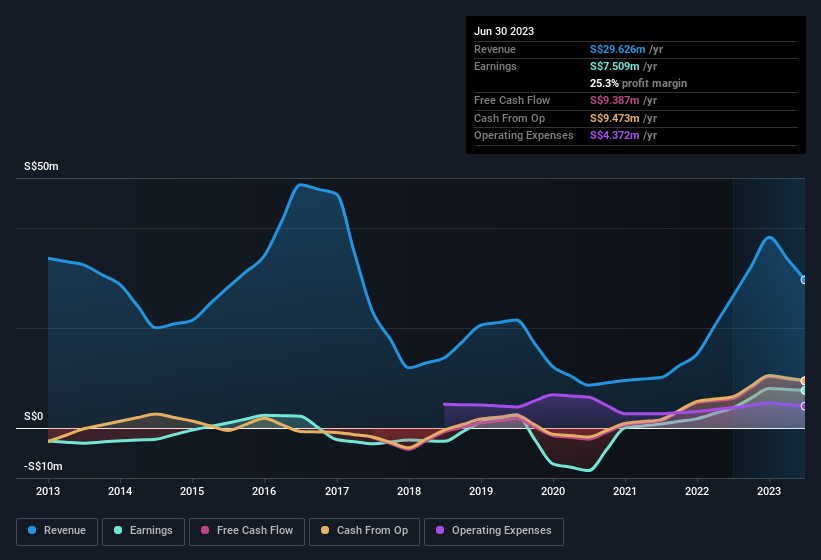

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Acesian Partners isn't a huge company, given its market capitalisation of S$20m. That makes it extra important to check on its balance sheet strength.

Are Acesian Partners Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Over the last 12 months Acesian Partners insiders spent S$188k more buying shares than they received from selling them. Although some people may hesitate due to the share sales, the fact that insiders bought more than they sold, is a positive thing to note. It is also worth noting that it was company insider Tiow Guan Goh who made the biggest single purchase, worth S$1.3m, paying S$0.025 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Acesian Partners insiders own more than a third of the company. In fact, they own 63% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Although, with Acesian Partners being valued at S$20m, this is a small company we're talking about. So this large proportion of shares owned by insiders only amounts to S$13m. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is Acesian Partners Worth Keeping An Eye On?

Acesian Partners' earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Acesian Partners belongs near the top of your watchlist. You should always think about risks though. Case in point, we've spotted 1 warning sign for Acesian Partners you should be aware of.

The good news is that Acesian Partners is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.