GoldenGold

commented on

$NVIDIA(NVDA.US$

Nvidia dominates the high-end market with a stable share of 70%. In the metasexes and related concepts, Nvidia focuses on software in addition to hardware-related products, and is truly enabling, such as software used in Tesla, to help build simulation scenarios so oems don't have to spend more money doing it

Nvidia dominates the high-end market with a stable share of 70%. In the metasexes and related concepts, Nvidia focuses on software in addition to hardware-related products, and is truly enabling, such as software used in Tesla, to help build simulation scenarios so oems don't have to spend more money doing it

1

4

GoldenGold

commented on

$Tesla(TSLA.US$ Very few companies (less than 1%) grow over the long term, and it is a good strategy for individual investors to find and hold on to them if they can. Public funds have position limits and relative ranking, long-term performance is good industry balance and rotation. The top companies are as obvious as the most beautiful, but special attention should be paid to the amazing and beautiful, rather than the meteor, that requires continuous tracking and flexible adjustment, not only to pay attention to the judgment of the general trend, but also to face the feedback of the market. $NVIDIA(NVDA.US$

2

GoldenGold

commented on

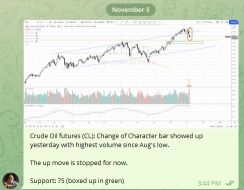

I have mentioned on 5 Nov 2021 that a change of character bar showed up in $Crude Oil Futures(JUN4)(CLmain.US$ (as circled) on 4 Nov and the up move is stopped for now with the immediate support around 75, as shown in the screenshot of my Telegram Group below:

Since then, crude oil had a test of the supply zone followed by a reversal and a reaction. Last Friday, it was testing the support zone (as boxed up in green) near 75, as shown below:

Now, let’s take a look at charts of Oil Services ETF (OIH) and Oil & Gas Exploration & Production ETF (XOP) as a representation of a basket of the crude oil related stocks below, where I have highlighted the bar on 4 Nov in yellow because this is where the change of character bar showed up in the crude oil chart:

Since 4 Nov, both $VanEck Oil Services ETF(OIH.US$ and $SPDR S&P Oil & Gas Exploration & Production ETF(XOP.US$ have broken below the support and on a sharp down move. This is not unexpected since these two ETFs are closely correlated with the crude oil performance.

Seasonality of Crude Oil

From the seasonality of the crude oil chart based on 21 years of data as shown below, it is clear to note that in general, crude oil tends to start a downtrend in end of Oct until Dec where Oct, Nov and Dec are the worst 3 continuous months in terms of average return by month.

Does that mean the current downtrend in crude oil will last until December at least?

Not necessary. Ultimately, we still need to interpret the current chart of the crude oil.

Crude Oil Analogue comparison

As shown in the daily chart below, crude oil is still in a well-established up channel.

In July 2021, crude oil rallied into the overbought line of the channel and had a a-b-c reaction started a short-term downtrend until Sep 2021.

As the current correction is still unfolding in the crude oil, there is similarity of the current correction compared to Jul’s, where I have highlighted using 3 different colors.

Last Friday’s bar hit the support area near 75 and is in an oversold condition, we might expect crude oil to have a rally to test the axis line near 80 before resumption of the downward movement.

Should the support area near 75 fail to hold, we can expect a test of 72 where the demand line of the channel could provide support. Most importantly, we will need to judge the character of the price movement together with the volume to anticipate the up-coming movement for the crude oil.

In terms of the volume, it is still considered as non-threatening hence I believe this could be still a normal pullback within an uptrend for crude oil.

Let's be patient and pay close attention to how the price interacts at the key level so that we can plan accordingly.

Safe trading. $VanEck Oil Services ETF(OIH.US$

Since then, crude oil had a test of the supply zone followed by a reversal and a reaction. Last Friday, it was testing the support zone (as boxed up in green) near 75, as shown below:

Now, let’s take a look at charts of Oil Services ETF (OIH) and Oil & Gas Exploration & Production ETF (XOP) as a representation of a basket of the crude oil related stocks below, where I have highlighted the bar on 4 Nov in yellow because this is where the change of character bar showed up in the crude oil chart:

Since 4 Nov, both $VanEck Oil Services ETF(OIH.US$ and $SPDR S&P Oil & Gas Exploration & Production ETF(XOP.US$ have broken below the support and on a sharp down move. This is not unexpected since these two ETFs are closely correlated with the crude oil performance.

Seasonality of Crude Oil

From the seasonality of the crude oil chart based on 21 years of data as shown below, it is clear to note that in general, crude oil tends to start a downtrend in end of Oct until Dec where Oct, Nov and Dec are the worst 3 continuous months in terms of average return by month.

Does that mean the current downtrend in crude oil will last until December at least?

Not necessary. Ultimately, we still need to interpret the current chart of the crude oil.

Crude Oil Analogue comparison

As shown in the daily chart below, crude oil is still in a well-established up channel.

In July 2021, crude oil rallied into the overbought line of the channel and had a a-b-c reaction started a short-term downtrend until Sep 2021.

As the current correction is still unfolding in the crude oil, there is similarity of the current correction compared to Jul’s, where I have highlighted using 3 different colors.

Last Friday’s bar hit the support area near 75 and is in an oversold condition, we might expect crude oil to have a rally to test the axis line near 80 before resumption of the downward movement.

Should the support area near 75 fail to hold, we can expect a test of 72 where the demand line of the channel could provide support. Most importantly, we will need to judge the character of the price movement together with the volume to anticipate the up-coming movement for the crude oil.

In terms of the volume, it is still considered as non-threatening hence I believe this could be still a normal pullback within an uptrend for crude oil.

Let's be patient and pay close attention to how the price interacts at the key level so that we can plan accordingly.

Safe trading. $VanEck Oil Services ETF(OIH.US$

+2

13

3

GoldenGold

commented on

My investing journey started quite late but I’m blessed to have guidance along the way. Great trading platform like $Futu Holdings Ltd(FUTU.US$ certainly helps. Reading books and following advices help too. Learned how to manage trades is super crucial.

Thank you to friends and family supporting. And special thank to @WYCKOFFPRO for providing valuable advices.

Thank you to friends and family supporting. And special thank to @WYCKOFFPRO for providing valuable advices.

10

4

GoldenGold

commented on

I would use my non trading days to read and think THE FOCUS I READ NOT ONLY FOCUS ON THE INVESTMENT, BUT ALSO FOCUS ON INVESTMENT MANAGEMENT & MANAGEMENT Then only able to consolidate what I learn in order to improve my investment plan..

Translated

3

2

GoldenGold

commented on and voted

Thanksgiving is a time for food, friends and family. It's also a time to pause, reflect on our lives and think about what we're thankful for.

The question we want to ask you on this Thanksgiving day is--What are you grateful for during your investing journey? Is it your supporting family? Your investing pals? Your profittable stock? A book you read? Maybe a guru? The list goes on and on. There are so many things that we appreciate and feel grateful deep down in our heart. Why don't you take this chance to say a big thank-you now!?

What stocks are you most thankful for this year? Or on the contrary, which stocks teach you a lesson? Be it success or setback, there's always a reason for us to be grateful because it made us grow stonger and become more experienced in investing.

Trading or investing is never an easy job. Thankfully, our family or friends provides emotional support during challenging time, encouragement along investing life's twists and turns, and the comfort of being understood and accepted for what you want to do with life.

Do you have a guru that guides you at the beginning of your investing journey? Do you find any book that's helpful for you to make a decision? There are countless online lessons and books you can turn to when you are at a loss. Which one do you want to express your thanks to?

By the time we decided to invest and started to learn from the ground up, we made a brave decision and hard choice. Don't forget that we are a courageous man/ woman and we should feel thankful for that.

5 best posts will get 1,888 points;

10 featured posts will get 888 points;

All participants will get 88 points.

Duration: Now – Nov. 29, 11:59 PM (ET)

Note:

1. Only relevant posts and those add topic #For this, I am grateful count. (Please post under the topic.)

2. Minimum word requirement: 50 words

3. Winners will be announced on Dec. 2nd.

Thank you, and best of luck to all of our trading or investing endeavors. Do forget to attach a picture of your thanksgiving dinner while joining the the topic here #For this, I am grateful

251

30

GoldenGold

commented on

$Tesla(TSLA.US$ hi guys, I’m a new investor, may i ask what is a stock split? Is it a good or bad thing when a stock splits? Thanks for the help! :)

1

1

GoldenGold

commented on

Cathie Wood's flagship $ARK Innovation ETF(ARKK.US$continues to feel the pressure as the fund ended in the red on Monday -4.19% and has now closed to the downside in eight of the last ten trading sessions.

Over the past ten days ARKK has fallen 12.44% and now trades -13.86% year-to-date.

The exchange traded fund touched an intraday low of $107.59, which it has not seen in well over a month, dating back to October 5.

Moreover, investors appear to be fleeing themselves from ARKK. Since November 1, the ETF has also witnessed an outpour of capital flows totaling $359.94M, according to etfdb.com.

Fueling ARKK’s recent selloff has been the rise of the $U.S. 10-Year Treasury Notes Yield(US10Y.BD$yield, which has climbed 16 basis points over the same period. Traditionally as yields ascend, they put pressure on tech-heavy names which ARKK holds.

Below is a two-month chart of ARKK highlighting its recent ten day decline. Investors opposed to ARKK may look towards the $Tuttle Capital Short Innovation ETF(SARK.US$, which is ARKK's inverse competitor fund that has returned +12.56% over the same ten-day period ARKK has slipped.

$Tesla(TSLA.US$

Over the past ten days ARKK has fallen 12.44% and now trades -13.86% year-to-date.

The exchange traded fund touched an intraday low of $107.59, which it has not seen in well over a month, dating back to October 5.

Moreover, investors appear to be fleeing themselves from ARKK. Since November 1, the ETF has also witnessed an outpour of capital flows totaling $359.94M, according to etfdb.com.

Fueling ARKK’s recent selloff has been the rise of the $U.S. 10-Year Treasury Notes Yield(US10Y.BD$yield, which has climbed 16 basis points over the same period. Traditionally as yields ascend, they put pressure on tech-heavy names which ARKK holds.

Below is a two-month chart of ARKK highlighting its recent ten day decline. Investors opposed to ARKK may look towards the $Tuttle Capital Short Innovation ETF(SARK.US$, which is ARKK's inverse competitor fund that has returned +12.56% over the same ten-day period ARKK has slipped.

$Tesla(TSLA.US$

39

14

GoldenGold

commented on

baba at a critical point. If it falls below $138 resistant it will keep falling. If it breaks this falling wedge we might see a reversal!

$Alibaba(BABA.US$

$Alibaba(BABA.US$

16

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

GoldenGold : The market is very aware of the potential of these new verticals for chip manufacturers