tony thuong

liked

Tesla $Tesla(TSLA.US$ bulls shouldn't get too comfy with the company's market dominance continuing unabated, warns Guggenheim analyst Ali Faghri.

"Our balanced view [on Tesla] is based on: 1) a favorable near-term setup — with demand outpacing supply, we see visibility to volume upside in 2022 and 2023 as new factories in Austin and Berlin ramp; 2) competitive advantage over all original equipment manufacturers today, including a high degree of vertical integration, a software defined vehicle approach, a dedicated charging network, and greater battery capacity; 3) increasing competition, from both legacy players and new EV-only entrants, and as a result, we see risk of moderating global EV share for Tesla from current lofty levels (especially post 2023 as competitors scale capacity)," explained Faghri in a note to clients on Monday.

Faghri initiated coverage on Tesla at a Neutral rating with a $925 price target.

Tesla shares currently trade at $902, down 20% over the past month as CEO Elon Musk has sold large chunks of stock to satisfy tax obligations. Musk has unloaded nearly $12 billion worth of Tesla's stock since Nov. 8.

Part of the content is taken from Yahoo

$NIO Inc(NIO.US$

$Ford Motor(F.US$

$Rivian Automotive(RIVN.US$

"Our balanced view [on Tesla] is based on: 1) a favorable near-term setup — with demand outpacing supply, we see visibility to volume upside in 2022 and 2023 as new factories in Austin and Berlin ramp; 2) competitive advantage over all original equipment manufacturers today, including a high degree of vertical integration, a software defined vehicle approach, a dedicated charging network, and greater battery capacity; 3) increasing competition, from both legacy players and new EV-only entrants, and as a result, we see risk of moderating global EV share for Tesla from current lofty levels (especially post 2023 as competitors scale capacity)," explained Faghri in a note to clients on Monday.

Faghri initiated coverage on Tesla at a Neutral rating with a $925 price target.

Tesla shares currently trade at $902, down 20% over the past month as CEO Elon Musk has sold large chunks of stock to satisfy tax obligations. Musk has unloaded nearly $12 billion worth of Tesla's stock since Nov. 8.

Part of the content is taken from Yahoo

$NIO Inc(NIO.US$

$Ford Motor(F.US$

$Rivian Automotive(RIVN.US$

14

tony thuong

liked

ColumnsSector Rotation?

What happened after FED's meeting?

We are currently having a sector rotation from tech growth stocks into value stocks after Wednesday's Fed policy of 3 rate hikes in 2022 instead of 2 and also speed up tapering and ending it a few months earlier than expected.

The initial taper plan was $10B for treasury securities and $5B for MBS (Mortgage Backed Securities) but now it has doubled the speed of tapering to $20B for treasury securities and $10B for MBS and tapering to end by March 2022. Which shortly after, rate hikes should come in progressively.

The reason for the fed turning hawkish and a quick shift to taper at a quicker pace and more rate hikes was due to inflation at a 40 year high. They also did not expect inflation to rise above 2% in 2021 and kept mentioning about higher inflation rate being transitory. Current inflation is at 6.8% based on the YOY report.

How did this affect the market on Thursday?

When tapering is sped up, liquidity will be tightened in the market. There will not be as much free cash to be pumped into the market to let prices rally like we have seen the last 2 years.

Interest rate hikes will also dampen valuation on growth stocks as growth stocks are priced in more to future earnings expectations. If rates rise, it will hurt those expectations. Investors will start to see bonds and value stocks that thrive in high-interest rate environments a better asset class thus making it more appealing against higher-risk growth stocks.

Small-cap stocks usually also suffer because they tend to loan more money to fund the growth of the company thus making them more sensitive towards the rate hikes.

Thus we saw the $NASDAQ 100 Index(.NDX.US$ and $iShares Russell 2000 ETF(IWM.US$ mostly small-cap and tech stocks falling much sharper than $Dow Jones Industrial Average(.DJI.US$ yesterday which consist mainly of value stocks.

What to do now? Should I exit my growth holdings?

That being said, inflation and rate hikes over the long run still don't pose a huge threat to growth stocks. It is usually short-term when the rotation happens towards value stocks. So take this opportunity to find good entry points into the stocks which are undergoing the selloff.

As always, trade safe & invest wise!

$Apple(AAPL.US$ $Tesla(TSLA.US$ $Meta Platforms(FB.US$ $Microsoft(MSFT.US$ $Amazon(AMZN.US$ $NVIDIA(NVDA.US$ $Adobe(ADBE.US$ $Invesco QQQ Trust(QQQ.US$ $SPDR Dow Jones Industrial Average Trust(DIA.US$

We are currently having a sector rotation from tech growth stocks into value stocks after Wednesday's Fed policy of 3 rate hikes in 2022 instead of 2 and also speed up tapering and ending it a few months earlier than expected.

The initial taper plan was $10B for treasury securities and $5B for MBS (Mortgage Backed Securities) but now it has doubled the speed of tapering to $20B for treasury securities and $10B for MBS and tapering to end by March 2022. Which shortly after, rate hikes should come in progressively.

The reason for the fed turning hawkish and a quick shift to taper at a quicker pace and more rate hikes was due to inflation at a 40 year high. They also did not expect inflation to rise above 2% in 2021 and kept mentioning about higher inflation rate being transitory. Current inflation is at 6.8% based on the YOY report.

How did this affect the market on Thursday?

When tapering is sped up, liquidity will be tightened in the market. There will not be as much free cash to be pumped into the market to let prices rally like we have seen the last 2 years.

Interest rate hikes will also dampen valuation on growth stocks as growth stocks are priced in more to future earnings expectations. If rates rise, it will hurt those expectations. Investors will start to see bonds and value stocks that thrive in high-interest rate environments a better asset class thus making it more appealing against higher-risk growth stocks.

Small-cap stocks usually also suffer because they tend to loan more money to fund the growth of the company thus making them more sensitive towards the rate hikes.

Thus we saw the $NASDAQ 100 Index(.NDX.US$ and $iShares Russell 2000 ETF(IWM.US$ mostly small-cap and tech stocks falling much sharper than $Dow Jones Industrial Average(.DJI.US$ yesterday which consist mainly of value stocks.

What to do now? Should I exit my growth holdings?

That being said, inflation and rate hikes over the long run still don't pose a huge threat to growth stocks. It is usually short-term when the rotation happens towards value stocks. So take this opportunity to find good entry points into the stocks which are undergoing the selloff.

As always, trade safe & invest wise!

$Apple(AAPL.US$ $Tesla(TSLA.US$ $Meta Platforms(FB.US$ $Microsoft(MSFT.US$ $Amazon(AMZN.US$ $NVIDIA(NVDA.US$ $Adobe(ADBE.US$ $Invesco QQQ Trust(QQQ.US$ $SPDR Dow Jones Industrial Average Trust(DIA.US$

168

6

tony thuong

liked

$Netflix(NFLX.US$ Netflix on Tuesday announced steep price cuts of up to 60% in India, Aims to regain market share from $Amazon(AMZN.US$ and $Disney(DIS.US$. The company said in a statement on Tuesday that it had cut prices on all of its four-tier packages, with the biggest reduction coming from 499 rupees to 199 rupees ($2.60) a month for the entry-level package. The new price will make streaming services more accessible to Indian viewers.

12

tony thuong

liked

" $Rivian Automotive(RIVN.US$ has been the topic of a number of other reports. JPMorgan Chase & Co. started coverage on shares of Rivian in a research report on Monday. They set a neutral rating and a $104.00 target price on the stock."

2

tony thuong

liked

$Starbucks(SBUX.US$ Dividends coming

21

1

tony thuong

liked

$NIO Inc(NIO.US$

$Lucid Group(LCID.US$

$Rivian Automotive(RIVN.US$

All in the green premarket!

Stay tuned for more news!

As usual, DCA is the best strategy in the long run!

$Lucid Group(LCID.US$

$Rivian Automotive(RIVN.US$

All in the green premarket!

Stay tuned for more news!

As usual, DCA is the best strategy in the long run!

11

3

tony thuong

liked

$Lucid Group(LCID.US$ I think should be able go back to 47 tonight ! those sold are buying back … dead cat bounced again! go sleep . have faith!!

3

tony thuong

liked

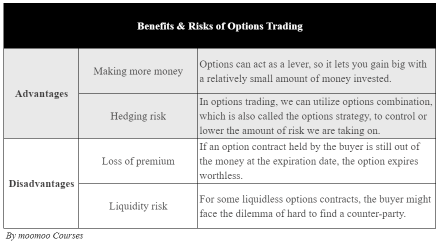

Options are a great way to hedge against market uncertainty.

Free options course for moomoo-ers.

Learn now and enjoy the benefits.

Perfect for falling stocks like:

$NVIDIA(NVDA.US$

$Palantir(PLTR.US$

$Coinbase(COIN.US$

$Twitter (Delisted)(TWTR.US$

Free options course for moomoo-ers.

Learn now and enjoy the benefits.

Perfect for falling stocks like:

$NVIDIA(NVDA.US$

$Palantir(PLTR.US$

$Coinbase(COIN.US$

$Twitter (Delisted)(TWTR.US$

40

1

tony thuong

commented on

US yogurt brandChobani filed on November 17th with the SEC. It plans to list on the Nasdaq under the symbol CHO.

According to Renaissance Capital's estimation, the company could raise up to $1.5 billion. The joint bookrunners on the deal includes Goldman Sachs, BofA Securities, J.P. Morgan, Barclays,etc.

In July, the company confidentially filed for an IPO, and Reuters reported its valuation could exceed $10 billion.

Business Overview

Chobani, founded in 2005, is a leading Greek yogurt brand in the US. Since 2007, it has maintained its position as the #1 Greek yogurt brand. It also provides a portfolio of high-quality yogurt products.

Chobani's products come in single-serve, multi-serve, and/or multi-pack formats through approximately 95,000 retail locations in the US. Its key customers include Wal-Mart, Whole Foods, Amazon, Target, Kroger, Publix, Costco and Safeway/Albertsons. It also sells its products to various other national and regional retailers and has an international presence.

Chobani values innovation. Its trusted brand and expertise in the food value chain also helps it convert into new high-growth categories,including oat milk, coffee creamer, ready-to-drink coffee and plant-based probiotic beverage lines.

The U.S. oat milk market has experienced explosive growth in recent years and is the fastest growing segment within plant-based milk. In the 52 weeks ended October 16, 2021, it was a $376 million category, growing 79.6% year-over-year.

Chobani Oat entered the oat milk market in December 2019 and has grown to 15.1% of total Nielsen reported U.S. market share for the 13 weeks ended October 16, 2021, gaining share more quickly than it did in the yogurt category.

For the 13 weeks ended October 16, 2021, total Nielsen reported sales of Chobani Oat have grown 68% year-over year, ahead of the category and several incumbents.

Chobani's in-house production capabilities across its three plants with 1,900 dedicated people. It has a manufacturing facility in New Berlin, New York, a state-of-the-art multi-platform factory in Twin Falls, Idaho, and an additional facility in Melbourne, Australia.

It plans to add capacity to the Twin Falls, Idaho facility for yogurt, oat milk, creamer and coffee products due to increased demand for the products.

Financial Performance

Chobani's revenue grew 5.2% to $1.4 billion from 2019 to 2020. However, its net loss reached $58.7 million, as it invested back into its business.

For the nine months ended September 25, 2021, it generated net sales, net loss and Adjusted EBITDA of approximately $1,213.0 million, $24.0 million and $142.2 million, respectively.

It achieved year-over-year net sales growth of 13.8%, Adjusted EBITDA decrease of 6.2% and an increase in net loss of 12.1%.

Click to view the prospectus

$Chobani(CHO.US$

According to Renaissance Capital's estimation, the company could raise up to $1.5 billion. The joint bookrunners on the deal includes Goldman Sachs, BofA Securities, J.P. Morgan, Barclays,etc.

In July, the company confidentially filed for an IPO, and Reuters reported its valuation could exceed $10 billion.

Business Overview

Chobani, founded in 2005, is a leading Greek yogurt brand in the US. Since 2007, it has maintained its position as the #1 Greek yogurt brand. It also provides a portfolio of high-quality yogurt products.

Chobani's products come in single-serve, multi-serve, and/or multi-pack formats through approximately 95,000 retail locations in the US. Its key customers include Wal-Mart, Whole Foods, Amazon, Target, Kroger, Publix, Costco and Safeway/Albertsons. It also sells its products to various other national and regional retailers and has an international presence.

Chobani values innovation. Its trusted brand and expertise in the food value chain also helps it convert into new high-growth categories,including oat milk, coffee creamer, ready-to-drink coffee and plant-based probiotic beverage lines.

The U.S. oat milk market has experienced explosive growth in recent years and is the fastest growing segment within plant-based milk. In the 52 weeks ended October 16, 2021, it was a $376 million category, growing 79.6% year-over-year.

Chobani Oat entered the oat milk market in December 2019 and has grown to 15.1% of total Nielsen reported U.S. market share for the 13 weeks ended October 16, 2021, gaining share more quickly than it did in the yogurt category.

For the 13 weeks ended October 16, 2021, total Nielsen reported sales of Chobani Oat have grown 68% year-over year, ahead of the category and several incumbents.

Chobani's in-house production capabilities across its three plants with 1,900 dedicated people. It has a manufacturing facility in New Berlin, New York, a state-of-the-art multi-platform factory in Twin Falls, Idaho, and an additional facility in Melbourne, Australia.

It plans to add capacity to the Twin Falls, Idaho facility for yogurt, oat milk, creamer and coffee products due to increased demand for the products.

Financial Performance

Chobani's revenue grew 5.2% to $1.4 billion from 2019 to 2020. However, its net loss reached $58.7 million, as it invested back into its business.

For the nine months ended September 25, 2021, it generated net sales, net loss and Adjusted EBITDA of approximately $1,213.0 million, $24.0 million and $142.2 million, respectively.

It achieved year-over-year net sales growth of 13.8%, Adjusted EBITDA decrease of 6.2% and an increase in net loss of 12.1%.

Click to view the prospectus

$Chobani(CHO.US$

+3

60

6

tony thuong

liked

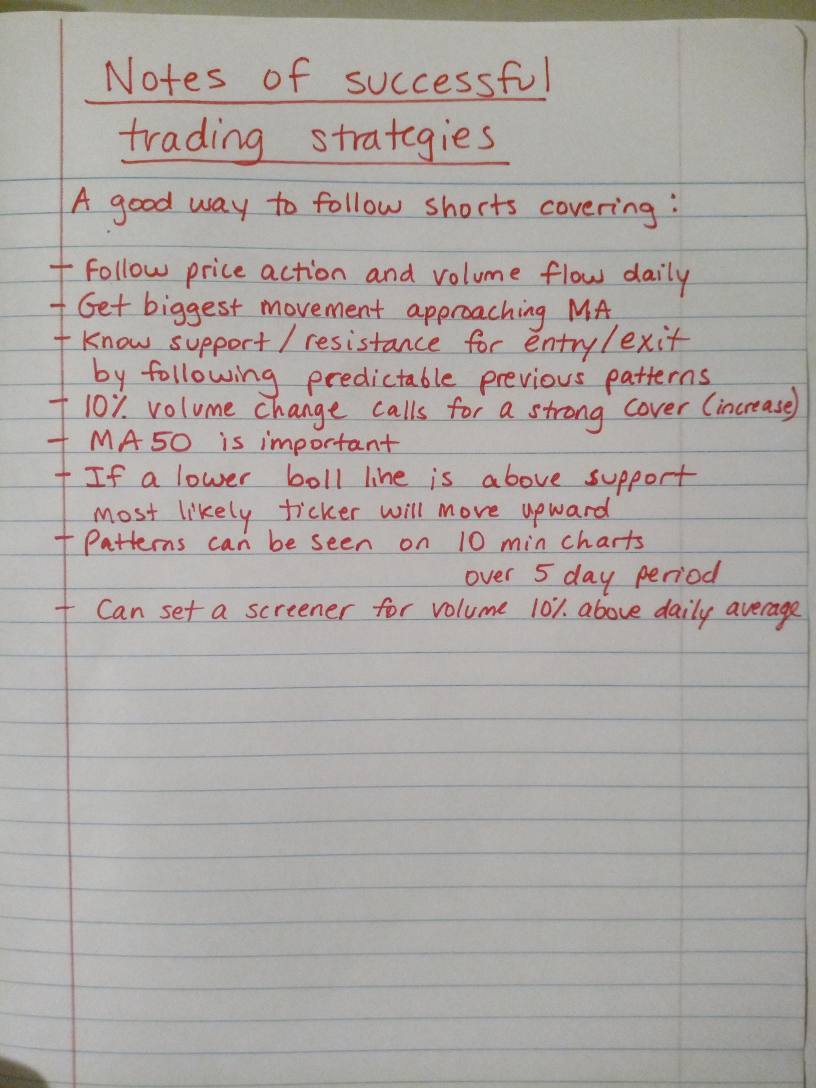

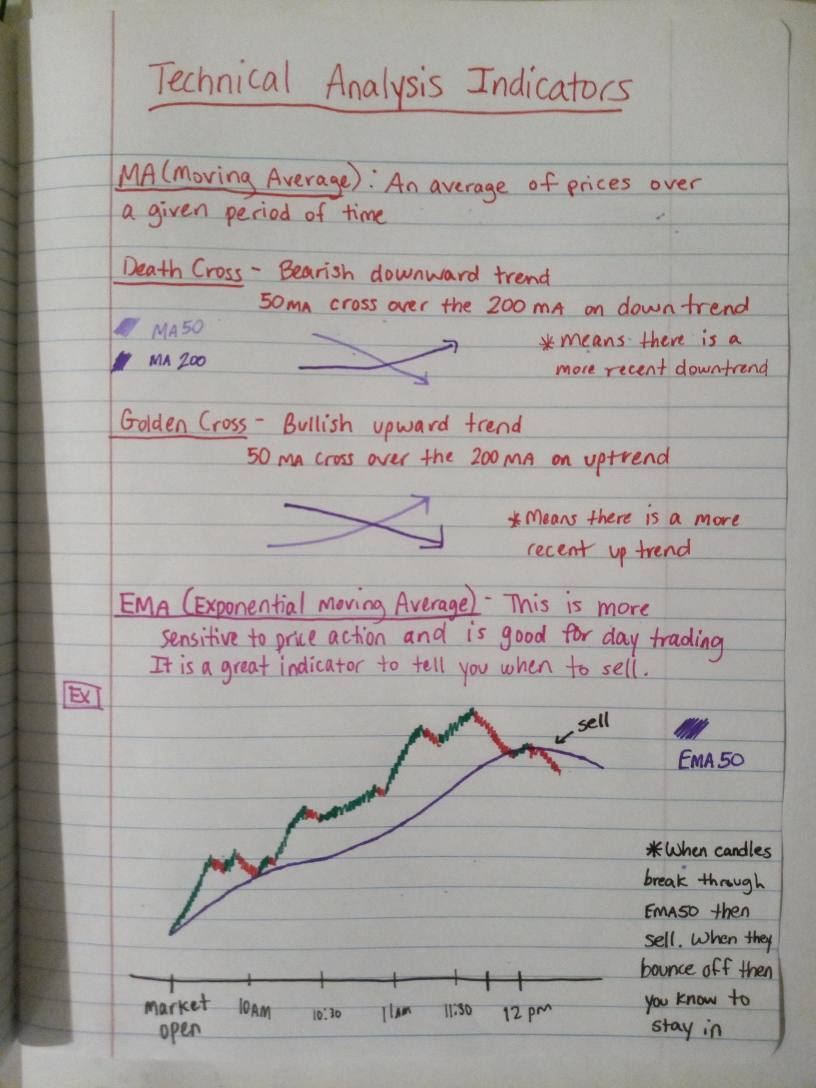

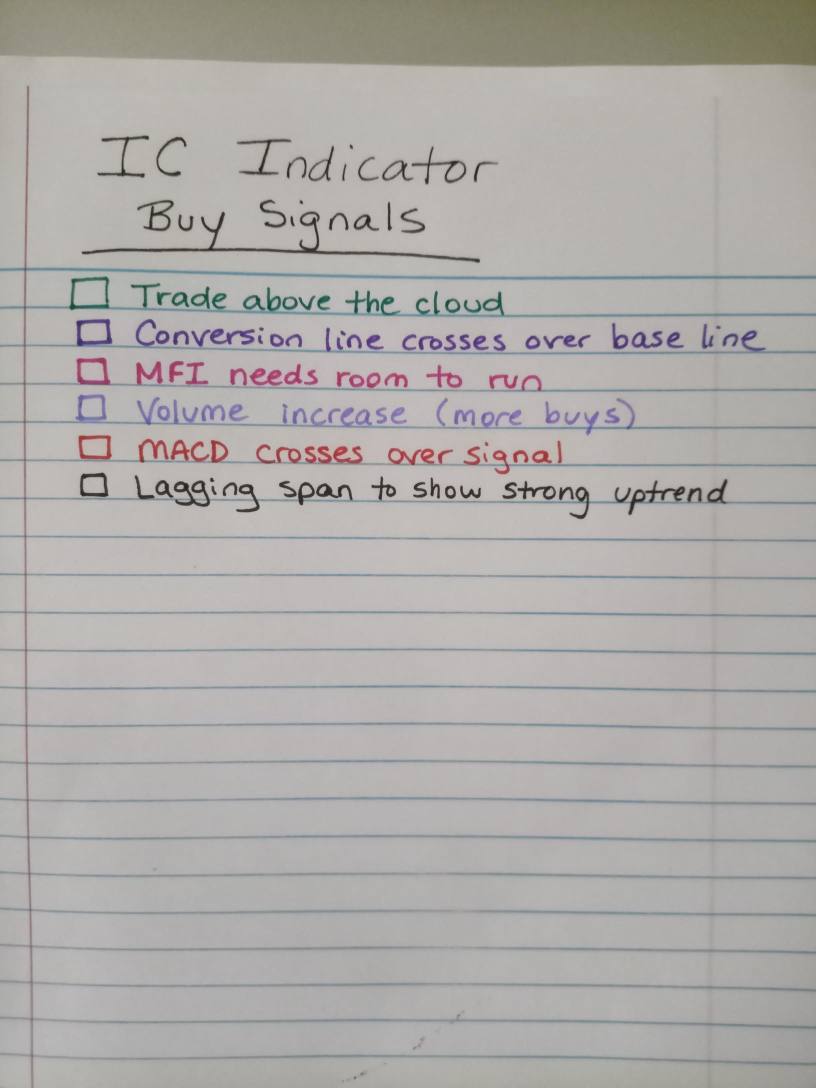

For all of you traders just entering the markets for the first time, here are some cornerstone concepts for you to master.

Hope this is helpful and Enjoy!!

obviously not everything but alwaya haooy to share the knowledge :) $iSpecimen(ISPC.US$ $Advanced Health Intelligence Ltd(AHI.AU$ $Advanced Micro Devices(AMD.US$ $Farmmi(FAMI.US$ $Grab Holdings(GRAB.US$ $Lordstown Motors(RIDE.US$ $Lucid Group(LCID.US$ $SOS Ltd(SOS.US$

Hope this is helpful and Enjoy!!

obviously not everything but alwaya haooy to share the knowledge :) $iSpecimen(ISPC.US$ $Advanced Health Intelligence Ltd(AHI.AU$ $Advanced Micro Devices(AMD.US$ $Farmmi(FAMI.US$ $Grab Holdings(GRAB.US$ $Lordstown Motors(RIDE.US$ $Lucid Group(LCID.US$ $SOS Ltd(SOS.US$

+4

222

33

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)