RexKwek

liked

$AMC Entertainment(AMC.US$

So, these idiots are going to short more after conversion/ reverse split? What happened to the hole they’re already in? They still have to cover. Nothing changed.

“ Cocaine’s a hell of a drug”

So, these idiots are going to short more after conversion/ reverse split? What happened to the hole they’re already in? They still have to cover. Nothing changed.

“ Cocaine’s a hell of a drug”

5

3

RexKwek

commented on

Good morning mooers! Here are things you need to know about today's Singapore:

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

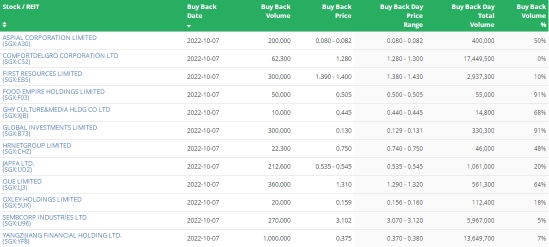

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index(.STI.SG$ decreased 1.01 per cent to 3,114.16 ...

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index(.STI.SG$ decreased 1.01 per cent to 3,114.16 ...

1443

1387

RexKwek

liked

$雷蛇(01337.HK$ 👍👍 good

Translated

5

RexKwek

liked

1. Tan Ming-Liang and Lim Kailing are offering HK$2.82 per share in a bid to delist $Razer Inc.(01337.HK$

2. Razer was listed in 2017 at an IPO price of HK$3.88. This will not go well with some shareholders who have bought at higher prices than the offer price.

3. The insiders shouldn't be blamed since the market determines the share prices. Investors should know the risk of stock investing - there's no guaranteed profits.

4. But a delisting offer timed at a point where the share price is below the IPO price will appear to be opportunistic. I believe shareholders would prefer the stock remain listed such that there's a chance share prices can go up in the future.

5. Some may complain that Tan in 2020 received US$10.457m in compensation (US$9.871m was in shares). This was more than the US$805k net profit generated by Razer. He was reportedly looking to buy a GCB in Jul 2021 at a price tag of S$52.8m. Some shareholders may feel they got the shorter end of the stick while the insiders benefited.

6. I have no issue with such compensation as I think the performance made him well deserved for the reward. He took the risk to start the business and managed to grow it to a US$1b revenue business and turn it profitable. Revenue grew at 33% CAGR in the past 5 years. I just don't like the delisting offer.

7. One of the consequences of being a publicly listed company means you have one more stakeholder to answer to - the public shareholders. They may not understand the insiders' situation and will only look after their own benefits, who doesn't? Such seemingly 'low-ball' delisting may leave a bad taste for these investors.

8. Razer contemplated to list in the US because they believe that they would get a higher valuation. Firstly, most of their revenue were generated in the US and the US market has a deep and wide investor base. Secondly, it has lots of liquidity due to QE and inflating Razer's share price shouldn't be a problem.

9. But it would be a slap on Razer shareholders' face if Razer delist and relist in the US at a higher price.

10. Competitor $Corsair Gaming(CRSR.US$ is trading at PE 17x and PS 1x. Razer is trading at PE 49x and PS 2x. $Logitech International(LOGI.US$ at PE 14x and PS 2x. So it seems like Razer's offer isn't that bad as it is already the most 'expensive' among the 3 players. Shareholders don't think this way. They will compare the offer price against the price they bought and feel unfair if the offer price is lower.

11. It would be better if they just keep the company listed and continue to focus on the business. Leave the share price to the markets. No good reasons were given for the delisting offer. I find it disappointing and expect better from a well-respected entrepreneur of a popular consumer brand. It looks opportunistic with this offer.

12. Shareholders will vote on the offer and need 75% to approve it and not more than 10% against it during the meeting. I am not sure how the shareholders are taking this. I'm not a shareholder.

2. Razer was listed in 2017 at an IPO price of HK$3.88. This will not go well with some shareholders who have bought at higher prices than the offer price.

3. The insiders shouldn't be blamed since the market determines the share prices. Investors should know the risk of stock investing - there's no guaranteed profits.

4. But a delisting offer timed at a point where the share price is below the IPO price will appear to be opportunistic. I believe shareholders would prefer the stock remain listed such that there's a chance share prices can go up in the future.

5. Some may complain that Tan in 2020 received US$10.457m in compensation (US$9.871m was in shares). This was more than the US$805k net profit generated by Razer. He was reportedly looking to buy a GCB in Jul 2021 at a price tag of S$52.8m. Some shareholders may feel they got the shorter end of the stick while the insiders benefited.

6. I have no issue with such compensation as I think the performance made him well deserved for the reward. He took the risk to start the business and managed to grow it to a US$1b revenue business and turn it profitable. Revenue grew at 33% CAGR in the past 5 years. I just don't like the delisting offer.

7. One of the consequences of being a publicly listed company means you have one more stakeholder to answer to - the public shareholders. They may not understand the insiders' situation and will only look after their own benefits, who doesn't? Such seemingly 'low-ball' delisting may leave a bad taste for these investors.

8. Razer contemplated to list in the US because they believe that they would get a higher valuation. Firstly, most of their revenue were generated in the US and the US market has a deep and wide investor base. Secondly, it has lots of liquidity due to QE and inflating Razer's share price shouldn't be a problem.

9. But it would be a slap on Razer shareholders' face if Razer delist and relist in the US at a higher price.

10. Competitor $Corsair Gaming(CRSR.US$ is trading at PE 17x and PS 1x. Razer is trading at PE 49x and PS 2x. $Logitech International(LOGI.US$ at PE 14x and PS 2x. So it seems like Razer's offer isn't that bad as it is already the most 'expensive' among the 3 players. Shareholders don't think this way. They will compare the offer price against the price they bought and feel unfair if the offer price is lower.

11. It would be better if they just keep the company listed and continue to focus on the business. Leave the share price to the markets. No good reasons were given for the delisting offer. I find it disappointing and expect better from a well-respected entrepreneur of a popular consumer brand. It looks opportunistic with this offer.

12. Shareholders will vote on the offer and need 75% to approve it and not more than 10% against it during the meeting. I am not sure how the shareholders are taking this. I'm not a shareholder.

32

2

RexKwek

commented on

Today I want to introduce my new column about market performance.

This time we talk about large-cap stocks.![]()

![]()

Some large-cap stocks like $Apple(AAPL.US$ or $Tesla(TSLA.US$ , we usually choose to buy the dip. This week, the U.S. market slid on Omicron fears, is it a good chance for large-cap stocks?![]()

![]()

Let's see the biggest movers for large-cap stocks:

Top 10 movers for mega-cap stocks![]()

![]()

Top 5 movers for large-cap value stocks![]()

![]()

Top 5 movers for large-cap growth stocks![]()

![]()

Which stock you choose to buy next week?![]()

![]()

And don't forget to follow me, next time we will talk about small-cap stocks![]()

![]()

This time we talk about large-cap stocks.

Some large-cap stocks like $Apple(AAPL.US$ or $Tesla(TSLA.US$ , we usually choose to buy the dip. This week, the U.S. market slid on Omicron fears, is it a good chance for large-cap stocks?

Let's see the biggest movers for large-cap stocks:

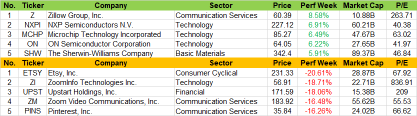

Top 10 movers for mega-cap stocks

Top 5 movers for large-cap value stocks

Top 5 movers for large-cap growth stocks

Which stock you choose to buy next week?

And don't forget to follow me, next time we will talk about small-cap stocks

196

21

RexKwek

liked

A quick question :

What content would you like to see in moomoo community?

(I mean this one here)

If you have other thoughts, please comment down below and tell us about them.

Let's make moomoo a better community together!![]()

What content would you like to see in moomoo community?

(I mean this one here)

If you have other thoughts, please comment down below and tell us about them.

Let's make moomoo a better community together!

143

22

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)