Katkar

liked

For growth stocks that have been hit hard recently, the situation may not be as dire, according to Strategists at Goldman Sachs.

After the recent sell-off in growth stocks caused by the surge in Treasury yields, we now expect only modest further moves in long-term yields.

The bank's strategists wrote in a note to clients, meaning that further risk to growth valuations from the discount rate is limited.

"The possibility o...

After the recent sell-off in growth stocks caused by the surge in Treasury yields, we now expect only modest further moves in long-term yields.

The bank's strategists wrote in a note to clients, meaning that further risk to growth valuations from the discount rate is limited.

"The possibility o...

87

7

Katkar

liked

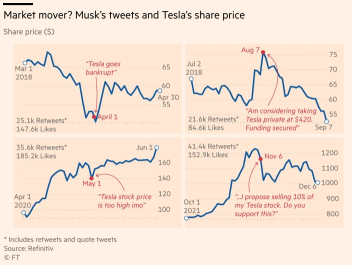

Elon Musk's Twitter musings have always moved Tesla's shares, with the infamous "funding secured" tweet drawing the ire of authorities.

Here is a brief timeline tracing Musk's candid Twitter posts that have impacted the market.

April 1, 2018: An April Fools' joke that fell flat, Musk's tweet that Tesla has gone "completely and totally bankrupt" came following a run of bad news for the automaker, including production shortfalls, regulatory scrutiny over its driver-assistance system Autopilot and a credit rating downgrade further into junk by Moody's Investors Service. All that combined to send the stock down as much as 8.1%.

Aug. 7, 2018: Shares closed up nearly 11% after Musk tweeted during market hours: "Am considering taking Tesla private at $420. Funding secured."

May 1, 2020: Tesla erased around $13 billion from its market value after Musk tweeted "Tesla stock price is too high."

Nov. 6, 2021: Elon Musk proposed selling 10% of his stock on Twitter, and took a poll of people on the social network to see if they supported it. After a clear majority (58%) of 3.5 million Twitter users voted yes, Tesla shares tumbled the most in eight months, falling as much as 7.3% as of Nov.8.

Mooers, what do you think of Musk's tweets? Have his tweets influenced your trading decisions?![]()

$Tesla(TSLA.US$

Source: Economic Times, Financial Times

Here is a brief timeline tracing Musk's candid Twitter posts that have impacted the market.

April 1, 2018: An April Fools' joke that fell flat, Musk's tweet that Tesla has gone "completely and totally bankrupt" came following a run of bad news for the automaker, including production shortfalls, regulatory scrutiny over its driver-assistance system Autopilot and a credit rating downgrade further into junk by Moody's Investors Service. All that combined to send the stock down as much as 8.1%.

Aug. 7, 2018: Shares closed up nearly 11% after Musk tweeted during market hours: "Am considering taking Tesla private at $420. Funding secured."

May 1, 2020: Tesla erased around $13 billion from its market value after Musk tweeted "Tesla stock price is too high."

Nov. 6, 2021: Elon Musk proposed selling 10% of his stock on Twitter, and took a poll of people on the social network to see if they supported it. After a clear majority (58%) of 3.5 million Twitter users voted yes, Tesla shares tumbled the most in eight months, falling as much as 7.3% as of Nov.8.

Mooers, what do you think of Musk's tweets? Have his tweets influenced your trading decisions?

$Tesla(TSLA.US$

Source: Economic Times, Financial Times

132

19

Katkar

liked

Applications for U.S. state unemployment benefits declined last week to the lowest level since 1969, illustrating difficulties adjusting the raw data for seasonal effects.

Initial unemployment claims totaled 184,000 in the week ended Dec. 4, down 43,000 from the prior period, Labor Department data showed Thursday. The median estimate in a Bloomberg survey of economists called for 220,000 applications.

Initial unemployment claims totaled 184,000 in the week ended Dec. 4, down 43,000 from the prior period, Labor Department data showed Thursday. The median estimate in a Bloomberg survey of economists called for 220,000 applications.

218

26

Katkar

liked

ColumnsMarket Temperature (11/1)

The fear and greed index was developed by CNNMoney to measure two of the primary emotions that influence how much investors are willing to pay for stocks.

The fear and greed index is measured on a daily, weekly, monthly, and yearly basis. In theory, the index can be used to gauge whether the stock market is fairly priced. This is based on the logic that excessive fear tends to drive down share prices, and too much greed tends to have the opposite effect.

Be fearful when others are greedy. Be greedy when others are fearful.

---Warren Buffett

Fear & Greed Index

What emotion is driving the market?

Market Momentum: Extreme Greed

The S&P 500 is 5.65% above its 125-day average. This is further above the average than has been typical during the last two years and rapid increases like this often indicate extreme greed.

Last changed Oct 27 from a Greed rating.

Put and Call Options: Extreme Greed

During the last five trading days, volume in put options has lagged volume in call options by 60.47% as investors make bullish bets in their portfolios. This is among the lowest levels of put buying seen during the last two years, indicating extreme greed on the part of investors.

Last changed Oct 27 from a Greed rating.

Junk Bond Demand: Extreme Greed

Investors in low quality junk bonds are accepting 1.92 percentage points in additional yield over safer investment grade corporate bonds. While this spread is historically high, it is sharply lower than recent prices and suggests that investors are pursuing higher risk strategies.

Last changed Oct 27 from a Greed rating.

Source: CNNmoney

The fear and greed index is measured on a daily, weekly, monthly, and yearly basis. In theory, the index can be used to gauge whether the stock market is fairly priced. This is based on the logic that excessive fear tends to drive down share prices, and too much greed tends to have the opposite effect.

Be fearful when others are greedy. Be greedy when others are fearful.

---Warren Buffett

Fear & Greed Index

What emotion is driving the market?

Market Momentum: Extreme Greed

The S&P 500 is 5.65% above its 125-day average. This is further above the average than has been typical during the last two years and rapid increases like this often indicate extreme greed.

Last changed Oct 27 from a Greed rating.

Put and Call Options: Extreme Greed

During the last five trading days, volume in put options has lagged volume in call options by 60.47% as investors make bullish bets in their portfolios. This is among the lowest levels of put buying seen during the last two years, indicating extreme greed on the part of investors.

Last changed Oct 27 from a Greed rating.

Junk Bond Demand: Extreme Greed

Investors in low quality junk bonds are accepting 1.92 percentage points in additional yield over safer investment grade corporate bonds. While this spread is historically high, it is sharply lower than recent prices and suggests that investors are pursuing higher risk strategies.

Last changed Oct 27 from a Greed rating.

Source: CNNmoney

+1

31

2

Katkar

liked

Q&A is a session under a company's earnings conference that institutional and retailinvestors ask some most-concerned questions to the management. On this page, you may find out some valuable info that might affect the stock price in the following weeks. $Lucid Group(LCID.US$

Key Takeaways:

Attitudes: themanagement feels like sitting in a terrific place today with a $4.8 billion.

Goals: Laser focused on growing the scale towards 20,000 units next year. But we're planning on 500,000 units by the end of the decade.

Products: the SUV Gravity is ready for production late '23.

Congrats on your first quarter as a public Company. 90,000 units capacity by 2023 seems a little bit pedestrian, right? As you think about your volume, if you could tell us where you're headed?

Laser focused on growing the scale towards 20,000 units next year. But we're planning on 500,000 units by the end of the decade. We have a plan in place to expand Casa Grande to that level. And we've also got localization of manufacturing. We've got incredible high value in our manufacturing as well because we manufacture the entire technology suite, the battery, the motor, the inverter, the whole electric powertrain, in-house. So we're not just buying in parts here and just having value that way. There's a whole lot of in-built value-add to the cars that we've got. But of course, we also plan probes in other parts of the world, the Middle East and in China, and this is going to be part of our global expansion plan.

Would you consider a greater issuance to raise capital, to maybe accelerate this 90,000 units capacity in 2023. And hopefully maybe grow even faster than what you've been talking about.

We're sitting in a terrific place today with a $4.8 billion as of September 30th. That can get us well through 2022. You're going to see a large CapEx increase happening next year. So we're already doing that acceleration. And in June, we announced that we were going to be bringing forward $350 million of planned CapEx investments from future periods into the 2021 to 2023 periods, and also increasing overall between 2021 and 2026 by 6% to 7%. So we are going to accelerate in our ability to deploy CapEx. And if the opportunity presents itself -- you might recall that our prior versions of our motto suggested that, 2024 and beyond that we might start to step down our CapEx but then opportunity is there for continued expansion and we are ready for it. We will certainly go after it.

You have a knockout products with best-in-class range. How do you view gravities differentiation in the market?

We've made a whole bunch of advances with Gravity project. It's very close to my heart. We're getting it ready for production late '23 and I think it's going to be equally as disruptive in the SUV space as Air is in its sedan space. We're going to deploy the space concept, miniaturization of the electric car train, incredible range for its class, and it's going to have 1 or 2 really big dialing, unique features as well. I am super excited about Gravity.

Congrats on the MotorTrend Car of the Year Award. I had a question on the delta of reservations from the 13 at the end of the quarter to the over 17 now. So I'd be curious what the like-for-like is of North American reservations within that delta? Then maybe within international, how much of a Saudi versus non Saudi or any color that would be helpful?

We don't international reservations before we announce the 13,000, also, the bulk of reservations is our home markets, U.S. and we haven't even opened up the big market and teacher, which is China. But absolutely Saudi is great because it's our biggest market number of reservations, and that's really heartening that the country which is gained its wealth based upon its carbon economy is so forward-looking and sees the efforts in corrective product.

On your distribution strategy, can you remind us why the advantages of going direct to consumer and why you are not using a franchise model?

The important thing here is that we are creating a new brand. It's not just about the product. The product defines the brand, but there's more here than just Lucid Air and a luxury brand. And the consumer experience in the consumer journey is too precious to delegate to third-party. We need to choreograph the consumer's journey through discovery, through intrigue, through purchase and ownership, and how better than to do it directly. You can also just driving consistency in messaging as well, you're not working with independent franchises and dealerships that it just really allows a lot more control

This article is a script from the Q&A session of Lucid's earnings call on Nov 16. In order to facilitate reading, we have made appropriate cuts. If you want to know more details, you can click here to re-watch the earnings call.

Key Takeaways:

Attitudes: themanagement feels like sitting in a terrific place today with a $4.8 billion.

Goals: Laser focused on growing the scale towards 20,000 units next year. But we're planning on 500,000 units by the end of the decade.

Products: the SUV Gravity is ready for production late '23.

Congrats on your first quarter as a public Company. 90,000 units capacity by 2023 seems a little bit pedestrian, right? As you think about your volume, if you could tell us where you're headed?

Laser focused on growing the scale towards 20,000 units next year. But we're planning on 500,000 units by the end of the decade. We have a plan in place to expand Casa Grande to that level. And we've also got localization of manufacturing. We've got incredible high value in our manufacturing as well because we manufacture the entire technology suite, the battery, the motor, the inverter, the whole electric powertrain, in-house. So we're not just buying in parts here and just having value that way. There's a whole lot of in-built value-add to the cars that we've got. But of course, we also plan probes in other parts of the world, the Middle East and in China, and this is going to be part of our global expansion plan.

Would you consider a greater issuance to raise capital, to maybe accelerate this 90,000 units capacity in 2023. And hopefully maybe grow even faster than what you've been talking about.

We're sitting in a terrific place today with a $4.8 billion as of September 30th. That can get us well through 2022. You're going to see a large CapEx increase happening next year. So we're already doing that acceleration. And in June, we announced that we were going to be bringing forward $350 million of planned CapEx investments from future periods into the 2021 to 2023 periods, and also increasing overall between 2021 and 2026 by 6% to 7%. So we are going to accelerate in our ability to deploy CapEx. And if the opportunity presents itself -- you might recall that our prior versions of our motto suggested that, 2024 and beyond that we might start to step down our CapEx but then opportunity is there for continued expansion and we are ready for it. We will certainly go after it.

You have a knockout products with best-in-class range. How do you view gravities differentiation in the market?

We've made a whole bunch of advances with Gravity project. It's very close to my heart. We're getting it ready for production late '23 and I think it's going to be equally as disruptive in the SUV space as Air is in its sedan space. We're going to deploy the space concept, miniaturization of the electric car train, incredible range for its class, and it's going to have 1 or 2 really big dialing, unique features as well. I am super excited about Gravity.

Congrats on the MotorTrend Car of the Year Award. I had a question on the delta of reservations from the 13 at the end of the quarter to the over 17 now. So I'd be curious what the like-for-like is of North American reservations within that delta? Then maybe within international, how much of a Saudi versus non Saudi or any color that would be helpful?

We don't international reservations before we announce the 13,000, also, the bulk of reservations is our home markets, U.S. and we haven't even opened up the big market and teacher, which is China. But absolutely Saudi is great because it's our biggest market number of reservations, and that's really heartening that the country which is gained its wealth based upon its carbon economy is so forward-looking and sees the efforts in corrective product.

On your distribution strategy, can you remind us why the advantages of going direct to consumer and why you are not using a franchise model?

The important thing here is that we are creating a new brand. It's not just about the product. The product defines the brand, but there's more here than just Lucid Air and a luxury brand. And the consumer experience in the consumer journey is too precious to delegate to third-party. We need to choreograph the consumer's journey through discovery, through intrigue, through purchase and ownership, and how better than to do it directly. You can also just driving consistency in messaging as well, you're not working with independent franchises and dealerships that it just really allows a lot more control

This article is a script from the Q&A session of Lucid's earnings call on Nov 16. In order to facilitate reading, we have made appropriate cuts. If you want to know more details, you can click here to re-watch the earnings call.

111

3

Katkar

liked

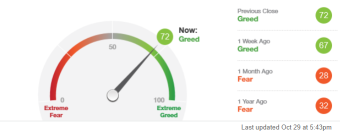

ColumnsMarket Temperature (10/22)

The fear and greed index was developed by CNNMoney to measure two of the primary emotions that influence how much investors are willing to pay for stocks.

The fear and greed index is measured on a daily, weekly, monthly, and yearly basis. In theory, the index can be used to gauge whether the stock market is fairly priced. This is based on the logic that excessive fear tends to drive down share prices, and too much greed tends to have the opposite effect.

Be fearful when others are greedy. Be greedy when others are fearful.

---Warren Buffett

Fear & Greed Index

What emotion is driving the market?

Market Momentum: Greed

The S&P 500 is 4.82% above its 125-day average. This is further above the average than has been typical during the last two years and indicates greed on the part of investors.

Last changed Oct 19 from a Neutral rating.

Stock Price Breadth: Neutral

The McClellan Volume Summation Index measures advancing and declining volume on the NYSE. During the last month, approximately 11.12% more of each day's volume has traded in advancing issues than in declining issues. This indicates that market breadth is improving, though the McClellan Oscillator is in the middle of its range for the last two years and is neutral.

Last changed Oct 18 from a Fear rating.

Safe Haven Demand: Extreme Greed

Stocks have outperformed bonds by 4.36 percentage points during the last 20 trading days. This is close to the strongest performance for stocks relative to bonds in the past two years and indicates investors are rotating into stocks from the relative safety of bonds.

Last changed Oct 14 from a Fear rating.

Source: CNNmoney

$S&P 500 Index(.SPX.US$ $Dow Jones Industrial Average(.DJI.US$ $Tesla(TSLA.US$ $DIGITAL WORLD ACQUISITION CORP(DWAC.US$ $Pinterest(PINS.US$

The fear and greed index is measured on a daily, weekly, monthly, and yearly basis. In theory, the index can be used to gauge whether the stock market is fairly priced. This is based on the logic that excessive fear tends to drive down share prices, and too much greed tends to have the opposite effect.

Be fearful when others are greedy. Be greedy when others are fearful.

---Warren Buffett

Fear & Greed Index

What emotion is driving the market?

Market Momentum: Greed

The S&P 500 is 4.82% above its 125-day average. This is further above the average than has been typical during the last two years and indicates greed on the part of investors.

Last changed Oct 19 from a Neutral rating.

Stock Price Breadth: Neutral

The McClellan Volume Summation Index measures advancing and declining volume on the NYSE. During the last month, approximately 11.12% more of each day's volume has traded in advancing issues than in declining issues. This indicates that market breadth is improving, though the McClellan Oscillator is in the middle of its range for the last two years and is neutral.

Last changed Oct 18 from a Fear rating.

Safe Haven Demand: Extreme Greed

Stocks have outperformed bonds by 4.36 percentage points during the last 20 trading days. This is close to the strongest performance for stocks relative to bonds in the past two years and indicates investors are rotating into stocks from the relative safety of bonds.

Last changed Oct 14 from a Fear rating.

Source: CNNmoney

$S&P 500 Index(.SPX.US$ $Dow Jones Industrial Average(.DJI.US$ $Tesla(TSLA.US$ $DIGITAL WORLD ACQUISITION CORP(DWAC.US$ $Pinterest(PINS.US$

+1

18

1

Katkar

liked

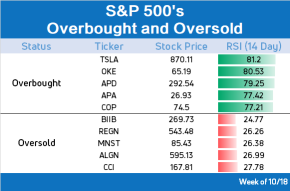

Hello mooers:

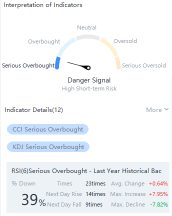

An overbought stock is believed to await a correction or pullback, while an oversold stock has the potential for a price bounce.

We selected a few stocks that contain potential investment opportunities with RSI indicator to find out what the most overbought and oversold companies in S&P 500 today are.

Overbought& Oversold definition

A stock would usually be considered overbought when the RSI > 70 and oversold when RSI < 30.

According to the theory created by J. Welles Wilder Jr, when the RSI < 30, it is a bullish sign (buy signal), and when RSI > 70, it is a bearish sign (sell signal).

Starting this week, this column would change from updating daily to weekly, since movements of stock prices often take a few days before they follow the suggested pattern. We would be tracking the performance of previously selected stocks from now on.

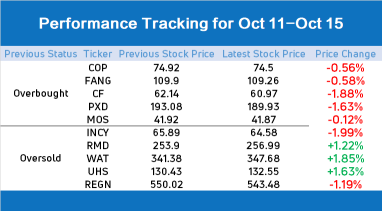

Performance Tracking of Previous Column (10/08)

There are 8 out of 10 selected stocks that followed the suggested movement provided by the RSI indicator.

OverBought

$ConocoPhillips(COP.US$

$Diamondback Energy(FANG.US$

$CF Industries Holdings(CF.US$

$Pioneer Natural Resources Co(PXD.US$

$The Mosaic(MOS.US$

Oversold

$Incyte(INCY.US$

$ResMed(RMD.US$

$Waters(WAT.US$

$Universal Health Services(UHS.US$

$Regeneron Pharmaceuticals(REGN.US$

We collect stocks from S&P 500 as it contains most of valuable companies.

Want to screen the market by yourself? Read:How to use a stock screener

Want to learn more about technical trading? Read: Technical Analysis 101:Introduction to technical indicators

An overbought stock is believed to await a correction or pullback, while an oversold stock has the potential for a price bounce.

We selected a few stocks that contain potential investment opportunities with RSI indicator to find out what the most overbought and oversold companies in S&P 500 today are.

Overbought& Oversold definition

A stock would usually be considered overbought when the RSI > 70 and oversold when RSI < 30.

According to the theory created by J. Welles Wilder Jr, when the RSI < 30, it is a bullish sign (buy signal), and when RSI > 70, it is a bearish sign (sell signal).

Starting this week, this column would change from updating daily to weekly, since movements of stock prices often take a few days before they follow the suggested pattern. We would be tracking the performance of previously selected stocks from now on.

Performance Tracking of Previous Column (10/08)

There are 8 out of 10 selected stocks that followed the suggested movement provided by the RSI indicator.

OverBought

$ConocoPhillips(COP.US$

$Diamondback Energy(FANG.US$

$CF Industries Holdings(CF.US$

$Pioneer Natural Resources Co(PXD.US$

$The Mosaic(MOS.US$

Oversold

$Incyte(INCY.US$

$ResMed(RMD.US$

$Waters(WAT.US$

$Universal Health Services(UHS.US$

$Regeneron Pharmaceuticals(REGN.US$

We collect stocks from S&P 500 as it contains most of valuable companies.

Want to screen the market by yourself? Read:How to use a stock screener

Want to learn more about technical trading? Read: Technical Analysis 101:Introduction to technical indicators

+9

90

9

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)