UserKKM

voted

We asked ChatGPT, "why is community important in investing?" It said:

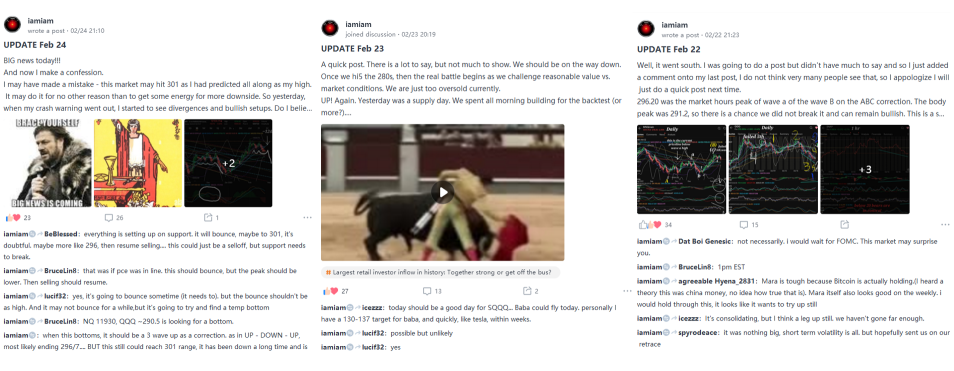

Yes, learning from each other is the essence of a community. That's why mooers are the core of our community. Mooers' Stories aims to let you meet mooers that might inspire you in our community. In this episode, we invited @iamiam, who has been investing for more than 20 years and posting daily, to offer his insights on how to take the...

Yes, learning from each other is the essence of a community. That's why mooers are the core of our community. Mooers' Stories aims to let you meet mooers that might inspire you in our community. In this episode, we invited @iamiam, who has been investing for more than 20 years and posting daily, to offer his insights on how to take the...

+4

63

48

UserKKM

voted

Hey, mooers! At the end of this post, there is a chance for you to win points!![]()

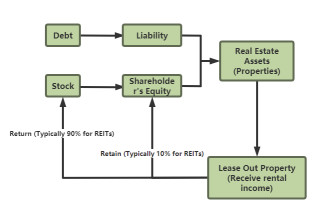

Welcome back to REITs 101, which will level up your REITs investment knowledge with our full educational REIT Investment.

Do you remember the question we left in the last post >> REITs 101: A brief history of REITs?

![]() Question :

Question :

What's the name of Singapore's first REIT?

Answer: SingMall Property Trust

Did you get it right? Congratulations to those mooers who got it right and won 50 poi...

Welcome back to REITs 101, which will level up your REITs investment knowledge with our full educational REIT Investment.

Do you remember the question we left in the last post >> REITs 101: A brief history of REITs?

What's the name of Singapore's first REIT?

Answer: SingMall Property Trust

Did you get it right? Congratulations to those mooers who got it right and won 50 poi...

25

8

UserKKM

liked

$XIAOMI-W(01810.HK$

It is said that xiaomi will release the Mi 12 X, MI 12 and MI 12 Pro in three models. In addition to the submersible lens, the other three lenses are all 50 megapixel flagship solutions with snapdragon 8 Gen1 chips. I have already finished the press conference on 28th, I can say that I am super looking forward to it.

It is said that xiaomi will release the Mi 12 X, MI 12 and MI 12 Pro in three models. In addition to the submersible lens, the other three lenses are all 50 megapixel flagship solutions with snapdragon 8 Gen1 chips. I have already finished the press conference on 28th, I can say that I am super looking forward to it.

23

UserKKM

liked

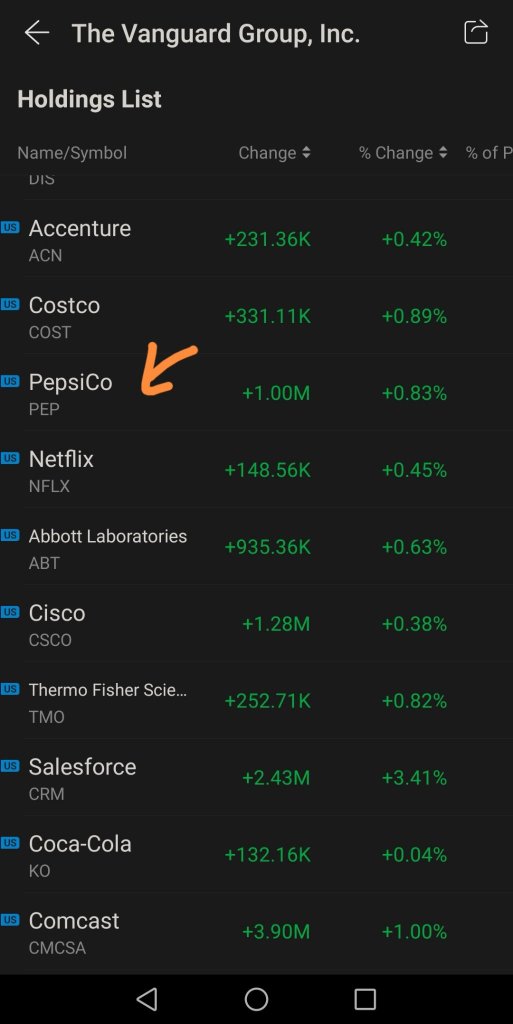

$PepsiCo(PEP.US$ dedicated to PepsiCo. First time using star institution function and i notice the top 5 institution have something in common based on their latest declaration (vanguard, state street, capital)

: increased pepsi portfolio. I believe there is a reasons based on the future prospect that the leadership are laying out or laid the foundations

Yes, the % growth is not higher than $Coca-Cola(KO.US$. However, as a long term investment and being a beverage formulation specialist who has been observing the trend of authorities across the globe on their take of war against sugar, i believe the pepsi is doing all the right move in reducing risk that coca cola is facing.

1) diversity from pure beverage play by venture into snacks (frito lays) , oat (quaker oat), fast food ( yum) and food. These move have synergism between them : bag of lays with bottle of mtn dew, kfc with pepsi.

2) latest acquisitions: pepsi have also evolve (plant based protein) brand which they aquired back in 2019 and rockstar in april 2021. They are of future direction whereby

a) plant based protein drink gaining traction due to consumers are welcoming flexitarian diet and believe plant based could reduce carbon foot print and higher nutritions

b) energy drink has been on the rise during pandemic, where consumers are seek for energy functional drinks as they experienced "pandemic fatigue" and amidst of sky rocket coffee price due to poor harvest back In may 2021 on top of covid restriction since 2020. Intent to leverage on mtn dew brand, which is a smart move as cola flavored energy taste horrible ( have u tried the failed coke energy? Horrible cough syrup). Fruity and flavourful mtn dew would be a wiser move like redbull austria has been trying with their colour ranges.

3) in their beverage portfolio, they cover an extensive range. From their iconic pepsi and its flavour extensions, to gatorade isotonic for sports segment, mug root beer etc. Now with the aquired rockstar, they have plans of strength the mtn dew branding and evolved in plant based.

4) disposal of weakening brand, tropicana due to consumer bad connotation of juice are high in sugar. Focus on more dynamic approach. Similar to coca cola who dispose of zico, odwalla last year

5) joint partnership with beyond meat to spearhead into plant based snacks and beverage. Expected debut in 2022

6) continued alliance with suntory whom spearhead in regional expansion of both suntory and pepsico beverage in Asia and europe (suntory pepsi co.)

7) acquisition of sodastreams has offer new ways for consumers to make their own bubbles. With the recent launch of their zebra brand RTD mixers would also have synergism with their soda stream usage and also tap into consumer customisation experience

8) recent development into functional beverages that address rising consumer need: launch of driftwell to tap into "sleep aiding" market that has grown substantially between 2020 and 2021. Next would be joint partnership with beyond meat on plant based

9) beverage sector has been hammered since 2016 due to war against sugar and media limelight of sugary drinks. Sugar taxes and shift of consumers preference has result in reduction of soft drink and juice drink in most countries. Reformulated beverage driven up the cost and result in lower margin or higher sales price. Render futher reduction of sales. Pepsi having non beverage pillars would cushion the impact and create synergism within its ecosystem to attract consumers

10) exploration of alcoholics with partnership with Boston beer to create a offerage of mtn dew hard seltzer

Tldr: i like pepsi for its diversity and on par with trend. Moreover, dividend payout enough to grab a can of pepsi and say cheers.

: increased pepsi portfolio. I believe there is a reasons based on the future prospect that the leadership are laying out or laid the foundations

Yes, the % growth is not higher than $Coca-Cola(KO.US$. However, as a long term investment and being a beverage formulation specialist who has been observing the trend of authorities across the globe on their take of war against sugar, i believe the pepsi is doing all the right move in reducing risk that coca cola is facing.

1) diversity from pure beverage play by venture into snacks (frito lays) , oat (quaker oat), fast food ( yum) and food. These move have synergism between them : bag of lays with bottle of mtn dew, kfc with pepsi.

2) latest acquisitions: pepsi have also evolve (plant based protein) brand which they aquired back in 2019 and rockstar in april 2021. They are of future direction whereby

a) plant based protein drink gaining traction due to consumers are welcoming flexitarian diet and believe plant based could reduce carbon foot print and higher nutritions

b) energy drink has been on the rise during pandemic, where consumers are seek for energy functional drinks as they experienced "pandemic fatigue" and amidst of sky rocket coffee price due to poor harvest back In may 2021 on top of covid restriction since 2020. Intent to leverage on mtn dew brand, which is a smart move as cola flavored energy taste horrible ( have u tried the failed coke energy? Horrible cough syrup). Fruity and flavourful mtn dew would be a wiser move like redbull austria has been trying with their colour ranges.

3) in their beverage portfolio, they cover an extensive range. From their iconic pepsi and its flavour extensions, to gatorade isotonic for sports segment, mug root beer etc. Now with the aquired rockstar, they have plans of strength the mtn dew branding and evolved in plant based.

4) disposal of weakening brand, tropicana due to consumer bad connotation of juice are high in sugar. Focus on more dynamic approach. Similar to coca cola who dispose of zico, odwalla last year

5) joint partnership with beyond meat to spearhead into plant based snacks and beverage. Expected debut in 2022

6) continued alliance with suntory whom spearhead in regional expansion of both suntory and pepsico beverage in Asia and europe (suntory pepsi co.)

7) acquisition of sodastreams has offer new ways for consumers to make their own bubbles. With the recent launch of their zebra brand RTD mixers would also have synergism with their soda stream usage and also tap into consumer customisation experience

8) recent development into functional beverages that address rising consumer need: launch of driftwell to tap into "sleep aiding" market that has grown substantially between 2020 and 2021. Next would be joint partnership with beyond meat on plant based

9) beverage sector has been hammered since 2016 due to war against sugar and media limelight of sugary drinks. Sugar taxes and shift of consumers preference has result in reduction of soft drink and juice drink in most countries. Reformulated beverage driven up the cost and result in lower margin or higher sales price. Render futher reduction of sales. Pepsi having non beverage pillars would cushion the impact and create synergism within its ecosystem to attract consumers

10) exploration of alcoholics with partnership with Boston beer to create a offerage of mtn dew hard seltzer

Tldr: i like pepsi for its diversity and on par with trend. Moreover, dividend payout enough to grab a can of pepsi and say cheers.

+1

19

UserKKM

liked

$Alibaba(BABA.US$

BABA pre is now at 117.6 thanks to US all falling as expected. However, NDX has probably bottom out in futures already. The max another 100 point fall before intraday reversal. Once NDX starts the reversal, we should also see BABA reversing intraday.

Still not sure what are the signs spotted in BABA chart? Maybe you should take some time to watch the video I made last Sunday to keep yourself in the loop for this week!

We will see later during cash open!

As always, trade safe & invest wise!

BABA pre is now at 117.6 thanks to US all falling as expected. However, NDX has probably bottom out in futures already. The max another 100 point fall before intraday reversal. Once NDX starts the reversal, we should also see BABA reversing intraday.

Still not sure what are the signs spotted in BABA chart? Maybe you should take some time to watch the video I made last Sunday to keep yourself in the loop for this week!

We will see later during cash open!

As always, trade safe & invest wise!

17

UserKKM

liked

4

Initial investments are always nerve wrecking. To feel safer, some may start to follow the crowd or start taking investment advice from websites.

I too, was tempted. Resisting against the human nature of feeling safe has left me anxious.

It was then, I started finding security in having knowledge, starting books such as "Rich dad poor dad", to build my mindset and technical analysis books to help me find the right stocks.

Above all, the most important skill was learnt through YouTube which was how to analyse a company. Through the video, the summarised key points is as follows:

8 steps to analyse a company:👍

Business Section of 10k(annual) or 10q(quarterly)

Management Discussion & Analysis (MD&A)

Business Overview

Management’s Plan

Industry Trends

Segment Performance

Overall Performance

Financial Statement Analysis (Read the footnotes)

Company Presentations & Earnings Calls

Competitor Analysis (identify 2 or 3 other companies and do light research and check of their margins? Profit? p/e?)

Determine Fair Value (p/e,...)

Identify Drivers of the stock (Can check the news)

Wait for Buying Opportunity

With this, I leave you with a closing thought: To buy or not, to sell or not. Depends on your own research, cross referenced with other experts opinions. Keep improving yourself and investing will be come easier

I too, was tempted. Resisting against the human nature of feeling safe has left me anxious.

It was then, I started finding security in having knowledge, starting books such as "Rich dad poor dad", to build my mindset and technical analysis books to help me find the right stocks.

Above all, the most important skill was learnt through YouTube which was how to analyse a company. Through the video, the summarised key points is as follows:

8 steps to analyse a company:👍

Business Section of 10k(annual) or 10q(quarterly)

Management Discussion & Analysis (MD&A)

Business Overview

Management’s Plan

Industry Trends

Segment Performance

Overall Performance

Financial Statement Analysis (Read the footnotes)

Company Presentations & Earnings Calls

Competitor Analysis (identify 2 or 3 other companies and do light research and check of their margins? Profit? p/e?)

Determine Fair Value (p/e,...)

Identify Drivers of the stock (Can check the news)

Wait for Buying Opportunity

With this, I leave you with a closing thought: To buy or not, to sell or not. Depends on your own research, cross referenced with other experts opinions. Keep improving yourself and investing will be come easier

UserKKM

liked

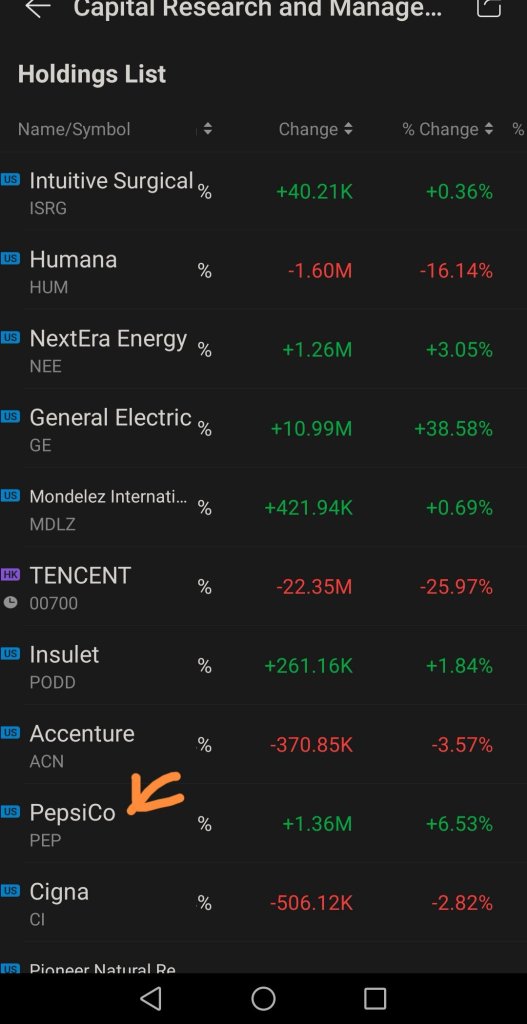

$AbbVie(ABBV.US$ Upgraded to buy?

Seems a day late and a dollar short if you ask me.

I've held on to my shares of AbbVie ever since it was spun off Abbott Labs on 1/2/13.

I used to think 13 was a bad luck number, but now I'm not so sure.

AbbVie has done nothing but rise in price and raise its dividend ever since it was spun off Abbott Labs.

I received my AbbVie dividend check in the mail a few days ago.

When I saw it, I started to sing: "AbbVie, how I love you, how I love you, my dear old AbbVie."

Seems a day late and a dollar short if you ask me.

I've held on to my shares of AbbVie ever since it was spun off Abbott Labs on 1/2/13.

I used to think 13 was a bad luck number, but now I'm not so sure.

AbbVie has done nothing but rise in price and raise its dividend ever since it was spun off Abbott Labs.

I received my AbbVie dividend check in the mail a few days ago.

When I saw it, I started to sing: "AbbVie, how I love you, how I love you, my dear old AbbVie."

17

6

UserKKM

liked

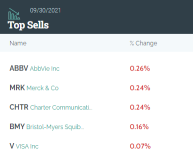

Warren Buffett's Berkshire Hathaway built new stakes in $Floor & Decor(FND.US$ and $Royalty Pharma(RPRX.US$ in the third quarter, a regulatory filing revealed on Monday. The famed investor's company also took a knife to several of its pharmaceutical and financial holdings in the period.

On the other hand, Berkshire boosted its $Chevron(CVX.US$ stake by 24%, after halving its position in the energy group in the first quarter of this year, and trimming it even more in the second quarter.

Buffett's company exited $Merck & Co(MRK.US$, $Organon & Co(OGN.US$, and $Liberty Global-A(LBTYA.US$. It also cut its $AbbVie(ABBV.US$and $Bristol-Myers Squibb(BMY.US$ positions by 30% and 16% respectively last quarter, despite only adding those names to its portfolio in the third quarter of last year. Moreover, it trimmed its $Visa(V.US$, $MasterCard(MA.US$, $Charter Communications(CHTR.US$, and $Marsh & McLennan(MMC.US$.

On the other hand, Berkshire boosted its $Chevron(CVX.US$ stake by 24%, after halving its position in the energy group in the first quarter of this year, and trimming it even more in the second quarter.

Buffett's company exited $Merck & Co(MRK.US$, $Organon & Co(OGN.US$, and $Liberty Global-A(LBTYA.US$. It also cut its $AbbVie(ABBV.US$and $Bristol-Myers Squibb(BMY.US$ positions by 30% and 16% respectively last quarter, despite only adding those names to its portfolio in the third quarter of last year. Moreover, it trimmed its $Visa(V.US$, $MasterCard(MA.US$, $Charter Communications(CHTR.US$, and $Marsh & McLennan(MMC.US$.

59

2

UserKKM

liked

You can also find more quality youtube video of individual stocks, broad market and macro analysis on my youtube channel at Hopehope赋予希望:

https://www.youtube.com/channel/UCAPWOEQKCpCWmzKkdo7v-iw

Metaverse is not a new concept as can be seen by ready player one movie. This concept was then amplified when Facebook rebranded its name to Meta.

I sat in and listened to Bilibili's recent 3Q earnings conference and while it is not unexpected for me to find the increase in MAU, I kinda get the sense that companies like Bilibili and Huya are now paying more for conent in the race to get users stickier to the platform. Why is this the case? Metaverse in itself is a concept and requires alot of technical support and tools from 5G, 6G, semiconductor chips, cloud storage space, software and hardware like augmented reality and virtual reality tools. Lastly and one of the more important factors is the participation of users.

So whoever has the community size to participate in the metaverse and dabble in the multi-metaverse is going to get a decent size of the pie. Huya being majority controlled by Tencent, which itself has claimed to have the tools for the metaverse would stand to benefit in the long run despite short term regulatory overhang. WIll it be one year before the game approvals restriction will be lifted? Nobody truly knows. But recent news that said that the game approvals activity may resume by Beijing did create some excitement and companies like Tencent and Netease did enjoy a brief surge.

It is noticeable to see Netease strengthening despite the sharp pull-back of Alibaba. Alibaba has definitely disappointed in terms of earnings and it may not be wise to hold Alibaba as compared to Tencent. Tencent being in a less touchy space compared to Alibaba (at least Tencent's founder has not been under that immense scrutiny as compared to Jack Ma)...

Stayed tuned to my youtube channel at Hopehope赋予希望 if you are keen to be kept updated on quality research covering individual stocks, broad market and macro market review.

As always, this should not be construed as any investment or trading advice.

$Youdao(DAO.US$ $NetEase(NTES.US$ $NTES-S(09999.HK$ $TENCENT(00700.HK$ $TENCENT N2301A(05091.HK$ $Alibaba(BABA.US$ $HUYA Inc(HUYA.US$ $DouYu(DOYU.US$ $Meta Platforms(FB.US$ $NVIDIA(NVDA.US$ $BILIBILI-W(09626.HK$ $Bilibili(BILI.US$ $KUAISHOU-W(01024.HK$ $Snap Inc(SNAP.US$ $Activision Blizzard(ATVI.US$ $Electronic Arts Inc(EA.US$

https://www.youtube.com/channel/UCAPWOEQKCpCWmzKkdo7v-iw

Metaverse is not a new concept as can be seen by ready player one movie. This concept was then amplified when Facebook rebranded its name to Meta.

I sat in and listened to Bilibili's recent 3Q earnings conference and while it is not unexpected for me to find the increase in MAU, I kinda get the sense that companies like Bilibili and Huya are now paying more for conent in the race to get users stickier to the platform. Why is this the case? Metaverse in itself is a concept and requires alot of technical support and tools from 5G, 6G, semiconductor chips, cloud storage space, software and hardware like augmented reality and virtual reality tools. Lastly and one of the more important factors is the participation of users.

So whoever has the community size to participate in the metaverse and dabble in the multi-metaverse is going to get a decent size of the pie. Huya being majority controlled by Tencent, which itself has claimed to have the tools for the metaverse would stand to benefit in the long run despite short term regulatory overhang. WIll it be one year before the game approvals restriction will be lifted? Nobody truly knows. But recent news that said that the game approvals activity may resume by Beijing did create some excitement and companies like Tencent and Netease did enjoy a brief surge.

It is noticeable to see Netease strengthening despite the sharp pull-back of Alibaba. Alibaba has definitely disappointed in terms of earnings and it may not be wise to hold Alibaba as compared to Tencent. Tencent being in a less touchy space compared to Alibaba (at least Tencent's founder has not been under that immense scrutiny as compared to Jack Ma)...

Stayed tuned to my youtube channel at Hopehope赋予希望 if you are keen to be kept updated on quality research covering individual stocks, broad market and macro market review.

As always, this should not be construed as any investment or trading advice.

$Youdao(DAO.US$ $NetEase(NTES.US$ $NTES-S(09999.HK$ $TENCENT(00700.HK$ $TENCENT N2301A(05091.HK$ $Alibaba(BABA.US$ $HUYA Inc(HUYA.US$ $DouYu(DOYU.US$ $Meta Platforms(FB.US$ $NVIDIA(NVDA.US$ $BILIBILI-W(09626.HK$ $Bilibili(BILI.US$ $KUAISHOU-W(01024.HK$ $Snap Inc(SNAP.US$ $Activision Blizzard(ATVI.US$ $Electronic Arts Inc(EA.US$

79

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)