Nicholascatcat

liked

28

Nicholascatcat

liked

$Tesla(TSLA.US$ CEO Elon Musk-led SpaceX’s all-civilian crew took a piece of an ancient meteorite to space back during its three-day trip to space and back in September, revealed astronaut Sian Proctor.

What Happened: Proctor in a Twitter post revealed she was able to take a meteorite to space during the all-civilian Inspiration4 mission earlier this year.

Why It Matters: Proctor and three others were part of the Inspiration4’s all-civilian crew that took the round trip. The mission was led by billionaire entrepreneur Jared Isaacman, founder and CEO of e-commerce firm $Shift4 Payments(FOUR.US$

Other astronauts included Hayley Arceneaux, a physician assistant at St. Jude Children’s Research Hospital who is also a childhood cancer survivor, Chris Sembroski, an Air Force veteran and aerospace data engineer, and Sian Proctor, a geoscientist and entrepreneur.

The event was live-streamed on $Netflix(NFLX.US$ as part of a limited episodes docuseries "Countdown: Inspiration4 Mission to Space."

What Happened: Proctor in a Twitter post revealed she was able to take a meteorite to space during the all-civilian Inspiration4 mission earlier this year.

Why It Matters: Proctor and three others were part of the Inspiration4’s all-civilian crew that took the round trip. The mission was led by billionaire entrepreneur Jared Isaacman, founder and CEO of e-commerce firm $Shift4 Payments(FOUR.US$

Other astronauts included Hayley Arceneaux, a physician assistant at St. Jude Children’s Research Hospital who is also a childhood cancer survivor, Chris Sembroski, an Air Force veteran and aerospace data engineer, and Sian Proctor, a geoscientist and entrepreneur.

The event was live-streamed on $Netflix(NFLX.US$ as part of a limited episodes docuseries "Countdown: Inspiration4 Mission to Space."

48

2

Nicholascatcat

reacted to

$Alibaba(BABA.US$ $Tesla(TSLA.US$ $NIO Inc(NIO.US$ $Disney(DIS.US$ $Netflix(NFLX.US$ $Advanced Micro Devices(AMD.US$ $Amazon(AMZN.US$ $Camber Energy(CEI.US$

In today’s market, everyone seems bullish on everything. There are certain stocks that people are being told to buy basically regardless of price. What is a stock that you see everyone pushing that you think is a bad investment that will either lose money or greatly underperform the market. Let’s have some interesting discussion.

In today’s market, everyone seems bullish on everything. There are certain stocks that people are being told to buy basically regardless of price. What is a stock that you see everyone pushing that you think is a bad investment that will either lose money or greatly underperform the market. Let’s have some interesting discussion.

91

3

Nicholascatcat

liked

$Boeing(BA.US$ As long as 787 plummeted as soon as it came out on the news, it was always a trial and error! Boeing's problem isn't really the pandemic; it's its own quality problem.

Translated

44

1

Nicholascatcat

liked

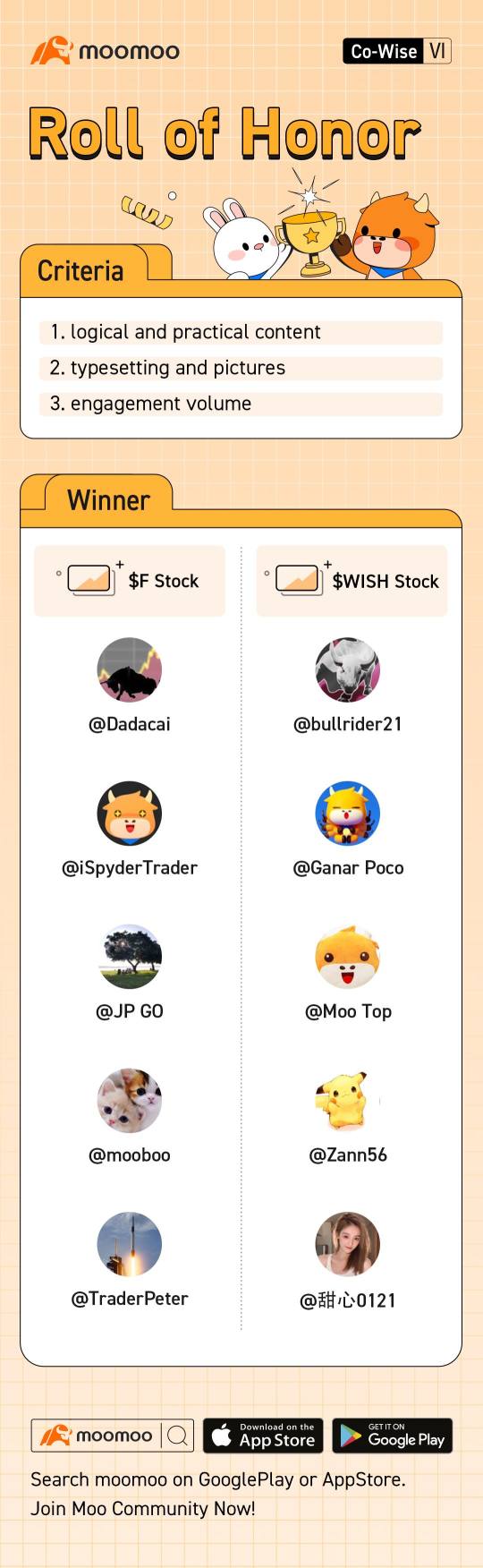

Time flies! You have completed another journey of Co-Wise: What habits help you become a better trader. Thank you all for your participation!![]() In this topic, most mooers mentioned FOMO emotions, panics, and mistakes. When newbies first got in the market, they followed blindly, not knowing what they were doing, and made losses due to succumbing to emotions.

In this topic, most mooers mentioned FOMO emotions, panics, and mistakes. When newbies first got in the market, they followed blindly, not knowing what they were doing, and made losses due to succumbing to emotions.![]()

Will you get sucked into a BULL/FOMO trap when the market plunges? We must learn to stop emotions from getting in the way and take the upper hand in our decision-making.![]() Successful tradings arise from constant practicing and establishing trading rules. Once your trading plan is created, you should be patient and keep plugging away. It would be best to grasp mistakes and be pragmatic to accept them and move on. Let's cultivate good habits to yield consistent results.

Successful tradings arise from constant practicing and establishing trading rules. Once your trading plan is created, you should be patient and keep plugging away. It would be best to grasp mistakes and be pragmatic to accept them and move on. Let's cultivate good habits to yield consistent results.

![]()

![]()

![]() Now, it's time for the winning list of this topic. Let's enjoy the highlight moments together! Congratulation to all the mooers winning $Ford Motor(F.US$ and $ContextLogic(WISH.US$ stocks!

Now, it's time for the winning list of this topic. Let's enjoy the highlight moments together! Congratulation to all the mooers winning $Ford Motor(F.US$ and $ContextLogic(WISH.US$ stocks!

*The rewards will be distributed to winners within 15 working days—the ranking sortes in alphabetical order.

Part Ⅰ: High-Quality Post Collection

@Dadacai Habits To Becoming A Better Trader

One of the key successful habits is to form a trading plan. As Benjamin Franklin rightly said, if you fail to plan, you are planning to fail. Don’t give in to the fear of missing out (FOMO). With practice and perseverance, we can all become successful traders!

@iSpyderTrader Building Good Trading Habits

DO NOT try to copy someone else's idea as that works for them. You need to get insight about it and try it on your own. Practice makes perfect. Do your due diligence (research, articles, news, etc.) Trade with a positive attitude. Don't be greedy and take profits.

@JP GO Set a rule that suitable your lifestyle

Trading have to link with lifestyle and set up a rule of it. More importantly is following it as a habit. I start from small amounts to test that if my thoughts/rule works for me and make some adjustments. I only allow myself to use 3 quarters, leave a last option for myself and I won't fear while look at the red numbers.

@mooboo Habits that made me a better trader

For my value investing, I do a certain amount of due diligence before starting a position in any stock. I fight the urge every time I panic. Emotions are your biggest enemy in the stock market. Lastly, manage your risk well.

@TraderPeter Be mechanical!

The risk and the size are highly correlated. Ask Why first. Knowing the why helps me to make quick decision without second guess myself. Only trade something that is liquid enough. Take profit early and often and let time cure the pain.

@bullrider21Nothing is foolproof

Always do your homework before you buy a stock. Don't speculate. Don't buy on rumours. Find out the support and resistance levels to determine your buying and selling prices. You must be disciplined. Don't be too greedy.

@Ganar PocoGood habits will make you a consistent winner

Trading Psychology is a mental aspect of trading. It involves things like how to control your emotions, eg FOMO. After you have control your emotions & learned the importance of Risk Management. The next important aspect that will give an edge in trading is Strategy.

@Moo Top My 117 days experiences

I am still figuring out what is my plan in investing and trading after 117 days in Moomoo. However, the following are what I gather from my experiences: Investment or Trading. Have an exit plan if trading. Value or Growth or Meme stocks. Trading is not everything. Have a life.

@Zann56 Overcoming emotions

Human emotions (Fear and greed) are inevitably involved when it comes to investing. I have made losses in the past due to succumbing to my emotions. To avoid such mistakes, I have learnt to adopt 3 strategies now. Invest in what I strongly believe in. Dollar Cost Averaging. Diversification.

@甜心0121 My Habits

For me personally, I hold on to these 4 habits to ensure consistency in my trading. Set goals. Manage risks. Research, research and research. Limit time and get a life.

![]() For more engaging posts, please click Co-Wise: What habits help you become a better trader? to check. Don't forget to leave your comments and tell mooers what you've learned!

For more engaging posts, please click Co-Wise: What habits help you become a better trader? to check. Don't forget to leave your comments and tell mooers what you've learned!![]()

Part Ⅱ: Voting on the “Mentor Moo” Title

It's time for voting! Let's vote for the candidates to see who will win the "Mentor Moo" title. Whose post do you think is the best? Your vote means a lot to them!

Emotions and responsibilities could cloud your thinking. Deduction and objectivity could lead you to impulsive and irrational decision-making, resulting in more losses. It is not valid to trade based on feelings or rumors. Analysis and research should be trading fundamentals. Emotional trading may bring back some earnings, but rational trading is how you survive for a long time. Enhance your lifestyle with trading and follow the rules as a habit. Practice makes perfect.![]()

Disclaimer: All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

Will you get sucked into a BULL/FOMO trap when the market plunges? We must learn to stop emotions from getting in the way and take the upper hand in our decision-making.

*The rewards will be distributed to winners within 15 working days—the ranking sortes in alphabetical order.

Part Ⅰ: High-Quality Post Collection

@Dadacai Habits To Becoming A Better Trader

One of the key successful habits is to form a trading plan. As Benjamin Franklin rightly said, if you fail to plan, you are planning to fail. Don’t give in to the fear of missing out (FOMO). With practice and perseverance, we can all become successful traders!

@iSpyderTrader Building Good Trading Habits

DO NOT try to copy someone else's idea as that works for them. You need to get insight about it and try it on your own. Practice makes perfect. Do your due diligence (research, articles, news, etc.) Trade with a positive attitude. Don't be greedy and take profits.

@JP GO Set a rule that suitable your lifestyle

Trading have to link with lifestyle and set up a rule of it. More importantly is following it as a habit. I start from small amounts to test that if my thoughts/rule works for me and make some adjustments. I only allow myself to use 3 quarters, leave a last option for myself and I won't fear while look at the red numbers.

@mooboo Habits that made me a better trader

For my value investing, I do a certain amount of due diligence before starting a position in any stock. I fight the urge every time I panic. Emotions are your biggest enemy in the stock market. Lastly, manage your risk well.

@TraderPeter Be mechanical!

The risk and the size are highly correlated. Ask Why first. Knowing the why helps me to make quick decision without second guess myself. Only trade something that is liquid enough. Take profit early and often and let time cure the pain.

@bullrider21Nothing is foolproof

Always do your homework before you buy a stock. Don't speculate. Don't buy on rumours. Find out the support and resistance levels to determine your buying and selling prices. You must be disciplined. Don't be too greedy.

@Ganar PocoGood habits will make you a consistent winner

Trading Psychology is a mental aspect of trading. It involves things like how to control your emotions, eg FOMO. After you have control your emotions & learned the importance of Risk Management. The next important aspect that will give an edge in trading is Strategy.

@Moo Top My 117 days experiences

I am still figuring out what is my plan in investing and trading after 117 days in Moomoo. However, the following are what I gather from my experiences: Investment or Trading. Have an exit plan if trading. Value or Growth or Meme stocks. Trading is not everything. Have a life.

@Zann56 Overcoming emotions

Human emotions (Fear and greed) are inevitably involved when it comes to investing. I have made losses in the past due to succumbing to my emotions. To avoid such mistakes, I have learnt to adopt 3 strategies now. Invest in what I strongly believe in. Dollar Cost Averaging. Diversification.

@甜心0121 My Habits

For me personally, I hold on to these 4 habits to ensure consistency in my trading. Set goals. Manage risks. Research, research and research. Limit time and get a life.

Part Ⅱ: Voting on the “Mentor Moo” Title

It's time for voting! Let's vote for the candidates to see who will win the "Mentor Moo" title. Whose post do you think is the best? Your vote means a lot to them!

Emotions and responsibilities could cloud your thinking. Deduction and objectivity could lead you to impulsive and irrational decision-making, resulting in more losses. It is not valid to trade based on feelings or rumors. Analysis and research should be trading fundamentals. Emotional trading may bring back some earnings, but rational trading is how you survive for a long time. Enhance your lifestyle with trading and follow the rules as a habit. Practice makes perfect.

Disclaimer: All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

Expand

Expand 72

29

Nicholascatcat

liked

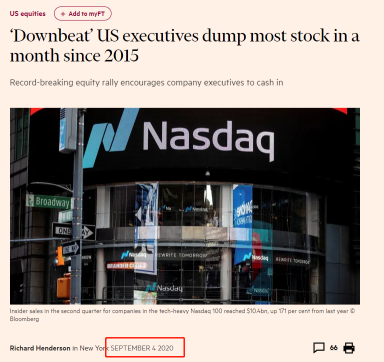

Recently, reports about cashing out by American business leaders have stirred the nerves of investors. It has reached its peak when the CEOs of $Tesla(TSLA.US$and $Microsoft(MSFT.US$ started selling their stock while their company's stock prices were hovering near new records.

$Microsoft(MSFT.US$ Chief Executive Satya Nadella sold about half of his shares in the company last week, reported by Wall Street Journal on Nov. 29.

The filing of Mr. Nadella’s transaction was made public on the Wednesday before the long Thanksgiving weekend. The transaction yielded more than $285 million for Mr. Nadella. This is the single-largest stock sale for Mr. Nadella, according to InsiderScore.

How did the market react?

Interestingly, MSFT has fallen 2% since LAST Wednesday, while $S&P 500 Index(.SPX.US$ has fallen 2.64% over the same period.

Ben Silverman, director of research at InsiderScore, said the sale is similar to Tesla CEO Elon Musk's recent stock sales. Mr. Musk took to Twitter on Nov. 7 pledging to sell 10% of his stockholdings. The Tesla CEO was taking advantage of gains in the company’s stock price, Mr. Silverman said.

$Tesla(TSLA.US$'s stock price has fallen by about 7%, and its market value has shrunk by nearly $100 billion from that point.

Does CEOs’ sell-off mean it’s time to sell?

Action speaks louder than words. Of course, the behavior of business leaders will affect investors' confidence in the company. At least, for better or worse, news usually makes stocks more volatile in the short term.

However, their actions are not always noteworthy.

For one thing, insiders may have their own reason each time they sell stock. As to Nadella, analysts said the move could be related to Washington state instituting a 7% tax for long-term capital gains beginning at the start of next year for anything exceeding $250,000 a year.

For another, insider trading shouldn't be the only source of information, because not every executive is correct each time. In the long run, the best option is to research in-depth.

News about the sale of stocks by executives is reported from time to time. To paint a clearer picture of their effects, let's check the performance of markets and those stocks:

1. The broad market has continuously set new highs since the pandemic.

2. Taking Amazon as an example, after the CEO sold shares, the stock price has still climbed higher.

The same story also applies to $Pfizer(PFE.US$, whose CEO sold stocks last November.

3. It's not all good news. $GameStop(GME.US$ CEO announced to sell stocks in April. Here is how the stock price performed since then.

The bottom line

1. The CEO's sell-off may help you predict the future volatility of stock prices in the short term.

2. There is no obvious correlation between long-term stock performance and CEO selling.

3. Insider trading should not be the only source of information. Before making wise investment decisions, we should rely on in-depth research to check the company’s financial statements, annual reports, and other public opinions.

As a rule, value investors generally prefer to invest in high-quality companies with fair prices. The question is, how to identify the value of a company?

Click to our newly unveiled courses: How to invest in stocks: Quick-Start Guide.

Welcome to Courses in Moo Community, we help you trade like a pro.

$S&P 500 Index(.SPX.US$ $Dow Jones Industrial Average(.DJI.US$ $Nasdaq Composite Index(.IXIC.US$

$Microsoft(MSFT.US$ Chief Executive Satya Nadella sold about half of his shares in the company last week, reported by Wall Street Journal on Nov. 29.

The filing of Mr. Nadella’s transaction was made public on the Wednesday before the long Thanksgiving weekend. The transaction yielded more than $285 million for Mr. Nadella. This is the single-largest stock sale for Mr. Nadella, according to InsiderScore.

How did the market react?

Interestingly, MSFT has fallen 2% since LAST Wednesday, while $S&P 500 Index(.SPX.US$ has fallen 2.64% over the same period.

Ben Silverman, director of research at InsiderScore, said the sale is similar to Tesla CEO Elon Musk's recent stock sales. Mr. Musk took to Twitter on Nov. 7 pledging to sell 10% of his stockholdings. The Tesla CEO was taking advantage of gains in the company’s stock price, Mr. Silverman said.

$Tesla(TSLA.US$'s stock price has fallen by about 7%, and its market value has shrunk by nearly $100 billion from that point.

Does CEOs’ sell-off mean it’s time to sell?

Action speaks louder than words. Of course, the behavior of business leaders will affect investors' confidence in the company. At least, for better or worse, news usually makes stocks more volatile in the short term.

However, their actions are not always noteworthy.

For one thing, insiders may have their own reason each time they sell stock. As to Nadella, analysts said the move could be related to Washington state instituting a 7% tax for long-term capital gains beginning at the start of next year for anything exceeding $250,000 a year.

For another, insider trading shouldn't be the only source of information, because not every executive is correct each time. In the long run, the best option is to research in-depth.

News about the sale of stocks by executives is reported from time to time. To paint a clearer picture of their effects, let's check the performance of markets and those stocks:

1. The broad market has continuously set new highs since the pandemic.

2. Taking Amazon as an example, after the CEO sold shares, the stock price has still climbed higher.

The same story also applies to $Pfizer(PFE.US$, whose CEO sold stocks last November.

3. It's not all good news. $GameStop(GME.US$ CEO announced to sell stocks in April. Here is how the stock price performed since then.

The bottom line

1. The CEO's sell-off may help you predict the future volatility of stock prices in the short term.

2. There is no obvious correlation between long-term stock performance and CEO selling.

3. Insider trading should not be the only source of information. Before making wise investment decisions, we should rely on in-depth research to check the company’s financial statements, annual reports, and other public opinions.

As a rule, value investors generally prefer to invest in high-quality companies with fair prices. The question is, how to identify the value of a company?

Click to our newly unveiled courses: How to invest in stocks: Quick-Start Guide.

Welcome to Courses in Moo Community, we help you trade like a pro.

$S&P 500 Index(.SPX.US$ $Dow Jones Industrial Average(.DJI.US$ $Nasdaq Composite Index(.IXIC.US$

+5

98

28

Nicholascatcat

liked

Robinhood (HOOD) $Robinhood(HOOD.US$ is the popular stock market-trading app among young and first-time investors and traders. After the company's hyped IPO on July 29, is Robinhood stock a buy in the current stock market rally?

Robinhood Stock IPO

On July 28, Robinhood priced 55 million shares at $38 a share, raising $2.1 billion. But the pricing came in at the low end of its expected range. The stock closed the day at 34.82, more than 8% below the IPO price.

The app is popular among young and first-time investors and traders. Millions of young investors flocked to Robinhood during the meme-stocks trading mania for stocks like GameStop (GME) $GameStop(GME.US$ and AMC Entertainment (AMC) $AMC Entertainment(AMC.US$ . Excitement around cryptocurrencies like Bitcoin also fueled interest in the app.

"While we are only six years into our journey, we have already seen profound transformations in how people think about their money," Chief Executive Vlad Tenev and Chief Creative Officer Baiju Bhatt said in written remarks with the Robinhood IPO filing.

Article excerpted from Investor's Business Daily.

Robinhood Stock IPO

On July 28, Robinhood priced 55 million shares at $38 a share, raising $2.1 billion. But the pricing came in at the low end of its expected range. The stock closed the day at 34.82, more than 8% below the IPO price.

The app is popular among young and first-time investors and traders. Millions of young investors flocked to Robinhood during the meme-stocks trading mania for stocks like GameStop (GME) $GameStop(GME.US$ and AMC Entertainment (AMC) $AMC Entertainment(AMC.US$ . Excitement around cryptocurrencies like Bitcoin also fueled interest in the app.

"While we are only six years into our journey, we have already seen profound transformations in how people think about their money," Chief Executive Vlad Tenev and Chief Creative Officer Baiju Bhatt said in written remarks with the Robinhood IPO filing.

Article excerpted from Investor's Business Daily.

1

4

Nicholascatcat

liked

Nicholascatcat

liked

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)