TradeMore

liked

Former first lady Melania Trump will make Parler "Her Social Media Home,” the company claimed Wednesday — despite the fact that her husband's platform TRUTH Social is expected to launch next month.

Parler said in a press release posted on Substack that the former first lady "engaged Parler in a special arrangement for her social media communication.”Melania Trump previously used Parler to host her NFT artwork sales. "As part of the synergistic...

Parler said in a press release posted on Substack that the former first lady "engaged Parler in a special arrangement for her social media communication.”Melania Trump previously used Parler to host her NFT artwork sales. "As part of the synergistic...

24

6

TradeMore

commented on

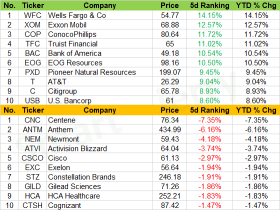

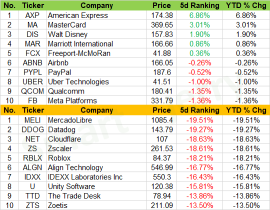

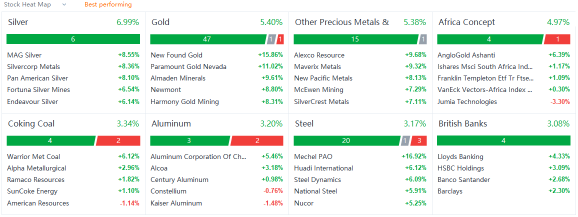

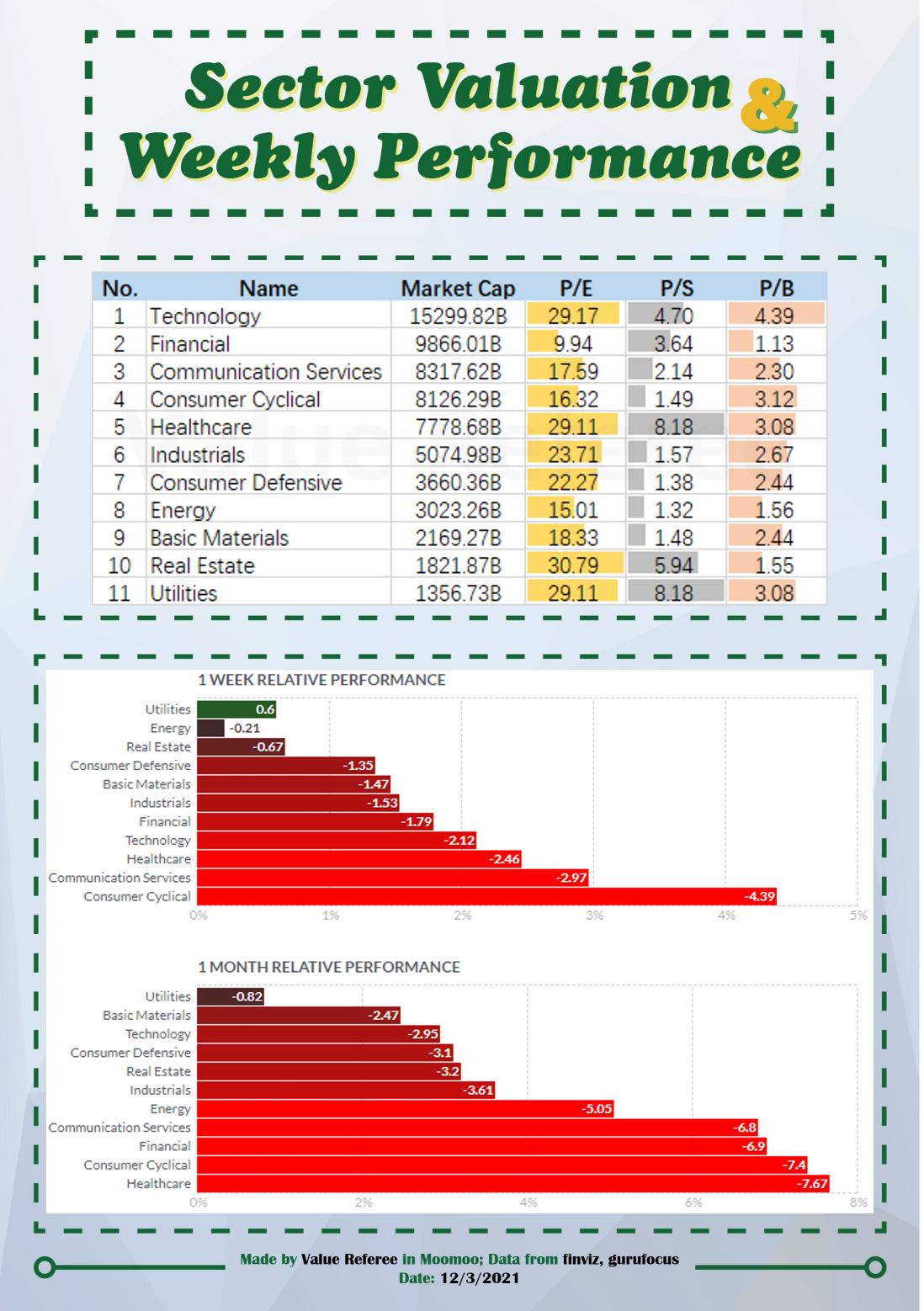

Hard week for growth stocks.![]()

![]()

Let's see what happened last week.![]()

![]()

Top 10 movers for large-cap value stocks![]()

![]()

Top 10 movers for large-cap growth stocks![]()

![]()

Top 10 movers for large-cap core stocks![]()

![]()

Happy weekend!![]()

![]()

Let's see what happened last week.

Top 10 movers for large-cap value stocks

Top 10 movers for large-cap growth stocks

Top 10 movers for large-cap core stocks

Happy weekend!

+1

91

13

TradeMore

liked

Stocks set for mixed open on virus risk; oil falls

Stocks looked set for a mixed start Monday and oil slid amid concerns about more curbs to tackle the omicron virus variant, tightening monetary policy and a setback for President Joe Biden's economic agenda.

Futures earlier slipped for Japan but rose for Hong Kong. Australian stocks edged down, while U.S. equity futures fluctuated. Global stocks retreated last week in part on an outlook of diminishing central bank stimulus as officials pivot toward fighting inflation.

Risks pile up for millions of day traders buying India stocks

Nithin Kamath, the chief executive officer of India's largest online brokerage, estimates that his platform handles 10 to 12 million orders on the average day. They're increasingly from first-time investors under the age of 30, executing dozens of trades at lightning speed off their mobile phones.

Young investors like those on Kamath's Zerodha Broking -- which has come to be known as India's Robinhood -- helped drive its stock market to records this year, but many are now buying at a time when risks are building up.

European power prices for Monday rise to record on cold snap

A combination of colder weather, low wind and nuclear outages, combined with very expensive natural gas prices, saw daily power prices in Spain jump to a record while French equivalent rose to its highest level since a rare price peak in 2009.

With benchmark natural gas prices seen seven times higher than at the start of the year due hampered supplies from Russia, traders are bracing for even higher prices in the coming coldest winter months.

Crypto attracts more money in 2021 than all previous years combined

Need more proof that this is the year digital assets went mainstream? How about the fact that venture capital funds have poured about $30 billion into crypto, or more than in all previous years combined for the little more than decade-old technology.

As other established firms such as Coinbase Ventures, Digital Currency Group and Polychain Capital bet on the next big crypto thing, all manner of experimental projects — a social media app that turns celebrities into tokens, a play-to-earn NFT game inspired by Elon Musk or a collectible consisting of a list of words — secured funding.

Cathie Wood says innovation stocks are in 'deep value' territory

"After correcting for nearly 11 months, innovation stocks seem to have entered deep value territory," she wrote in a blog post she said was intended to share ARK's thought process. "We take advantage of volatility during corrections and concentrate our portfolios toward our highest conviction stocks."

Chinese electric car start-up Nio reveals a new sedan, augmented reality glasses

Chinese electric car start-up $NIO Inc(NIO.US$'s second electric sedan, the ET5, is set to begin deliveries in September 2022, CEO William Li said Saturday at the company's annual "Nio Day" event. Li also announced custom augmented reality glasses for the car that are made by Nreal, a Chinese start-up backed by Nio's investing arm.

On the global front, Nio plans to enter Germany and three other countries in Europe next year, Li said.

'Cash could be your friend': Wilmington Trust sees a deeper pullback providing better opportunities for investors

Despite a bullish 2022 outlook, Wilmington Trust's Meghan Shue expects the wild swings to ramp up as investors digest a less accommodative Federal Reserve and assess new risks tied to the Covid omicron variant.

"While we're overweight to equities, we're holding elevated cash because we think there are probably going to be more opportunities presenting themselves," the firm's head of investment strategy told CNBC on Friday. "Cash could be your friend over the coming months."

Slim chance U.S. stocks will rack up another year of gains

The $S&P 500 Index(.SPX.US$ is poised to end higher for the third year in a row, having added more than 20% so far in 2021. Another rally in 2022 would make for a four-year winning streak, which has happened only five times in nearly a century.

Analysis shows a three-year streak -- like the one now -- is uncommon, but not terribly out of the ordinary, occurring 11 times for data going back to 1927, and making another year of gains a toss-up. The longest-ever wining streak was the eight-year period from 1982 to 1989 (even with a dramatic crash in October 1987, the S&P 500 still eked out a gain).

Source: Bloomberg, CNBC

Stocks looked set for a mixed start Monday and oil slid amid concerns about more curbs to tackle the omicron virus variant, tightening monetary policy and a setback for President Joe Biden's economic agenda.

Futures earlier slipped for Japan but rose for Hong Kong. Australian stocks edged down, while U.S. equity futures fluctuated. Global stocks retreated last week in part on an outlook of diminishing central bank stimulus as officials pivot toward fighting inflation.

Risks pile up for millions of day traders buying India stocks

Nithin Kamath, the chief executive officer of India's largest online brokerage, estimates that his platform handles 10 to 12 million orders on the average day. They're increasingly from first-time investors under the age of 30, executing dozens of trades at lightning speed off their mobile phones.

Young investors like those on Kamath's Zerodha Broking -- which has come to be known as India's Robinhood -- helped drive its stock market to records this year, but many are now buying at a time when risks are building up.

European power prices for Monday rise to record on cold snap

A combination of colder weather, low wind and nuclear outages, combined with very expensive natural gas prices, saw daily power prices in Spain jump to a record while French equivalent rose to its highest level since a rare price peak in 2009.

With benchmark natural gas prices seen seven times higher than at the start of the year due hampered supplies from Russia, traders are bracing for even higher prices in the coming coldest winter months.

Crypto attracts more money in 2021 than all previous years combined

Need more proof that this is the year digital assets went mainstream? How about the fact that venture capital funds have poured about $30 billion into crypto, or more than in all previous years combined for the little more than decade-old technology.

As other established firms such as Coinbase Ventures, Digital Currency Group and Polychain Capital bet on the next big crypto thing, all manner of experimental projects — a social media app that turns celebrities into tokens, a play-to-earn NFT game inspired by Elon Musk or a collectible consisting of a list of words — secured funding.

Cathie Wood says innovation stocks are in 'deep value' territory

"After correcting for nearly 11 months, innovation stocks seem to have entered deep value territory," she wrote in a blog post she said was intended to share ARK's thought process. "We take advantage of volatility during corrections and concentrate our portfolios toward our highest conviction stocks."

Chinese electric car start-up Nio reveals a new sedan, augmented reality glasses

Chinese electric car start-up $NIO Inc(NIO.US$'s second electric sedan, the ET5, is set to begin deliveries in September 2022, CEO William Li said Saturday at the company's annual "Nio Day" event. Li also announced custom augmented reality glasses for the car that are made by Nreal, a Chinese start-up backed by Nio's investing arm.

On the global front, Nio plans to enter Germany and three other countries in Europe next year, Li said.

'Cash could be your friend': Wilmington Trust sees a deeper pullback providing better opportunities for investors

Despite a bullish 2022 outlook, Wilmington Trust's Meghan Shue expects the wild swings to ramp up as investors digest a less accommodative Federal Reserve and assess new risks tied to the Covid omicron variant.

"While we're overweight to equities, we're holding elevated cash because we think there are probably going to be more opportunities presenting themselves," the firm's head of investment strategy told CNBC on Friday. "Cash could be your friend over the coming months."

Slim chance U.S. stocks will rack up another year of gains

The $S&P 500 Index(.SPX.US$ is poised to end higher for the third year in a row, having added more than 20% so far in 2021. Another rally in 2022 would make for a four-year winning streak, which has happened only five times in nearly a century.

Analysis shows a three-year streak -- like the one now -- is uncommon, but not terribly out of the ordinary, occurring 11 times for data going back to 1927, and making another year of gains a toss-up. The longest-ever wining streak was the eight-year period from 1982 to 1989 (even with a dramatic crash in October 1987, the S&P 500 still eked out a gain).

Source: Bloomberg, CNBC

77

12

TradeMore

liked

Hey mooers, check out today's hot sectors and hot stocks here!

+1

12

1

TradeMore

liked and commented on

Asian stocks set for mixed start after U.S. drop

Asian stocks looked set for a mixed start Friday following a decline in U.S. shares led by the technology sector as tightening monetary policy to fight inflation buffets investor sentiment.

Australian equities edged up, while futures pointed lower for Japan and were little changed for Hong Kong. The tech-heavy $NASDAQ 100 Index(.NDX.US$ sank the most since September, skidding on reduced appetite for more richly valued investments amid the Fed's pivot toward scaling back outsized stimulus. U.S. equity contracts wavered in early Asian trading.

Apple leads big tech lower as investors reconsider Fed moves

Megacap tech names initially saw a positive reaction to the Fed's statement on Wednesday, with investors buying up shares of $Apple(AAPL.US$, $Microsoft(MSFT.US$ and $NVIDIA(NVDA.US$, among others. But those stocks came under pressure Thursday, erasing most or all of their gains.

Apple shares declined 3.9% on Thursday, with the iPhone maker retreating further from a $3 trillion market valuation as it posted its worst day since March. Among other names, Microsoft fell 2.9%, $Amazon(AMZN.US$ slid 2.6%, and Nvidia shed 6.8%.

Melania Trump is releasing an NFT that will cost 1 SOL each

Melania Trump has become the latest celebrity to try to cash in on the craze for non-fungible tokens.

The former first lady's first NFT, called Melania's Vision, will include watercolor art that "embodies Mrs. Trump's cobalt blue eyes, providing the collector with an amulet to inspire," according to an emailed statement. It will be available from Dec. 16 to Dec. 31 for one SOL, a cryptocurrency that runs on the Solana blockchain, currently priced at $187.

A pair of teenagers helps launch ETF targeting youngest traders

An exchange-traded fund tracking U.S. companies that adhere to the values of Generation Z starts trading on Thursday.

The $THE GENERATION Z ETF(ZGEN.US$ tracks a portfolio of "future-focused companies that align with Generation Z," according to a press release. It will trade under the ticker ZGEN and charge a fee of 0.6%, the fund's website says.

Consumer Financial Protection Bureau probing 'buy now, pay later' companies, including Affirm, Klarna

The bureau issued orders seeking information from the firms that would help it examine concerns such as the kind of role these ' buy now, pay later' plans play in increasing consumers' debt and how these companies use consumer data, the agency said.

The CFPB said the ease of getting these plans can mean consumers end up spending more than anticipated. $Affirm Holdings(AFRM.US$ dopped 10.6% on Thursday.

Rivian shares slide after company cuts 2021 EV production expectations

$Rivian Automotive(RIVN.US$ said it expects to fall "a few hundred vehicles short" of its 2021 production target of 1,200 vehicles. The company said it faced supply chain issues as well as challenges ramping up production of the complex batteries that power the vehicles.

The updates come alongside Rivian's first quarterly report as a public company and confirmation of plans for a new $5 billion plant in Georgia that's expected to come online in 2024.

Millennial millionaires plan to add more crypto in 2022, CNBC Millionaire Survey finds

Most millennial millionaires have the bulk of their wealth in crypto, and they're planning to add more in 2022 despite the recent price declines, according to the CNBC Millionaire Survey.

Fully 83% of millennial millionaires own cryptocurrencies, according to the survey. The crypto holdings of millennial millionaires stand in stark contrast to older generations of millionaires, and could create a new dilemma for wealth management firms and how they work with clients.

Netflix slashes India prices in battle with Amazon, Disney

$Netflix(NFLX.US$ this week said in a blog post from India executive Monika Shergill that it is cutting its basic plan in India by 60% to 199 rupees, equivalent to $2.61, a month. Netflix also lowered prices on its least expensive plan and most expensive plan.

Despite the price cuts, Netflix is still more expensive than competitors. Netflix has some 5 million subscribers in India, according to data from consulting firm Media Partners Asia, far fewer than Amazon Prime Video's 19 million and $Disney(DIS.US$ Disney+ Hotstar's 46 million.

Source: Bloomberg, CNBC, WSJ

Asian stocks looked set for a mixed start Friday following a decline in U.S. shares led by the technology sector as tightening monetary policy to fight inflation buffets investor sentiment.

Australian equities edged up, while futures pointed lower for Japan and were little changed for Hong Kong. The tech-heavy $NASDAQ 100 Index(.NDX.US$ sank the most since September, skidding on reduced appetite for more richly valued investments amid the Fed's pivot toward scaling back outsized stimulus. U.S. equity contracts wavered in early Asian trading.

Apple leads big tech lower as investors reconsider Fed moves

Megacap tech names initially saw a positive reaction to the Fed's statement on Wednesday, with investors buying up shares of $Apple(AAPL.US$, $Microsoft(MSFT.US$ and $NVIDIA(NVDA.US$, among others. But those stocks came under pressure Thursday, erasing most or all of their gains.

Apple shares declined 3.9% on Thursday, with the iPhone maker retreating further from a $3 trillion market valuation as it posted its worst day since March. Among other names, Microsoft fell 2.9%, $Amazon(AMZN.US$ slid 2.6%, and Nvidia shed 6.8%.

Melania Trump is releasing an NFT that will cost 1 SOL each

Melania Trump has become the latest celebrity to try to cash in on the craze for non-fungible tokens.

The former first lady's first NFT, called Melania's Vision, will include watercolor art that "embodies Mrs. Trump's cobalt blue eyes, providing the collector with an amulet to inspire," according to an emailed statement. It will be available from Dec. 16 to Dec. 31 for one SOL, a cryptocurrency that runs on the Solana blockchain, currently priced at $187.

A pair of teenagers helps launch ETF targeting youngest traders

An exchange-traded fund tracking U.S. companies that adhere to the values of Generation Z starts trading on Thursday.

The $THE GENERATION Z ETF(ZGEN.US$ tracks a portfolio of "future-focused companies that align with Generation Z," according to a press release. It will trade under the ticker ZGEN and charge a fee of 0.6%, the fund's website says.

Consumer Financial Protection Bureau probing 'buy now, pay later' companies, including Affirm, Klarna

The bureau issued orders seeking information from the firms that would help it examine concerns such as the kind of role these ' buy now, pay later' plans play in increasing consumers' debt and how these companies use consumer data, the agency said.

The CFPB said the ease of getting these plans can mean consumers end up spending more than anticipated. $Affirm Holdings(AFRM.US$ dopped 10.6% on Thursday.

Rivian shares slide after company cuts 2021 EV production expectations

$Rivian Automotive(RIVN.US$ said it expects to fall "a few hundred vehicles short" of its 2021 production target of 1,200 vehicles. The company said it faced supply chain issues as well as challenges ramping up production of the complex batteries that power the vehicles.

The updates come alongside Rivian's first quarterly report as a public company and confirmation of plans for a new $5 billion plant in Georgia that's expected to come online in 2024.

Millennial millionaires plan to add more crypto in 2022, CNBC Millionaire Survey finds

Most millennial millionaires have the bulk of their wealth in crypto, and they're planning to add more in 2022 despite the recent price declines, according to the CNBC Millionaire Survey.

Fully 83% of millennial millionaires own cryptocurrencies, according to the survey. The crypto holdings of millennial millionaires stand in stark contrast to older generations of millionaires, and could create a new dilemma for wealth management firms and how they work with clients.

Netflix slashes India prices in battle with Amazon, Disney

$Netflix(NFLX.US$ this week said in a blog post from India executive Monika Shergill that it is cutting its basic plan in India by 60% to 199 rupees, equivalent to $2.61, a month. Netflix also lowered prices on its least expensive plan and most expensive plan.

Despite the price cuts, Netflix is still more expensive than competitors. Netflix has some 5 million subscribers in India, according to data from consulting firm Media Partners Asia, far fewer than Amazon Prime Video's 19 million and $Disney(DIS.US$ Disney+ Hotstar's 46 million.

Source: Bloomberg, CNBC, WSJ

129

6

TradeMore

commented on

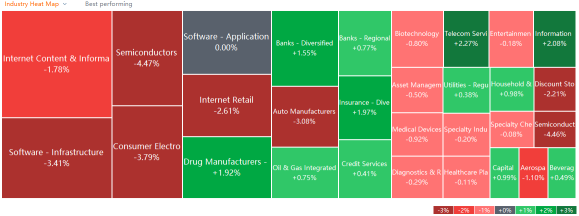

A cold week.![]()

![]() But anyway, have a nice weekend my friends.

But anyway, have a nice weekend my friends.![]()

![]()

Next week I will upload more details on each sector, please follow me to catch new updates![]()

![]()

Next week I will upload more details on each sector, please follow me to catch new updates

166

29

TradeMore

liked and commented on

Defiance ETFs launched the $DEFIANCE DIGITAL REVOLUTION ETF(NFTZ.US$ on Thursday, which offers investors thematic exposure to the NFT (Non-Fungible Tokens), blockchain and cryptocurrency ecosystems, which include NFT marketplaces and issuers such as $Coinbase(COIN.US$ and $PLBY Group(PLBY.US$.

![]() What is NFT?

What is NFT?

NFTs, which allow holders of art, collectibles and just about any other asset to track ownership, have caught fire this year amid a wider boom in crypto markets. Investors have doled out eye-popping sums toward pictures of rocks, cartoonish depictions of penguins and apes, and other concoctions and artworks.

The NFT revolution will fundamentally change the economic model for artists, athletes, creators, and many more industries that we can't even conceive of today. "In October, all time NFT trading volume surpassed $15 Billion," says Jablonski.

![]() What is NFTZ?

What is NFTZ?

NFTZ is testament to our vision of the revolutionary potential for growth in crypto and digital asset related securities, and our commitmen to offering exposure to the dynamic and disruptive NFT space. NFTZ seeks to track an index of a portfolio of publicly listed companies with relevant thematic exposure to the NFT, blockchain and cryptocurrency ecosystems.

--- According to 'Investment case for NFTZ, the first NFT focused ETF', Defiance ETFs

[The NFTZ fund] is a great way for investors to gain access to not only the fast-growth blockchain technology aspect of the digital world, but companies involved in the renaissance of NFT. The companies in this index are key players in the build-out of Web 3.0, [or an idealized version of the internet that is decentralized and based on blockchains.]

--- said Sylvia Jablonski, chief investment officer for Defiance ETFs.

The ETF is tracking the BITA NFT and Blockchain Select Index.

NFTZ holdings

The initial makeup of the ETF consists of asset allocation of 32.5% for non-fungible token stocks, 25.9% cryptocurrency mining stocks, 21.9% crypto asset management and trading stocks, 15.2% crypto banking, payments and services stocks and 4.6% blockchain technology stocks.

Here are the top 10 initial holdings on the ETF:

· $Silvergate Capital(SI.US$ : 6.7%

· $PLBY Group(PLBY.US$ : 5.3%

· $Cloudflare(NET.US$ : 5.2%

· Northern Data AG : 5.1%

· $Bitfarms(BITF.US$ : 4.9%

· $Marathon Digital(MARA.US$ : 4.8%

· $Hut 8(HUT.US$ : 4.5%

· Sbi Holdings Inc : 4.3%

· $Coinbase(COIN.US$ : 4.3%

· $Riot Platforms(RIOT.US$ : 4.3%

Have you ever traded NFT? Would you invest in this NFT-focused ETF?

Source: Defiance ETFs, PR Newswires, Bloomberg, Benzinga

NFTs, which allow holders of art, collectibles and just about any other asset to track ownership, have caught fire this year amid a wider boom in crypto markets. Investors have doled out eye-popping sums toward pictures of rocks, cartoonish depictions of penguins and apes, and other concoctions and artworks.

The NFT revolution will fundamentally change the economic model for artists, athletes, creators, and many more industries that we can't even conceive of today. "In October, all time NFT trading volume surpassed $15 Billion," says Jablonski.

NFTZ is testament to our vision of the revolutionary potential for growth in crypto and digital asset related securities, and our commitmen to offering exposure to the dynamic and disruptive NFT space. NFTZ seeks to track an index of a portfolio of publicly listed companies with relevant thematic exposure to the NFT, blockchain and cryptocurrency ecosystems.

--- According to 'Investment case for NFTZ, the first NFT focused ETF', Defiance ETFs

[The NFTZ fund] is a great way for investors to gain access to not only the fast-growth blockchain technology aspect of the digital world, but companies involved in the renaissance of NFT. The companies in this index are key players in the build-out of Web 3.0, [or an idealized version of the internet that is decentralized and based on blockchains.]

--- said Sylvia Jablonski, chief investment officer for Defiance ETFs.

The ETF is tracking the BITA NFT and Blockchain Select Index.

NFTZ holdings

The initial makeup of the ETF consists of asset allocation of 32.5% for non-fungible token stocks, 25.9% cryptocurrency mining stocks, 21.9% crypto asset management and trading stocks, 15.2% crypto banking, payments and services stocks and 4.6% blockchain technology stocks.

Here are the top 10 initial holdings on the ETF:

· $Silvergate Capital(SI.US$ : 6.7%

· $PLBY Group(PLBY.US$ : 5.3%

· $Cloudflare(NET.US$ : 5.2%

· Northern Data AG : 5.1%

· $Bitfarms(BITF.US$ : 4.9%

· $Marathon Digital(MARA.US$ : 4.8%

· $Hut 8(HUT.US$ : 4.5%

· Sbi Holdings Inc : 4.3%

· $Coinbase(COIN.US$ : 4.3%

· $Riot Platforms(RIOT.US$ : 4.3%

Have you ever traded NFT? Would you invest in this NFT-focused ETF?

Source: Defiance ETFs, PR Newswires, Bloomberg, Benzinga

57

15

TradeMore

commented on

Cathie Wood amped up buying of $Twitter (Delisted)(TWTR.US$after the stock slumped to its lowest in a year amid founder Jack Dorsey's move to step down as chief executive officer.![]()

![]()

Ark Investment Management, which is already one of the largest shareholders of the social-media platform, bought about 1.1 million shares in Twitter on Tuesday through $ARK Innovation ETF(ARKK.US$, $ARK Fintech Innovation ETF(ARKF.US$, and $ARK Next Generation Internet ETF(ARKW.US$.

According to the asset manager's daily trading updates, the total buying was worth close to $49 million at Tuesday's closing price of Twitter. It was biggest one-day purchase of the stock since July 23.![]()

![]()

Follow me to know more about ETF![]()

Shares of Twitter were down 4% on Tuesday and later dropped 2.5% to $42.82 in the regular trading sessions on Wednesday.![]()

![]()

![]()

Wood's move to increase exposure to Twitter comes one day after Dorsey he will hand over the control of the microblogging site he founded and helped build into a global communications platform to Chief Technology Officer Parag Agrawal.

Dorsey's departure could spark interest in Twitter, which could be "interesting bolt-on acquisition" for a traditional media firm wanting to enter the social media space.

--- Peter Garnry, head of equity strategy at Saxo Bank

Wood and her firm frequently say that they have at least a five-year investment horizon, and acknowledge that the disruptive companies they target are often volatile.

Watch more from Bloomberg: Twitter Inc. has named Parag Agrawal Chief Executive Officer with co-founder Jack Dorsey stepping down as CEO effective immediately. Bloomberg's Naomi Nix and Bloomberg Intelligence s Mandeep Singh have the details on Quicktake Stock.

How often do you use Twitter?![]()

![]()

Would you invest in Twitter after CTO Parag Agrawal replace Jack Dorsey as CEO?![]()

![]()

Source: Bloomberg, Ark Invest

Ark Investment Management, which is already one of the largest shareholders of the social-media platform, bought about 1.1 million shares in Twitter on Tuesday through $ARK Innovation ETF(ARKK.US$, $ARK Fintech Innovation ETF(ARKF.US$, and $ARK Next Generation Internet ETF(ARKW.US$.

According to the asset manager's daily trading updates, the total buying was worth close to $49 million at Tuesday's closing price of Twitter. It was biggest one-day purchase of the stock since July 23.

Follow me to know more about ETF

Shares of Twitter were down 4% on Tuesday and later dropped 2.5% to $42.82 in the regular trading sessions on Wednesday.

Wood's move to increase exposure to Twitter comes one day after Dorsey he will hand over the control of the microblogging site he founded and helped build into a global communications platform to Chief Technology Officer Parag Agrawal.

Dorsey's departure could spark interest in Twitter, which could be "interesting bolt-on acquisition" for a traditional media firm wanting to enter the social media space.

--- Peter Garnry, head of equity strategy at Saxo Bank

Wood and her firm frequently say that they have at least a five-year investment horizon, and acknowledge that the disruptive companies they target are often volatile.

Watch more from Bloomberg: Twitter Inc. has named Parag Agrawal Chief Executive Officer with co-founder Jack Dorsey stepping down as CEO effective immediately. Bloomberg's Naomi Nix and Bloomberg Intelligence s Mandeep Singh have the details on Quicktake Stock.

How often do you use Twitter?

Would you invest in Twitter after CTO Parag Agrawal replace Jack Dorsey as CEO?

Source: Bloomberg, Ark Invest

34

7

TradeMore

liked

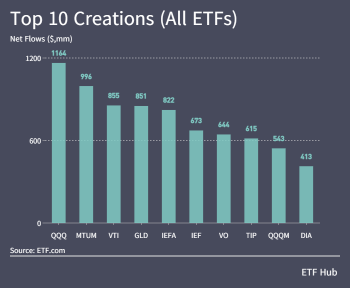

The U.S.-listed ETF industry added nearly $6.5 billion in fresh assets in a shortened trading week between Nov. 19 and Nov. 24, with defensive ETFs gaining steam to play among the large cap funds that tend to dominate inflows.![]()

![]()

Follow me to know more about ETFs![]()

Large caps, total market ETFs keep adding![]()

![]()

The $Invesco QQQ Trust(QQQ.US$ led inflows on the period, with $1.16 billion added, while the $iShares MSCI USA Momentum Factor ETF(MTUM.US$ and $Vanguard Total Stock Market ETF(VTI.US$added $996 million and $855 million, respectively.

Fears over inflation in the U.S. sent some assets abroad, with the $Ishares Trust Core Msci Eafe Etf(IEFA.US$ taking in $822 million.![]()

Defensive ETFs also peppered the top inflows list, with inflation in mind. The $SPDR Gold ETF(GLD.US$ took in $851 million, while the $iShares TIPS Bond ETF(TIP.US$ added $615 million.

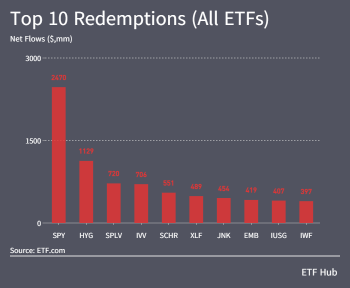

Growth, junk bonds hammered![]()

![]()

The $SPDR S&P 500 ETF(SPY.US$ was the biggest loser from flows in the period, as investors pulled nearly $2.5 billion from the oldest ETF in the U.S. The $iShares Core S&P 500 ETF(IVV.US$ found itself losing $706 million, as investors lessened their exposure to the index.![]()

![]()

High yield bonds were not in vogue either. The $Ishares Iboxx $ High Yield Corporate Bond Etf(HYG.US$ saw $1.13 billion in outflows, while the $SPDR Bloomberg High Yield Bond ETF(JNK.US$ lost $454 million.

Source: ETF.com

Follow me to know more about ETFs

Large caps, total market ETFs keep adding

The $Invesco QQQ Trust(QQQ.US$ led inflows on the period, with $1.16 billion added, while the $iShares MSCI USA Momentum Factor ETF(MTUM.US$ and $Vanguard Total Stock Market ETF(VTI.US$added $996 million and $855 million, respectively.

Fears over inflation in the U.S. sent some assets abroad, with the $Ishares Trust Core Msci Eafe Etf(IEFA.US$ taking in $822 million.

Defensive ETFs also peppered the top inflows list, with inflation in mind. The $SPDR Gold ETF(GLD.US$ took in $851 million, while the $iShares TIPS Bond ETF(TIP.US$ added $615 million.

Growth, junk bonds hammered

The $SPDR S&P 500 ETF(SPY.US$ was the biggest loser from flows in the period, as investors pulled nearly $2.5 billion from the oldest ETF in the U.S. The $iShares Core S&P 500 ETF(IVV.US$ found itself losing $706 million, as investors lessened their exposure to the index.

High yield bonds were not in vogue either. The $Ishares Iboxx $ High Yield Corporate Bond Etf(HYG.US$ saw $1.13 billion in outflows, while the $SPDR Bloomberg High Yield Bond ETF(JNK.US$ lost $454 million.

Source: ETF.com

49

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)