hai momoo i,am happy

Hambali Bali

commented on

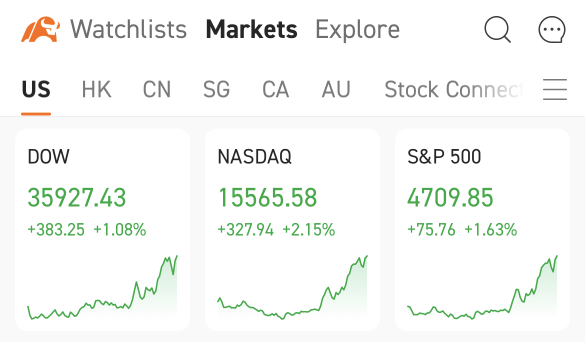

Here is what happened on Wednesday in the U.S. stocks market.

The stock market was subdued ahead of the year-end FOMC meeting. In the late-day trading session, stocks rallied when the Fed statement came out, which injected faith into investors because it showed the determination to fight inflation without restraining economic growth.

Key takeaways - Hawkish talk, dovish action

1. Speed up tapering, on track to end bond buying mid-March

2. Keep the federal funds rate in a target range of 0% to 0.25%

3. Fed forecasts three rate hikes in 2022 and three more in 2023

4. Interest rates policies are closely related to employment data

Why did the market jump on the Fed's decision?

1. Traders have prepared for the worst. It could be an explanation to the rally on a Fed hawkish decision. Since the last Fed meeting, the market already expected hawkish decisions such as tapering speed up and interest hikes.

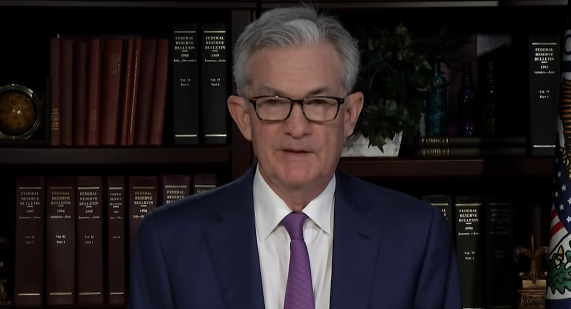

2. Federal Reserve Chairman Jerome Powell balanced his rates outlook with a positive outlook of the economy.

3. Investors are somewhat encouraged by the Fed's recognition and determination to fight inflation.

“It seemed like there was some hedging demand into the event, perhaps relief that the event has happened, regardless of outcome,” said Danny Kirsch, head of options at Cornerstone Macro LLC. “The event is gone, sell your hedge and move on.”

The bottom line

Daily fluctuations of the stock markets are directly or indirectly affected by the changes in macroeconomic factors.

Therefore, knowing more about the Federal Reserve is helpful for your trading. Click to access the free course:

[Weekly Wins]

For more investment knowledge and trends, welcome to Courses in the Community.

$S&P 500 Index(.SPX.US$ $Dow Jones Industrial Average(.DJI.US$ $Nasdaq Composite Index(.IXIC.US$

The stock market was subdued ahead of the year-end FOMC meeting. In the late-day trading session, stocks rallied when the Fed statement came out, which injected faith into investors because it showed the determination to fight inflation without restraining economic growth.

Key takeaways - Hawkish talk, dovish action

1. Speed up tapering, on track to end bond buying mid-March

2. Keep the federal funds rate in a target range of 0% to 0.25%

3. Fed forecasts three rate hikes in 2022 and three more in 2023

4. Interest rates policies are closely related to employment data

Why did the market jump on the Fed's decision?

1. Traders have prepared for the worst. It could be an explanation to the rally on a Fed hawkish decision. Since the last Fed meeting, the market already expected hawkish decisions such as tapering speed up and interest hikes.

2. Federal Reserve Chairman Jerome Powell balanced his rates outlook with a positive outlook of the economy.

3. Investors are somewhat encouraged by the Fed's recognition and determination to fight inflation.

“It seemed like there was some hedging demand into the event, perhaps relief that the event has happened, regardless of outcome,” said Danny Kirsch, head of options at Cornerstone Macro LLC. “The event is gone, sell your hedge and move on.”

The bottom line

Daily fluctuations of the stock markets are directly or indirectly affected by the changes in macroeconomic factors.

Therefore, knowing more about the Federal Reserve is helpful for your trading. Click to access the free course:

[Weekly Wins]

For more investment knowledge and trends, welcome to Courses in the Community.

$S&P 500 Index(.SPX.US$ $Dow Jones Industrial Average(.DJI.US$ $Nasdaq Composite Index(.IXIC.US$

+2

63

48

Hambali Bali

voted

moomoo annual ceremony is happening right now!

Check it out here:

2021 in Review: Grow Together to the Moon!

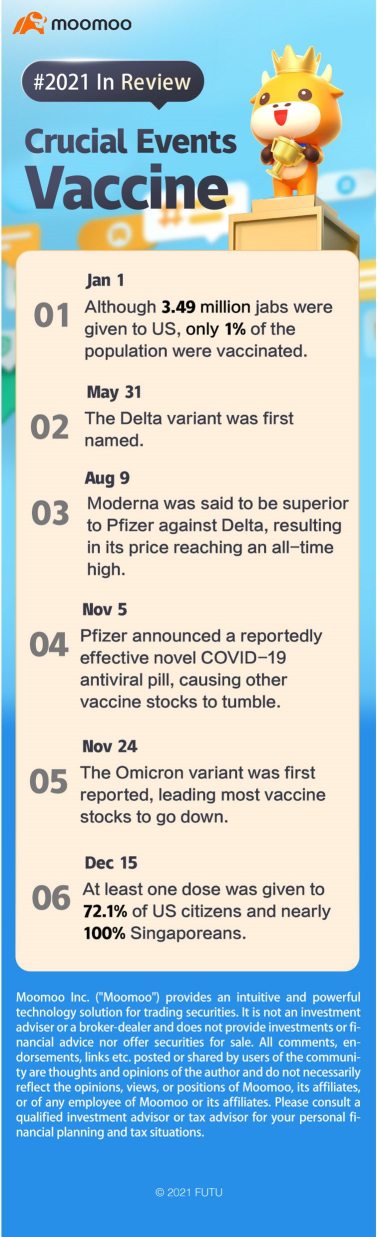

2021 is a bumpy year for investors.

In the post-pandemic era, 2021 has become one of the most unusual years for stock market investors. We try to conclude this year's stock market with three keywords.

"Apes," "Vaccine," and "Musk" are chosen to be the three magical words that could best describe 2021.

Each of them alone is a powerful catalyst that could lead the entire stock market into turmoils. Let's take a deep dive into these words one by one and see how influential they are.

2021 is possibly the genesis of APEs. After the epic battle started in the GME arena, some investors changed from being "solitary animals" to "social animals." The surface of apes group is putting an end to investing alone.

Together, apes have a real impact!

The above are the merits made by apes. All of them are forged in the heat of battle so that the revolution is imprinted into the makeup of apes. In 2021, apes finally stood up and stuck together to fight against the almost unbeatable enemy, making the year memorable. They claimed that if combining every shred of power, apes could become the mainstream one day.

"APE together strong!!!!!!"![]()

![]()

![]()

Are you an ape?

Did I miss anything significant about "Apes?"

Please comment below to remind me of the missing memorable moments of apes.

You May Also Like:

Word of the Year: Musk

Word of the Year: Vaccine

Check it out here:

2021 in Review: Grow Together to the Moon!

2021 is a bumpy year for investors.

In the post-pandemic era, 2021 has become one of the most unusual years for stock market investors. We try to conclude this year's stock market with three keywords.

"Apes," "Vaccine," and "Musk" are chosen to be the three magical words that could best describe 2021.

Each of them alone is a powerful catalyst that could lead the entire stock market into turmoils. Let's take a deep dive into these words one by one and see how influential they are.

2021 is possibly the genesis of APEs. After the epic battle started in the GME arena, some investors changed from being "solitary animals" to "social animals." The surface of apes group is putting an end to investing alone.

Together, apes have a real impact!

The above are the merits made by apes. All of them are forged in the heat of battle so that the revolution is imprinted into the makeup of apes. In 2021, apes finally stood up and stuck together to fight against the almost unbeatable enemy, making the year memorable. They claimed that if combining every shred of power, apes could become the mainstream one day.

"APE together strong!!!!!!"

Are you an ape?

Did I miss anything significant about "Apes?"

Please comment below to remind me of the missing memorable moments of apes.

You May Also Like:

Word of the Year: Musk

Word of the Year: Vaccine

88

38

Hambali Bali

voted

moomoo annual ceremony is happening right now!

Check it out here:

2021 in Review: Grow Together to the Moon!

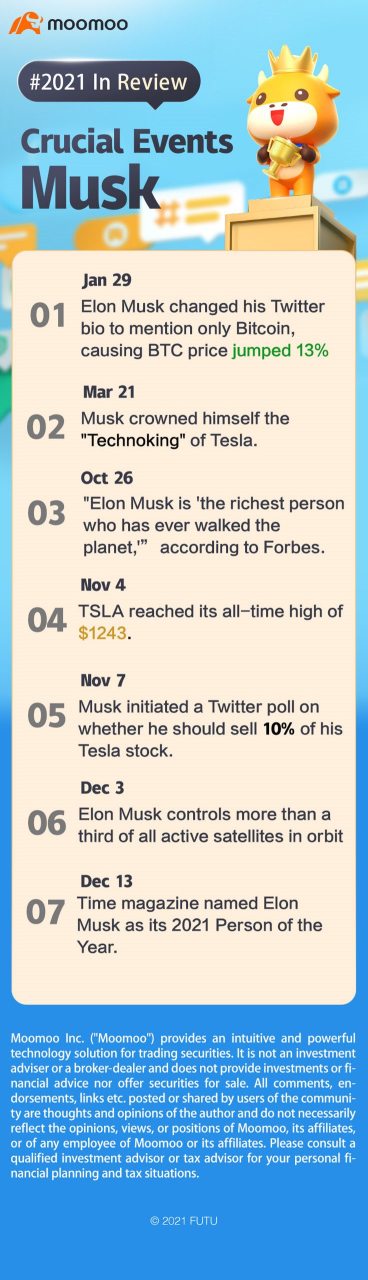

Elon Musk is not just an entrepreneur who starts businesses but a dreamer who wants to accomplish great things.

He wanted to reduce the carbon footprints, so $Tesla(TSLA.US$ came out.

He also wanted to help humankind "colonize" Mars, so he established SpaceX.

He fulfills his dreams step by step and takes human civilization to the next level.

Apart from all the great works, he's like the Thanos in real life. He is visionary but controversial. His tweets are so powerful that they may cause significant damage or make quite a contribution (IDK) to our portfolio. Let's see how did he "snap" in 2021.

If you follow Musk to invest, you may find yourself playing the game of "He loves me... He loves me not. He loves me. He loves me not… "![]()

![]()

![]()

The tag of being capricious has been slapped on his back since a long time ago. Well, his unpredictable actions indeed came to us with big shocks. However, we can't deny that his companies give decent returns to shareholders.

Do you think this dude can keep surprising us and making his name the word of the year again in 2022?

Do you agree or disagree with the word "Musk" here?

Which words do you think could best describe the 2022 stock market?

Comment below with your word of the year "candidates" to let us know.

You May Also Like:

Word of the Year: Apes

Word of the Year: Vaccine

Check it out here:

2021 in Review: Grow Together to the Moon!

Elon Musk is not just an entrepreneur who starts businesses but a dreamer who wants to accomplish great things.

He wanted to reduce the carbon footprints, so $Tesla(TSLA.US$ came out.

He also wanted to help humankind "colonize" Mars, so he established SpaceX.

He fulfills his dreams step by step and takes human civilization to the next level.

Apart from all the great works, he's like the Thanos in real life. He is visionary but controversial. His tweets are so powerful that they may cause significant damage or make quite a contribution (IDK) to our portfolio. Let's see how did he "snap" in 2021.

If you follow Musk to invest, you may find yourself playing the game of "He loves me... He loves me not. He loves me. He loves me not… "

The tag of being capricious has been slapped on his back since a long time ago. Well, his unpredictable actions indeed came to us with big shocks. However, we can't deny that his companies give decent returns to shareholders.

Do you think this dude can keep surprising us and making his name the word of the year again in 2022?

Do you agree or disagree with the word "Musk" here?

Which words do you think could best describe the 2022 stock market?

Comment below with your word of the year "candidates" to let us know.

You May Also Like:

Word of the Year: Apes

Word of the Year: Vaccine

112

13

Hambali Bali

voted

moomoo annual ceremony is happening right now!

Check it out here:

2021 in Review: Grow Together to the Moon!

When can I get the vaccine? One of the most-searched questions on Google indicates people's biggest worry in 2021. However, it's an entirely different story for vaccine stocks holders. Sometimes they want the market sentiments to be different because they found that the line in the cases-versus-price graph increases exponentially.

Instead of getting vaccinated, investors stared at news channels. They tried to find the next catalyst for a strong momentum of growth. Are they speculating? Yes, they are. Maybe you'd like to join them if you look at the cost-benefit ratio or the daily performance of the trending vaccine stocks.

Anyway, I sincerely hope that the vaccines will be enough for every mooer![]() . Sufficient supply also indicates healthy cash flows... Oh, I mean, the virus might stop spreading if most of us are vaccinated.

. Sufficient supply also indicates healthy cash flows... Oh, I mean, the virus might stop spreading if most of us are vaccinated.

We also hope that the vaccine stocks could become value stocks with solid business models and stable cash flows one day. In that case, there will be no need for us to be on tenterhooks all day, waiting for monthly job reports or the infection numbers anymore.

Well, unless you enjoy the extreme volatility of the sudden outbreaks and are confident that you can profit from the biotech stocks shortly.

Did you get the vaccine?

Do you think the word "Vaccine" here qualifies to be the word of the year?

If you've got better ideas, please comment below to let us know.

You May Also Like:

Word of the Year: Apes

Word of the Year: Musk

Check it out here:

2021 in Review: Grow Together to the Moon!

When can I get the vaccine? One of the most-searched questions on Google indicates people's biggest worry in 2021. However, it's an entirely different story for vaccine stocks holders. Sometimes they want the market sentiments to be different because they found that the line in the cases-versus-price graph increases exponentially.

Instead of getting vaccinated, investors stared at news channels. They tried to find the next catalyst for a strong momentum of growth. Are they speculating? Yes, they are. Maybe you'd like to join them if you look at the cost-benefit ratio or the daily performance of the trending vaccine stocks.

Anyway, I sincerely hope that the vaccines will be enough for every mooer

We also hope that the vaccine stocks could become value stocks with solid business models and stable cash flows one day. In that case, there will be no need for us to be on tenterhooks all day, waiting for monthly job reports or the infection numbers anymore.

Well, unless you enjoy the extreme volatility of the sudden outbreaks and are confident that you can profit from the biotech stocks shortly.

Did you get the vaccine?

Do you think the word "Vaccine" here qualifies to be the word of the year?

If you've got better ideas, please comment below to let us know.

You May Also Like:

Word of the Year: Apes

Word of the Year: Musk

118

15

Hambali Bali

commented on

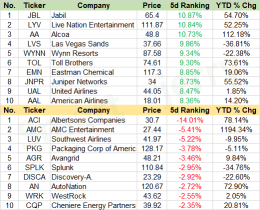

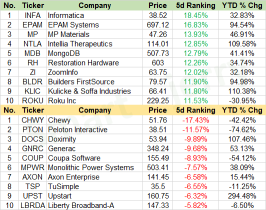

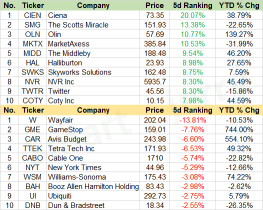

Let's see the biggest movers for this week.![]()

![]()

Top 10 movers for mid-cap value stocks![]()

![]()

Mid-Cap Value Stocks: Stocks of medium-sized companies that are less expensive or growing more slowly than other mid-cap stocks.Value is defined based on low valuations (low price ratios and high dividend yields) and slow growth (low growth rates for earnings, sales, book value, and cash flow).

The market capitalization range for U.S. mid-caps typically falls between $1 billion and $8 billion and represents 20% of the total capitalization of the U.S. equity market.

Top 10 movers for mid-cap growth stocks![]()

![]()

Mid-Cap Growth Stocks: Stocks of medium-sized companies that are projected to grow faster than other mid-cap stocks. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

Top 10 movers for mid-cap core stocks![]()

![]()

Mid-Cap Core Stocks: Stocks of medium-sized companies where neither growth nor value characteristics predominate.

Source: Moomoo, morningstar

There were too many things this week![]() Next week I will try for more updates.

Next week I will try for more updates.![]()

Don't forget to follow me. Thank for your supports!![]()

![]()

Top 10 movers for mid-cap value stocks

Mid-Cap Value Stocks: Stocks of medium-sized companies that are less expensive or growing more slowly than other mid-cap stocks.Value is defined based on low valuations (low price ratios and high dividend yields) and slow growth (low growth rates for earnings, sales, book value, and cash flow).

The market capitalization range for U.S. mid-caps typically falls between $1 billion and $8 billion and represents 20% of the total capitalization of the U.S. equity market.

Top 10 movers for mid-cap growth stocks

Mid-Cap Growth Stocks: Stocks of medium-sized companies that are projected to grow faster than other mid-cap stocks. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

Top 10 movers for mid-cap core stocks

Mid-Cap Core Stocks: Stocks of medium-sized companies where neither growth nor value characteristics predominate.

Source: Moomoo, morningstar

There were too many things this week

Don't forget to follow me. Thank for your supports!

42

2

Hambali Bali

reacted to

Stocks set for steady open; Pound dips on omicron

Stocks looked set for a steady open Monday at the start of a key week for central bank policy decisions amid elevated inflation and questions about the impact of the omicron virus variant on growth.

Futures earlier pointed higher for Australia, Japan and Hong Kong. The $S&P 500 Index(.SPX.US$ closed at a record high Friday on bets the U.S. economy can weather the Federal Reserve's move to reduce stimulus to curb price pressures.

Goldman Sachs says risk of major stocks drawdown modest for now

$Goldman Sachs(GS.US$ strategists said there's little reason to expect a major retreat in U.S. stocks in the months ahead, even as the breadth of the rally that has pushed the S&P 500 index into successive records is getting increasingly narrow.

"The macro environment does not suggest drawdown risk is elevated in the coming months," the strategists wrote, highlighting that earnings and margins continue to surpass expectations, a low risk of recession, and share prices already reflecting the likely Fed tightening.

Airbnb, Lucid and Zscaler added to Nasdaq 100 tech benchmark

Six stocks, including $Airbnb(ABNB.US$ and $Lucid Group(LCID.US$, will be added to the Nasdaq 100 index as part of its annual reconstitution, which adjusts the tech benchmark's membership for changes in market capitalization.

$Fortinet(FTNT.US$, $Palo Alto Networks(PANW.US$, $Zscaler(ZS.US$ and $Datadog(DDOG.US$ will also be added to the index. All changes are effective as of the close on Dec. 17, the same day as the rebalancing of the S&P 500 Index takes effect.

ETF inflows top $1 trillion for first time

This year's inflows into ETFs world-wide crossed the $1 trillion mark for the first time at the end of November, surpassing last year's total of $735.7 billion, according to Morningstar Inc. data. That wave of money, along with rising markets, pushed global ETF assets to nearly $9.5 trillion, more than double where the industry stood at the end of 2018.

Most of that money has gone into low-cost U.S. funds that track indexes run by Vanguard Group, $Blackrock(BLK.US$ and $State Street(STT.US$ , which together control more than three-quarters of all U.S. ETF assets.

Own everything but 'bubble assets' tech and crypto, recommends Institutional Investor hall of famer Rich Bernstein

Institutional Investor hall of famer Rich Bernstein is a market bull whose playbook excludes some of Wall Street's most popular groups. He blames a risky see-saw dynamic playing out in the marketplace.

"On one side, we have all that I would call the bubble assets: tech, innovation, cryptocurrencies," the Richard Bernstein Advisors CEO and CIO told CNBC on Friday. "On the other side of this see-saw, you have literally everything else in the world. I think if you're looking at 2022 into 2023, you want to be in the everything else in the world side of that see-saw."

Amazon Web Services explains outage and will make it easier to track future ones

A major Amazon Web Services outage on Tuesday started after network devices got overloaded, the company said on Friday.

$Amazon(AMZN.US$ ran into issues updating the public and taking support inquiries, and now will revamp those systems.

Inflation surge pushes U.S. real interest rates into more deeply negative territory

Inflation rose 6.8% from a year ago in November, slightly higher than estimates according to the consumer price index released Friday. Excluding food and energy, the CPI increased 4.9%, in line with expectations.

Surging prices for food, energy and shelter accounted for much of the gains.

Uber, Lyft drivers want more protection as rising crime keeps many off the roads

Ride-sharing companies $Uber Technologies(UBER.US$ and $Lyft Inc(LYFT.US$ —which were already caused by Covid-19 concerns—are grappling with a rise in violent crimes and implementing new safety measures and policies to try to better protect the drivers still on their systems. Drivers aren't returning as quickly as consumers, despite big bonuses from companies and the expiration of temporary unemployment benefits extended to gig workers.

Source: Bloomberg, WSJ, CNBC

Stocks looked set for a steady open Monday at the start of a key week for central bank policy decisions amid elevated inflation and questions about the impact of the omicron virus variant on growth.

Futures earlier pointed higher for Australia, Japan and Hong Kong. The $S&P 500 Index(.SPX.US$ closed at a record high Friday on bets the U.S. economy can weather the Federal Reserve's move to reduce stimulus to curb price pressures.

Goldman Sachs says risk of major stocks drawdown modest for now

$Goldman Sachs(GS.US$ strategists said there's little reason to expect a major retreat in U.S. stocks in the months ahead, even as the breadth of the rally that has pushed the S&P 500 index into successive records is getting increasingly narrow.

"The macro environment does not suggest drawdown risk is elevated in the coming months," the strategists wrote, highlighting that earnings and margins continue to surpass expectations, a low risk of recession, and share prices already reflecting the likely Fed tightening.

Airbnb, Lucid and Zscaler added to Nasdaq 100 tech benchmark

Six stocks, including $Airbnb(ABNB.US$ and $Lucid Group(LCID.US$, will be added to the Nasdaq 100 index as part of its annual reconstitution, which adjusts the tech benchmark's membership for changes in market capitalization.

$Fortinet(FTNT.US$, $Palo Alto Networks(PANW.US$, $Zscaler(ZS.US$ and $Datadog(DDOG.US$ will also be added to the index. All changes are effective as of the close on Dec. 17, the same day as the rebalancing of the S&P 500 Index takes effect.

ETF inflows top $1 trillion for first time

This year's inflows into ETFs world-wide crossed the $1 trillion mark for the first time at the end of November, surpassing last year's total of $735.7 billion, according to Morningstar Inc. data. That wave of money, along with rising markets, pushed global ETF assets to nearly $9.5 trillion, more than double where the industry stood at the end of 2018.

Most of that money has gone into low-cost U.S. funds that track indexes run by Vanguard Group, $Blackrock(BLK.US$ and $State Street(STT.US$ , which together control more than three-quarters of all U.S. ETF assets.

Own everything but 'bubble assets' tech and crypto, recommends Institutional Investor hall of famer Rich Bernstein

Institutional Investor hall of famer Rich Bernstein is a market bull whose playbook excludes some of Wall Street's most popular groups. He blames a risky see-saw dynamic playing out in the marketplace.

"On one side, we have all that I would call the bubble assets: tech, innovation, cryptocurrencies," the Richard Bernstein Advisors CEO and CIO told CNBC on Friday. "On the other side of this see-saw, you have literally everything else in the world. I think if you're looking at 2022 into 2023, you want to be in the everything else in the world side of that see-saw."

Amazon Web Services explains outage and will make it easier to track future ones

A major Amazon Web Services outage on Tuesday started after network devices got overloaded, the company said on Friday.

$Amazon(AMZN.US$ ran into issues updating the public and taking support inquiries, and now will revamp those systems.

Inflation surge pushes U.S. real interest rates into more deeply negative territory

Inflation rose 6.8% from a year ago in November, slightly higher than estimates according to the consumer price index released Friday. Excluding food and energy, the CPI increased 4.9%, in line with expectations.

Surging prices for food, energy and shelter accounted for much of the gains.

Uber, Lyft drivers want more protection as rising crime keeps many off the roads

Ride-sharing companies $Uber Technologies(UBER.US$ and $Lyft Inc(LYFT.US$ —which were already caused by Covid-19 concerns—are grappling with a rise in violent crimes and implementing new safety measures and policies to try to better protect the drivers still on their systems. Drivers aren't returning as quickly as consumers, despite big bonuses from companies and the expiration of temporary unemployment benefits extended to gig workers.

Source: Bloomberg, WSJ, CNBC

82

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)