_JHAO

liked

Weekly market recap

Stock futures fluctuated in overnight trading Sunday following a losing week as investors continued to grapple with the resurgence of Covid cases and an upcoming shift in the Federal Reserve's easy monetary policy.

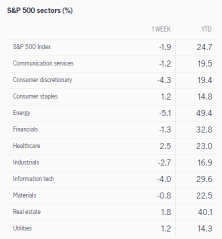

The major averages are coming off a negative week, with the $S&P 500 Index(.SPX.US$ declining 1.9%. The tech-heavy $Nasdaq Composite Index(.IXIC.US$ dropped nearly 3% last week as investors dumped high-flying growth stocks on the prospect of higher interest rates, while the $Dow Jones Industrial Average(.DJI.US$ slipped 1.7%.

Here's a look at the return of S&P 500 sectors

The week ahead in focus

Stock and bond markets around the world will be closed Friday in observance of Christmas. Before the holiday break, Nike and Micron Technology report on Monday, BlackBerry and General Mills on Tuesday, and CarMax, Cintas, and Paychex on Wednesday.

It will be a busy week of economic data releases. On Monday, the Conference Board publishes its Leading Economic Index for November, followed by its Consumer Confidence Index for December on Wednesday.

On Thursday, the Bureau of Economic Analysis reports personal income and consumption expenditures for November. Consumer earnings are forecast to have risen 0.6% while spending is seen climbing 0.5%. The Federal Reserve's preferred measure of inflation, the core PCE price index, is expected to have spiked 4.5% in November.

Also Thursday, the Census Bureau releases the durable goods report for November, which will provide a window into investment spending in the economy. New orders are forecast to have risen 2.1%. Housing-market indicators out this week include existing-home sales for November on Wednesday and new-home sales for November on Thursday.

Monday 12/20

$Micron Technology(MU.US$ and $Nike(NKE.US$ report quarterly results.

The Conference Board releases its Leading Economic Index for November. Consensus estimate is for a 119 reading, which would be 0.6% more than October's level. The Conference Board currently projects a 5% growth rate for fourth-quarter gross domestic product and a slower but still robust 2.6% for 2022.

Tuesday 12/21

$BlackBerry(BB.US$, $FactSet Research Systems(FDS.US$, and $General Mills(GIS.US$ announce earnings.

Wednesday 12/22

The NAR reports existing-home sales for November. Economists forecast a seasonally adjusted annual rate of 6.4 million homes sold, slightly more than in October and the highest since the beginning of the year.

$CarMax(KMX.US$, $Cintas(CTAS.US$, and $Paychex(PAYX.US$ hold conference calls to discuss quarterly results.

The Bureau of Economic Analysis reports its third and final estimate for third-quarter GDP. Economists forecast a 2.1% seasonally adjusted annual growth rate, unchanged from November's second estimate.

The Conference Board releases its Consumer Confidence Index for December. Expectations are for a 110 reading, roughly even with the November data. The index is 15% lower than the postpandemic peak reached in June of this year, due to concerns about rising prices and, to a lesser degree, Covid-19 variants.

Thursday 12/23

The Department of Labor reports initial jobless claims for the week ending on Dec. 18. Jobless claims have averaged 225,667 a week in November and December, and have finally reached prepandemic levels.

The Census Bureau reports new-home sales for November. Consensus estimate is for a seasonally adjusted annual rate of 770,000 new single-family houses sold, 25,000 more than in October. The median sales price of new houses sold in October was $407,700, while the average sales price was $477,800 -- both record highs.

The BEA reports personal income and consumption expenditures for November. Economists forecast a 0.6% monthly increase for income and 0.5% for consumption. This compares with gains for 0.5% and 1.3%, respectively, in October. The Federal Reserve's preferred inflation gauge, the core PCE price index, jumped 4.1% year over year in October, the fastest rate since 1991. Predictions are for it to spike 4.6% in November.

The Census Bureau releases the durable goods report for November. New orders for durable manufactured goods are expected to increase 2.1%, to $265.6 billion. Excluding transportation, new orders are seen gaining 0.6%, compared with a 0.5% rise in October.

Friday 12/24

U.S. equity and fixed-income markets are closed in observance of Christmas.

Source: CNBC, jhinvestments, Dow Jones Newswires

Stock futures fluctuated in overnight trading Sunday following a losing week as investors continued to grapple with the resurgence of Covid cases and an upcoming shift in the Federal Reserve's easy monetary policy.

The major averages are coming off a negative week, with the $S&P 500 Index(.SPX.US$ declining 1.9%. The tech-heavy $Nasdaq Composite Index(.IXIC.US$ dropped nearly 3% last week as investors dumped high-flying growth stocks on the prospect of higher interest rates, while the $Dow Jones Industrial Average(.DJI.US$ slipped 1.7%.

Here's a look at the return of S&P 500 sectors

The week ahead in focus

Stock and bond markets around the world will be closed Friday in observance of Christmas. Before the holiday break, Nike and Micron Technology report on Monday, BlackBerry and General Mills on Tuesday, and CarMax, Cintas, and Paychex on Wednesday.

It will be a busy week of economic data releases. On Monday, the Conference Board publishes its Leading Economic Index for November, followed by its Consumer Confidence Index for December on Wednesday.

On Thursday, the Bureau of Economic Analysis reports personal income and consumption expenditures for November. Consumer earnings are forecast to have risen 0.6% while spending is seen climbing 0.5%. The Federal Reserve's preferred measure of inflation, the core PCE price index, is expected to have spiked 4.5% in November.

Also Thursday, the Census Bureau releases the durable goods report for November, which will provide a window into investment spending in the economy. New orders are forecast to have risen 2.1%. Housing-market indicators out this week include existing-home sales for November on Wednesday and new-home sales for November on Thursday.

Monday 12/20

$Micron Technology(MU.US$ and $Nike(NKE.US$ report quarterly results.

The Conference Board releases its Leading Economic Index for November. Consensus estimate is for a 119 reading, which would be 0.6% more than October's level. The Conference Board currently projects a 5% growth rate for fourth-quarter gross domestic product and a slower but still robust 2.6% for 2022.

Tuesday 12/21

$BlackBerry(BB.US$, $FactSet Research Systems(FDS.US$, and $General Mills(GIS.US$ announce earnings.

Wednesday 12/22

The NAR reports existing-home sales for November. Economists forecast a seasonally adjusted annual rate of 6.4 million homes sold, slightly more than in October and the highest since the beginning of the year.

$CarMax(KMX.US$, $Cintas(CTAS.US$, and $Paychex(PAYX.US$ hold conference calls to discuss quarterly results.

The Bureau of Economic Analysis reports its third and final estimate for third-quarter GDP. Economists forecast a 2.1% seasonally adjusted annual growth rate, unchanged from November's second estimate.

The Conference Board releases its Consumer Confidence Index for December. Expectations are for a 110 reading, roughly even with the November data. The index is 15% lower than the postpandemic peak reached in June of this year, due to concerns about rising prices and, to a lesser degree, Covid-19 variants.

Thursday 12/23

The Department of Labor reports initial jobless claims for the week ending on Dec. 18. Jobless claims have averaged 225,667 a week in November and December, and have finally reached prepandemic levels.

The Census Bureau reports new-home sales for November. Consensus estimate is for a seasonally adjusted annual rate of 770,000 new single-family houses sold, 25,000 more than in October. The median sales price of new houses sold in October was $407,700, while the average sales price was $477,800 -- both record highs.

The BEA reports personal income and consumption expenditures for November. Economists forecast a 0.6% monthly increase for income and 0.5% for consumption. This compares with gains for 0.5% and 1.3%, respectively, in October. The Federal Reserve's preferred inflation gauge, the core PCE price index, jumped 4.1% year over year in October, the fastest rate since 1991. Predictions are for it to spike 4.6% in November.

The Census Bureau releases the durable goods report for November. New orders for durable manufactured goods are expected to increase 2.1%, to $265.6 billion. Excluding transportation, new orders are seen gaining 0.6%, compared with a 0.5% rise in October.

Friday 12/24

U.S. equity and fixed-income markets are closed in observance of Christmas.

Source: CNBC, jhinvestments, Dow Jones Newswires

+2

113

7

_JHAO

liked

$Tesla(TSLA.US$ hehehehehheh trust me

3

_JHAO

liked

Trading with the following in mind is crucial to being a successful day trader.

Understanding The Market Requires You To Understand Market Psychology

Stock market intraday patterns – all times are in Eastern Standard Time!

When day trading the US stock market you may notice certain patterns, based on the time of day, that occur more often than not. These patterns, or tendencies, happen often enough for professional day traders to base their trading around them.

9:30am: The stock market opens, and there is an initial push in one direction. Highly volatile!

9:45am: The initial push often sees a significant reversal or pullback. This is often just a short-term shift, and then the original trending direction re-asserts itself.

10:00am: If the trend that began at 9:30am is still happening, it will often be challenged around this time. This tends to be another time where there is a significant reversal or pullback.

11:15am-11:30am: The market is heading into lunch hour, and London is getting ready to close. This is when volatility will typically die out for a few hours, but often the daily high or low will be tested around this time. European traders will usually close out positions or accumulate a position before they finish for the day. Whether the highs or lows are tested or not, the markets tend to ‘drift’ for the next hour or more.

11:45am-1:30pm: This is lunch time in New York, plus a bit of a time buffer. Usually, this is the quietest time of the day, and often, day traders like to avoid it.

1:30pm-2:00pm: If the lunch hour was calm, then expect a breakout of the range established during lunch hour. Often, the market will try to move in the direction it was trading in before the lunch hour doldrums set in.

2:00pm-2:45pm: The close is getting closer, and many traders are trading with the trend thinking it will continue into close. That may happen, but expect some sharp reversals around this time, because on the flip side, man traders are quicker to take profits or move their trailing stop losses closer to the current price.

3:00pm-3:30pm: These are big “Shake-out” points, in that they will force many traders out of their positions. If a reversal of the prior trend occurs around this time, then the price is likely to move very strongly in the opposite direction. Even if the prior trend does sustain itself through these periods, expect some quick and sizable counter-trend moves.

As a day trader, its best to be nimble and not get tied into one position or direction. Many traders only trade the first hour and the last hour of every day, as these times are the most volatile.

3:30pm-4:00pm: The market closes at 4pm. After that, the liquidity dries up in nearly all stocks and ETFs, except for the very active ones. It’s common to close all positions a minute or more before the closing bell, unless you have orders placed to close your position on a closing auction or “cross”.

💰Wasnt sure where the “tips for day trading” event is or i wouldve posted this there. 🍻 @moomoo Event @moomoo Lily

Hope this provides some clarity to the workd of daytrading!

$Energy Focus(EFOI.US$

Understanding The Market Requires You To Understand Market Psychology

Stock market intraday patterns – all times are in Eastern Standard Time!

When day trading the US stock market you may notice certain patterns, based on the time of day, that occur more often than not. These patterns, or tendencies, happen often enough for professional day traders to base their trading around them.

9:30am: The stock market opens, and there is an initial push in one direction. Highly volatile!

9:45am: The initial push often sees a significant reversal or pullback. This is often just a short-term shift, and then the original trending direction re-asserts itself.

10:00am: If the trend that began at 9:30am is still happening, it will often be challenged around this time. This tends to be another time where there is a significant reversal or pullback.

11:15am-11:30am: The market is heading into lunch hour, and London is getting ready to close. This is when volatility will typically die out for a few hours, but often the daily high or low will be tested around this time. European traders will usually close out positions or accumulate a position before they finish for the day. Whether the highs or lows are tested or not, the markets tend to ‘drift’ for the next hour or more.

11:45am-1:30pm: This is lunch time in New York, plus a bit of a time buffer. Usually, this is the quietest time of the day, and often, day traders like to avoid it.

1:30pm-2:00pm: If the lunch hour was calm, then expect a breakout of the range established during lunch hour. Often, the market will try to move in the direction it was trading in before the lunch hour doldrums set in.

2:00pm-2:45pm: The close is getting closer, and many traders are trading with the trend thinking it will continue into close. That may happen, but expect some sharp reversals around this time, because on the flip side, man traders are quicker to take profits or move their trailing stop losses closer to the current price.

3:00pm-3:30pm: These are big “Shake-out” points, in that they will force many traders out of their positions. If a reversal of the prior trend occurs around this time, then the price is likely to move very strongly in the opposite direction. Even if the prior trend does sustain itself through these periods, expect some quick and sizable counter-trend moves.

As a day trader, its best to be nimble and not get tied into one position or direction. Many traders only trade the first hour and the last hour of every day, as these times are the most volatile.

3:30pm-4:00pm: The market closes at 4pm. After that, the liquidity dries up in nearly all stocks and ETFs, except for the very active ones. It’s common to close all positions a minute or more before the closing bell, unless you have orders placed to close your position on a closing auction or “cross”.

💰Wasnt sure where the “tips for day trading” event is or i wouldve posted this there. 🍻 @moomoo Event @moomoo Lily

Hope this provides some clarity to the workd of daytrading!

$Energy Focus(EFOI.US$

113

3

_JHAO

liked

12

_JHAO

liked

$Taiwan Semiconductor(TSM.US$ come on climb back up

2

_JHAO

liked

_JHAO

voted

_JHAO

liked

$Marin Software(MRIN.US$ It should be time to keep an eye on it. As soon as there is good news, I'll go to space on a rocket

Translated

10

_JHAO

liked

My personal guess about this mutation is that the thunder is loud and the rain is light. Because this mutation is probably highly contagious and less lethal, because there are so many cases in South Africa, yet no fatal cases have been reported $Moderna(MRNA.US$ $Tesla(TSLA.US$ $Apple(AAPL.US$ $Microsoft(MSFT.US$

Translated

18

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)