Chee Wei6

voted

Today was a big day for the largest tech companies, as they led the stock market to climb higher. The $Invesco QQQ Trust(QQQ.US$, which tracks these big tech stocks, rose by 1.4%, while the $iShares Russell 2000 ETF(IWM.US$, which includes smaller companies, increased by 0.7%. $Alphabet-A(GOOGL.US$ was a standout, with its stock rising due to excitement about a new AI product, which also triggered automated trading systems to buy more of these large company sto...

26

Chee Wei6

liked

Green market signal, buy quater position at this pb with 4% risk and adding backif stock resume higher on volume.

$NVIDIA(NVDA.US$

$NVIDIA(NVDA.US$

26

4

Chee Wei6

voted

$Grab Holdings(GRAB.US$ $Singtel(Z74.SG$

BNM to announce digital bank licence winners on Friday, say sources

https://www.theedgemarkets.com/article/bnm-announce-digital-bank-licence-winners-friday-say-sources

BNM to announce digital bank licence winners on Friday, say sources

https://www.theedgemarkets.com/article/bnm-announce-digital-bank-licence-winners-friday-say-sources

1

Chee Wei6

liked

Earth Day is just around the corner.

But the earth deserves more than a day - That's why ESG investing matters right now.

Nowadays, ESG investing has become a buzzword on Wall Street. Investors believe that a company should not only generate profits but also reward its employees, partners and the community.

What is ESG investing?

ESG stands for environmental, social and governance, which are the three criteria for evaluating a compa...

But the earth deserves more than a day - That's why ESG investing matters right now.

Nowadays, ESG investing has become a buzzword on Wall Street. Investors believe that a company should not only generate profits but also reward its employees, partners and the community.

What is ESG investing?

ESG stands for environmental, social and governance, which are the three criteria for evaluating a compa...

![[Weekly Wins] An effective way to invest in the planet's future](https://ussnsimg.moomoo.com/3880324085069369947.png/thumb)

![[Weekly Wins] An effective way to invest in the planet's future](https://ussnsimg.moomoo.com/f5a6a56c-51a7-4b05-9546-5b8b3168c6fb.jpg/thumb)

![[Weekly Wins] An effective way to invest in the planet's future](https://ussnsimg.moomoo.com/7042217397211418687.jpg/thumb)

+2

25

21

Chee Wei6

liked

The U.S. stock markets have been hovering near records since November. Investors are taking a breather amid the recent volatility.

This week, the U.S. stock markets rebounded from the last week's pullback before and on the quadruple witching day.

Have you noticed the market trends in time and grasped the trading time?

Too busy and have no time?

How to strike a balance between investment and work?

Maybe you can't help but want to know one of our most popular features-AI Monitor.

[Everyday Power]

What is AI Monitor:

AI Monitor aims to pay close attention to the real-time abnormal trend of the market and make investment more manageable. It issues alerts to help you seize trading opportunities and seize investment opportunities.

How to find it:

Quotes - Explore - AI Monitor

Don't forget that continuous learning and research are necessary for successful investment. The assistance of AI Monitor is the icing on the cake.

[In Discussion]

Some investors believe that the market is ready for the「Santa Claus rally」.

What is Santa Claus rally?

The Santa Claus rally describes a rise in the stock market over the last five trading days of December and January's first two trading days.

The seven-day combo yielded positive returns for nearly 78% of the time from 1950 to 2019

Do you believe in Santa Claus rally? Will it affect your investment decisions? What's your plan for the 2022 investment?

[Weekly Wins]

For more investment knowledge and trends, welcome to Courses in the Community.

$S&P 500 Index(.SPX.US$ $Dow Jones Industrial Average(.DJI.US$ $Nasdaq Composite Index(.IXIC.US$

This week, the U.S. stock markets rebounded from the last week's pullback before and on the quadruple witching day.

Have you noticed the market trends in time and grasped the trading time?

Too busy and have no time?

How to strike a balance between investment and work?

Maybe you can't help but want to know one of our most popular features-AI Monitor.

[Everyday Power]

What is AI Monitor:

AI Monitor aims to pay close attention to the real-time abnormal trend of the market and make investment more manageable. It issues alerts to help you seize trading opportunities and seize investment opportunities.

How to find it:

Quotes - Explore - AI Monitor

Don't forget that continuous learning and research are necessary for successful investment. The assistance of AI Monitor is the icing on the cake.

[In Discussion]

Some investors believe that the market is ready for the「Santa Claus rally」.

What is Santa Claus rally?

The Santa Claus rally describes a rise in the stock market over the last five trading days of December and January's first two trading days.

The seven-day combo yielded positive returns for nearly 78% of the time from 1950 to 2019

Do you believe in Santa Claus rally? Will it affect your investment decisions? What's your plan for the 2022 investment?

[Weekly Wins]

For more investment knowledge and trends, welcome to Courses in the Community.

$S&P 500 Index(.SPX.US$ $Dow Jones Industrial Average(.DJI.US$ $Nasdaq Composite Index(.IXIC.US$

+1

133

63

Chee Wei6

liked

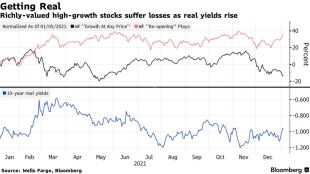

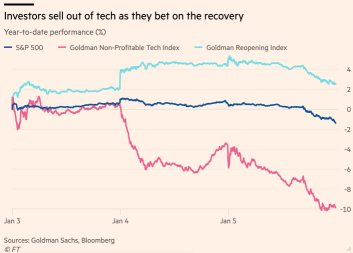

Accroding to Bloomberg and Financial times, investors dumped shares in many of the technology companies that surged during the pandemic as the looming spectre of higher interest rates prompted them to buy into businesses more tightly linked to the economic recovery.

Thanks to the new-year bond selloff, Wall Street pros are doubling down on a big stock call for 2022: The leadership of high-growth tech darlings is no more.

A closely watc...

Thanks to the new-year bond selloff, Wall Street pros are doubling down on a big stock call for 2022: The leadership of high-growth tech darlings is no more.

A closely watc...

37

17

Chee Wei6

liked

After a slow and somewhat painful Monday, the stock markets burst higher on Tuesday, rallying on impressive upside breadth. With that in mind, let's look at a few top stock trades as we push through the holiday-shortened trading week. ![]()

![]()

![]()

![]() Top stock trades for today No. 1: The Ark Innovation Fund

Top stock trades for today No. 1: The Ark Innovation Fund![]()

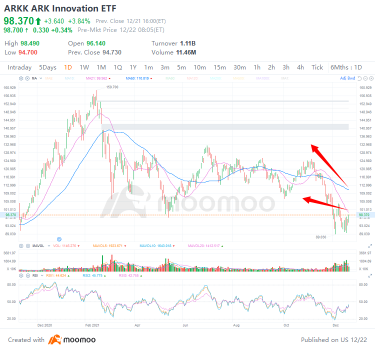

The $ARK Innovation ETF(ARKK.US$ is clearly trying to find its footing to call a bottom, but the selling in growth stocks has been relentless.

On Monday, I was looking for a potential weekly-up rotation over $97.50, following an inside week last week. Then on Monday, ARKK gave bulls and inside day — opening up the potential for a daily-up rotation over the area near $96.50.

It didn't matter which you chose, with ARKK clearing both levels today.

My preference laid with the first rotation — the weekly-up — because it's more significant in my opinion and it would put ARKK back above the bear-market low from May.

From here, let's see if we can get a tag of $100 and the 21-day moving average. Above these measures, and the $103 to $104 area could be on the table. Above that puts the 50-day in play.![]()

![]()

![]()

However, a break of this week's low flashes some rather bright caution signs, in my view.

![]() Top stock trades for today No. 2: Pfizer

Top stock trades for today No. 2: Pfizer![]()

$Pfizer(PFE.US$ gave the robust rotation last week and the subsequent rally to new highs.

This morning it pulled back to its 10-day moving average, which set up the dip-buy opportunity for bulls who were prepared. Bouncing hard off this level now, let's see if shares can get back above $60.![]()

![]()

![]()

North of $60 and the highs are back in play at $61.71, followed by $62.75 and then potentially $69 to $70 down the road.![]()

![]()

![]()

![]() Top trades for today No. 3: Rite Aid

Top trades for today No. 3: Rite Aid![]()

$Rite Aid(RAD.US$ has been a dog for most of the year, as it continues to put in a series of lower highs. But the stock may try to end that trend soon.

Shares are erupting over the 10-day, 21-day and 50-day moving averages on the day. However, the stock is running right into the 10-month moving average and the monthly VWAP measure.

If it can clear this area, the November high is on the table at $15.65. If we get a monthly-up rotation in Rite Aid (and thus, ending the series of lower highs), it could open the door up to $16.50 and the 200-day moving average.

On the downside, though, let's see if the 50-day moving average holds as support until some of Rite Aid's shorter-term moving averages can catch up.![]()

![]()

![]()

Source: InvestorPlace

The $ARK Innovation ETF(ARKK.US$ is clearly trying to find its footing to call a bottom, but the selling in growth stocks has been relentless.

On Monday, I was looking for a potential weekly-up rotation over $97.50, following an inside week last week. Then on Monday, ARKK gave bulls and inside day — opening up the potential for a daily-up rotation over the area near $96.50.

It didn't matter which you chose, with ARKK clearing both levels today.

My preference laid with the first rotation — the weekly-up — because it's more significant in my opinion and it would put ARKK back above the bear-market low from May.

From here, let's see if we can get a tag of $100 and the 21-day moving average. Above these measures, and the $103 to $104 area could be on the table. Above that puts the 50-day in play.

However, a break of this week's low flashes some rather bright caution signs, in my view.

$Pfizer(PFE.US$ gave the robust rotation last week and the subsequent rally to new highs.

This morning it pulled back to its 10-day moving average, which set up the dip-buy opportunity for bulls who were prepared. Bouncing hard off this level now, let's see if shares can get back above $60.

North of $60 and the highs are back in play at $61.71, followed by $62.75 and then potentially $69 to $70 down the road.

$Rite Aid(RAD.US$ has been a dog for most of the year, as it continues to put in a series of lower highs. But the stock may try to end that trend soon.

Shares are erupting over the 10-day, 21-day and 50-day moving averages on the day. However, the stock is running right into the 10-month moving average and the monthly VWAP measure.

If it can clear this area, the November high is on the table at $15.65. If we get a monthly-up rotation in Rite Aid (and thus, ending the series of lower highs), it could open the door up to $16.50 and the 200-day moving average.

On the downside, though, let's see if the 50-day moving average holds as support until some of Rite Aid's shorter-term moving averages can catch up.

Source: InvestorPlace

27

2

Chee Wei6

liked

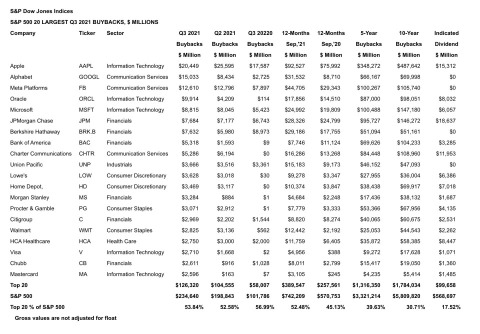

$Apple(AAPL.US$ $Alphabet-C(GOOG.US$ $Meta Platforms(FB.US$ $Microsoft(MSFT.US$ $Oracle(ORCL.US$

The biggest companies in the world are using their significant cash piles to pump up their stock prices into year-end.

About 53.8% of third quarter stock buyback activity was fueled by the top 20 companies, according to new data from S&P Dow Jones Indices senior index analyst Howard Silverblatt. The top 20 list (see below) was headlined by a who's who of the rich and powerful in corporate America: Apple, Alphabet, Meta, Oracle and Microsoft.

These five companies alone repurchased a startling $66.7 billion of their stock in the third quarter. Zoom out a bit, and the repurchase activity of these five companies is even more impressive: $211.6 billion in the aggregate.

The aggressive buying of stock by companies — which has the effect of lowering share counts and juicing earnings per share —in the third quarter was noteworthy beyond the 20 largest companies listed by Silverblatt.

Third quarter buybacks among S&P 500 companies tallied $234.6 billion, up 18% from the second quarter and 130.5% from one year ago. For the 12-months ended September 2021, buybacks totaled $742.2 billion — up 21.8% year-over-year.

The outlook for buyback activity remains strong, said Silverblatt.

The biggest companies in the world are using their significant cash piles to pump up their stock prices into year-end.

About 53.8% of third quarter stock buyback activity was fueled by the top 20 companies, according to new data from S&P Dow Jones Indices senior index analyst Howard Silverblatt. The top 20 list (see below) was headlined by a who's who of the rich and powerful in corporate America: Apple, Alphabet, Meta, Oracle and Microsoft.

These five companies alone repurchased a startling $66.7 billion of their stock in the third quarter. Zoom out a bit, and the repurchase activity of these five companies is even more impressive: $211.6 billion in the aggregate.

The aggressive buying of stock by companies — which has the effect of lowering share counts and juicing earnings per share —in the third quarter was noteworthy beyond the 20 largest companies listed by Silverblatt.

Third quarter buybacks among S&P 500 companies tallied $234.6 billion, up 18% from the second quarter and 130.5% from one year ago. For the 12-months ended September 2021, buybacks totaled $742.2 billion — up 21.8% year-over-year.

The outlook for buyback activity remains strong, said Silverblatt.

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)