Hosaybo888

liked

In 2021, moomoo became the place where investors could share their opinions and communicate freely with each other. The frequent interactions between the enthusiastic mooers have positively impacted the community.![]()

![]()

![]() Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

![]() ONE: Is investing in Trump's new merger a good idea?

ONE: Is investing in Trump's new merger a good idea?

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

![]() TWO: What do you think of meme stocks?

TWO: What do you think of meme stocks?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

![]() THREE: What can we learn from the big picture?

THREE: What can we learn from the big picture?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

![]() FOUR: Will the strong momentum of recovery stocks fade?

FOUR: Will the strong momentum of recovery stocks fade?

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

![]()

![]() FIVE: EV stocks skyrocketing: Good buy or goodbye?

FIVE: EV stocks skyrocketing: Good buy or goodbye?

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

![]() SIX: How do you decide when to buy/sell?

SIX: How do you decide when to buy/sell?

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

![]() SEVEN: How do you know when to stop loss / take profit?

SEVEN: How do you know when to stop loss / take profit?

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

![]() EIGHT: What urges you to press the "trade" button?

EIGHT: What urges you to press the "trade" button?

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

![]() NINE: How to build a portfolio with a windfall of $1 million?

NINE: How to build a portfolio with a windfall of $1 million?

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

![]() TEN: How to profit from short-selling?

TEN: How to profit from short-selling?

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

![]() Bonus

Bonus![]()

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

445

39

Hosaybo888

liked

$AMC Entertainment(AMC.US$ got me 100 shares.

5

Hosaybo888

liked and commented on

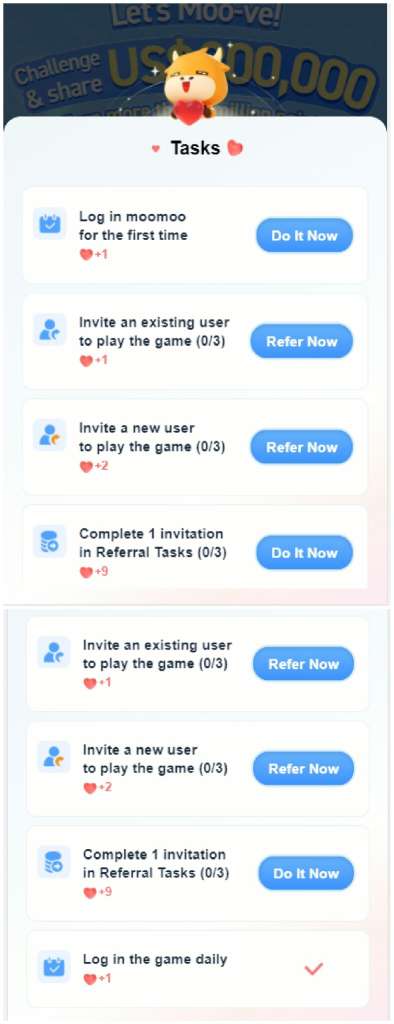

Futu’s 9th Anniversary Challenge Game has been launched recently. On such a short notice, it has attracted a large number of users to participate in the game with great enthusiasm.

For new participants, though, it could be difficult for them to maneuver moomoo, our hero, through the game. Failing to rise through the rank in the game could result in losing the chance to get a slice of the $200,000 final prize.

Don’t worry! Here are some useful tips to guide you through the game.

Tip 1: Keep in mind that extra lives could greatly improve the odds of winning. To get extra lives, you can complete the tasks listed to gain more chances to play and strike for higher scores and better rewards. Please complete the tasks as much and as soon as possible.

Tip 2: If you are an iPhone user, you may turn the Low Power Mode off or start the game with the battery full charged. High refresh rate mode would be ideal, because it enables a higher frame rate in the game, which could smooth your gaming experience and potentially improve your performance.

Tip 3: When you make the jumps, it is better to jump over one obstacle at a time. Since each jump to the central point is rewarded with one point, if you jump over multiple obstacles at a time, you will get one point only. Besides, it is much more difficult to jump over several obstacles at once.

Tip 4: Winning the game becomes harder as you are entering into the next level. The first three levels are the easiest. Please try your best to practice jumping to the center point between the obstacles to make the best of these levels. You may feel easier to adapt to harder modes with more practice.

Tip 5: The more times the game is cleared, the more obstacles and the higher the difficulty will be. Please noted that more risks potentially lead to higher scores. You will gain extra points after overcoming obstacles, so jumping over more obstacles can help you accumulate more points. In this way, it is possible for you to obtain higher scores in higher levels, but you still have to be careful when the risk increases.

Tip 6: For the newbies of the game who are not confident in their ability to reach the central points, you can firstly take small steps to the front of the obstacle and then jump over it. Despite of the more steps you have to take, it’s more secure in this way.

Tip 7: According to data collected, failure happens the most frequently at the corners in the game. You must be careful with corners by taking small steps when pass through them.

Tip 8: Going fast does not always lead to success. Keeping your own pace during the game and your investment journey brings more safety and success.

![]() With these tips, feel free to compete with mooers now!

With these tips, feel free to compete with mooers now!

For new participants, though, it could be difficult for them to maneuver moomoo, our hero, through the game. Failing to rise through the rank in the game could result in losing the chance to get a slice of the $200,000 final prize.

Don’t worry! Here are some useful tips to guide you through the game.

Tip 1: Keep in mind that extra lives could greatly improve the odds of winning. To get extra lives, you can complete the tasks listed to gain more chances to play and strike for higher scores and better rewards. Please complete the tasks as much and as soon as possible.

Tip 2: If you are an iPhone user, you may turn the Low Power Mode off or start the game with the battery full charged. High refresh rate mode would be ideal, because it enables a higher frame rate in the game, which could smooth your gaming experience and potentially improve your performance.

Tip 3: When you make the jumps, it is better to jump over one obstacle at a time. Since each jump to the central point is rewarded with one point, if you jump over multiple obstacles at a time, you will get one point only. Besides, it is much more difficult to jump over several obstacles at once.

Tip 4: Winning the game becomes harder as you are entering into the next level. The first three levels are the easiest. Please try your best to practice jumping to the center point between the obstacles to make the best of these levels. You may feel easier to adapt to harder modes with more practice.

Tip 5: The more times the game is cleared, the more obstacles and the higher the difficulty will be. Please noted that more risks potentially lead to higher scores. You will gain extra points after overcoming obstacles, so jumping over more obstacles can help you accumulate more points. In this way, it is possible for you to obtain higher scores in higher levels, but you still have to be careful when the risk increases.

Tip 6: For the newbies of the game who are not confident in their ability to reach the central points, you can firstly take small steps to the front of the obstacle and then jump over it. Despite of the more steps you have to take, it’s more secure in this way.

Tip 7: According to data collected, failure happens the most frequently at the corners in the game. You must be careful with corners by taking small steps when pass through them.

Tip 8: Going fast does not always lead to success. Keeping your own pace during the game and your investment journey brings more safety and success.

+2

101

60

Hosaybo888

voted

Car rental stock $Avis Budget(CAR.US$ surged Tuesday after the company reported a stronger-than-expected third quarter that sparked massive trading volume.

The stock closed 108.3% higher Tuesday at $185.7%. Trading in the stock was halted multiple times Tuesday morning, and it was up more than 200% for the day at one point.

Vague comments on the conference call by executives about increasing purchases of electric cars for its fleet appeared to add juice to the rally, as chief executive officer Joseph Ferraro said the company would play a “big role” in the growth of electric cars in the U.S.

Another car rental stock $Hertz Global Holdings, Inc.(HTZZ.US$ 's shares were also the subject of a trading frenzy earlier this year. Its stock has risen more than 110% since August.

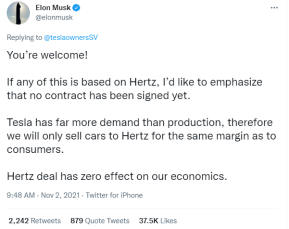

What you may interesting in is that $Tesla(TSLA.US$ CEO Elon Musk said on Monday night that his company has yet to sign a contract with Hertz. However, Hertz said Tesla has already started delivering cars into its rental fleet.

It seems that everything related to EV will suddenly go up. Any comment on the "new tech"? Is it the future or just another overrated topic in the market?

Source:

Shares of Avis double in single day as huge earnings beat sends hedge fund shorts running

The stock closed 108.3% higher Tuesday at $185.7%. Trading in the stock was halted multiple times Tuesday morning, and it was up more than 200% for the day at one point.

Vague comments on the conference call by executives about increasing purchases of electric cars for its fleet appeared to add juice to the rally, as chief executive officer Joseph Ferraro said the company would play a “big role” in the growth of electric cars in the U.S.

Another car rental stock $Hertz Global Holdings, Inc.(HTZZ.US$ 's shares were also the subject of a trading frenzy earlier this year. Its stock has risen more than 110% since August.

What you may interesting in is that $Tesla(TSLA.US$ CEO Elon Musk said on Monday night that his company has yet to sign a contract with Hertz. However, Hertz said Tesla has already started delivering cars into its rental fleet.

It seems that everything related to EV will suddenly go up. Any comment on the "new tech"? Is it the future or just another overrated topic in the market?

Source:

Shares of Avis double in single day as huge earnings beat sends hedge fund shorts running

61

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)