absolutemocha

liked

I am celebrating my wife beating stage 3 cancer. This year was her 5 yesr mark of getting her first all clear after multiple operations, radiation, and chemo. After being being given slim odds of being here at this point, she has crushed it and doing great. I wanted to share this because I believe we need to strive for financial freedom, but always remember what is truly important in life…family and health. I wish the best tor all that read this my friends.

124

21

Inversions of key parts of the Treasury yield curve – which occur when yields on shorter-term Treasuries exceed those for longer-dated government bonds.

Historically, yield curve inversions have occurred prior to to recessions, as investors selling out of short-dated Treasurys in favor of long-dated government bonds signals concerns about the health of the economy.

However, it was also said that Fed bond-buying — along with quantitative easing programmes from other central bank...

Historically, yield curve inversions have occurred prior to to recessions, as investors selling out of short-dated Treasurys in favor of long-dated government bonds signals concerns about the health of the economy.

However, it was also said that Fed bond-buying — along with quantitative easing programmes from other central bank...

absolutemocha

liked

Asia stocks to fall as tech rout deepens on Fed

Stocks in Asia are set to open weaker after a selloff in U.S. technology shares and Treasuries accelerated once Federal Reserve minutes signaled interest-rate hikes may be more aggressive than many had expected.

Australian equities slipped at the open, while Japan futures fell. U.S. contracts dropped after the $NASDAQ 100 Index(.NDX.US$ tumbled the most since March as ri...

Stocks in Asia are set to open weaker after a selloff in U.S. technology shares and Treasuries accelerated once Federal Reserve minutes signaled interest-rate hikes may be more aggressive than many had expected.

Australian equities slipped at the open, while Japan futures fell. U.S. contracts dropped after the $NASDAQ 100 Index(.NDX.US$ tumbled the most since March as ri...

57

10

absolutemocha

liked

2021 is the year I started my investment / trading journey, therefore, it’s definitely a year to remember. I must say Moomoo 🐮 and it’s competitor 🐯 (being objective here) have really made investment easy and affordable. Gone were the days where you need to pay hefty commission fees to brokerage firms, which may have deterred many young / new investors from investing. Can I have a hand to see how many investors, who’s like me, started their investment and trading journey on this platform this year?

Anyway, I’ve created a short video to commemorate my meeting with Moomoo, and the review for 2021’s investment journey :)

Have also summarised below the takeaways from my short journey thus far (and I’m sure more to come in future!):

1. Volatility - no matter you’re a investor or trader, you will have to learn to eat and drink volatility for breakfast, lunch and dinner. Look at $Tesla(TSLA.US$, most of the owners (including me) eat 20% ups and downs from time to time. Therefore, what is volatility? 可以吃的吗? Just keep calm and stay invested :)

2. Même stocks - 2021 saw a rise in Meme stocks. $AMC Entertainment(AMC.US$ , $GameStop(GME.US$ , $Digital World Acquisition Corp(DWAC.US$ , $Phunware(PHUN.US$ , just to name a few. I learnt the phrase “pump and dump” in the context of a stock market 😏 (if you know, you know). Stay away from these if your heart cannot handle point 1 - volatility. Bonus takeaway: Reddit’s WSB is a fun place to be in. Fun to watch, but probably not fun to follow their advices. 做个吃瓜民众就好 🍿️. PS: I got burnt by $Snap Inc(SNAP.US$ $IronNet(IRNT.US$ and $ChemoCentryx(CCXI.US$ when trying to trade like god of gambler.

Ironnet - Bought at its peak 😂

3. Staying invested - biggest takeaway from 2021 is to stay invested in fundamentally strong stocks. If you have done enough research, and have high conviction for certain stocks, go for it and stick to it. It will grow and rise with you overtime. Just like you don’t keep changing your partner every other day or month right? 😉 For me, I’ve invested in , $Tesla(TSLA.US$ $Microsoft(MSFT.US$ $Apple(AAPL.US$ $NVIDIA(NVDA.US$ $Meta Platforms(FB.US$ , and aiming for $Sea(SE.US$ $Salesforce(CRM.US$ $CrowdStrike(CRWD.US$ $ARK Innovation ETF(ARKK.US$ $The Trade Desk(TTD.US$ $Disney(DIS.US$ $ProShares Bitcoin Strategy ETF(BITO.US$ $Luminar Technologies(LAZR.US$ and $Palantir(PLTR.US$ next year. For trading, I’m still trying to grasp the gist and technique, and find good stocks with high volatility, where I wouldn’t minding “bagholding” even if I get stuck $BioDelivery Sciences International Inc(BDSI.US$ $LivePerson(LPSN.US$ $AppHarvest(APPH.US$ $AST SpaceMobile(ASTS.US$ $Aurora Cannabis(ACB.US$ $Blink Charging(BLNK.US$ $GoHealth(GOCO.US$ $Bionano Genomics(BNGO.US$

DCA for stock that I have high conviction:

There are lots of noise in the market. If they are killing you and making you can’t sleep at night, delete the brokerage app and don’t log in for a month. Just kidding! Train your heart to be strong and resilient, don’t overreact, don’t get emotional. Be rational. Just like how you deal with challenges in life, overcoming hurdles after hurdles, even when you thought you can’t.

Lastly, they call $Grab Holdings(GRAB.US$ the super app? I would say moomoo $Futu Holdings Ltd(FUTU.US$ is the super app for online brokerage, with such comprehensive features. Make use of the functions like “News” to stay updated, “Comments” section to exchange ideas and learn from others, “Heat map” to see the market sentiment for different industries, “Price Alerts” to keep you posted when you’re busy etc etc. And of course, for beginners, check out the cool courses! The review can go on n on. But I don’t want to test Moomoo’s word count limit 🙊

Anyway, I’ve created a short video to commemorate my meeting with Moomoo, and the review for 2021’s investment journey :)

Have also summarised below the takeaways from my short journey thus far (and I’m sure more to come in future!):

1. Volatility - no matter you’re a investor or trader, you will have to learn to eat and drink volatility for breakfast, lunch and dinner. Look at $Tesla(TSLA.US$, most of the owners (including me) eat 20% ups and downs from time to time. Therefore, what is volatility? 可以吃的吗? Just keep calm and stay invested :)

2. Même stocks - 2021 saw a rise in Meme stocks. $AMC Entertainment(AMC.US$ , $GameStop(GME.US$ , $Digital World Acquisition Corp(DWAC.US$ , $Phunware(PHUN.US$ , just to name a few. I learnt the phrase “pump and dump” in the context of a stock market 😏 (if you know, you know). Stay away from these if your heart cannot handle point 1 - volatility. Bonus takeaway: Reddit’s WSB is a fun place to be in. Fun to watch, but probably not fun to follow their advices. 做个吃瓜民众就好 🍿️. PS: I got burnt by $Snap Inc(SNAP.US$ $IronNet(IRNT.US$ and $ChemoCentryx(CCXI.US$ when trying to trade like god of gambler.

Ironnet - Bought at its peak 😂

3. Staying invested - biggest takeaway from 2021 is to stay invested in fundamentally strong stocks. If you have done enough research, and have high conviction for certain stocks, go for it and stick to it. It will grow and rise with you overtime. Just like you don’t keep changing your partner every other day or month right? 😉 For me, I’ve invested in , $Tesla(TSLA.US$ $Microsoft(MSFT.US$ $Apple(AAPL.US$ $NVIDIA(NVDA.US$ $Meta Platforms(FB.US$ , and aiming for $Sea(SE.US$ $Salesforce(CRM.US$ $CrowdStrike(CRWD.US$ $ARK Innovation ETF(ARKK.US$ $The Trade Desk(TTD.US$ $Disney(DIS.US$ $ProShares Bitcoin Strategy ETF(BITO.US$ $Luminar Technologies(LAZR.US$ and $Palantir(PLTR.US$ next year. For trading, I’m still trying to grasp the gist and technique, and find good stocks with high volatility, where I wouldn’t minding “bagholding” even if I get stuck $BioDelivery Sciences International Inc(BDSI.US$ $LivePerson(LPSN.US$ $AppHarvest(APPH.US$ $AST SpaceMobile(ASTS.US$ $Aurora Cannabis(ACB.US$ $Blink Charging(BLNK.US$ $GoHealth(GOCO.US$ $Bionano Genomics(BNGO.US$

DCA for stock that I have high conviction:

There are lots of noise in the market. If they are killing you and making you can’t sleep at night, delete the brokerage app and don’t log in for a month. Just kidding! Train your heart to be strong and resilient, don’t overreact, don’t get emotional. Be rational. Just like how you deal with challenges in life, overcoming hurdles after hurdles, even when you thought you can’t.

Lastly, they call $Grab Holdings(GRAB.US$ the super app? I would say moomoo $Futu Holdings Ltd(FUTU.US$ is the super app for online brokerage, with such comprehensive features. Make use of the functions like “News” to stay updated, “Comments” section to exchange ideas and learn from others, “Heat map” to see the market sentiment for different industries, “Price Alerts” to keep you posted when you’re busy etc etc. And of course, for beginners, check out the cool courses! The review can go on n on. But I don’t want to test Moomoo’s word count limit 🙊

128

7

absolutemocha

liked

sg’s $Lion-OSPL China L S(YYY.SG$ ??? but do take note the diffce is their expense ratio:

yyy by Lion ocbc is 0.62% where BlackRock charges 0.35% for 2823hk

$iShares FTSE A50 China Index ETF(02823.HK$

yyy by Lion ocbc is 0.62% where BlackRock charges 0.35% for 2823hk

$iShares FTSE A50 China Index ETF(02823.HK$

23

1

absolutemocha

liked

Southeast Asia's ride-hailing giant Grab set to merge with U.S. firm Altimeter Growth. According to the Forbes, The transaction—which will be the world’s largest SPAC deal—will give Grab a valuation of $40 billion.

According to Form F-4, an extraordinary general meeting will be held on November 30, 2021 to consider and vote upon the business combination proposal.

Upon completion of its merger, the SoftBank-backed company will trade on the Nasdaq under ticker symbol GRAB.

Grab will receive about $4.5 billion in cash, which includes $4 billion in a private investment in public equity arrangement.

Grab: Southeast Asia's ride-hailing and delivery giant

![]() Business Overview

Business Overview

SoftBank-backed Grab, founded in 2012, is a Southeast Asia's leading superapp based on GMV in 2020 in each of food deliveries, mobility and the e-wallets segment of financial services, according to Euromonitor.

The company enables millions of people each day to access its driver- and merchant-partners to order food or groceries, send packages, hail a ride or taxi, pay for online purchases or access services such as lending, insurance, wealth management and telemedicine, all through a single “everyday everything” app.

Grab operates across these service sectors in over 400 cities in eight countries in the Southeast Asia region – Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

The company is the dominant player in the region of about 650 million people, though competition is intensifying from rivals such as Gojek, which merged with e-commerce company PT Tokopedia to bulk up.

It is also competing against Delivery Hero SE’s Foodpanda and Deliveroo Plc as well as new entrants such as AirAsia Group Bhd. in the region.

The company started out as a taxi-app, but it has been extending its services over time and expanding into grocery deliveries and financial services, as the pandemic accelerated the adoption of e-commerce and other digital platforms.

Earlier this month, GrabMart signed partnerships with supermarket and grocery chains across Indonesia, Malaysia, the Philippines, Thailand and Vietnam.

At the same time, it tied up with e-commerce firm Lazada to provide same-day delivery services to consumers in Singapore via GrabExpress.

![]() Financial Performance

Financial Performance

Grab generated revenue of $78 million and $396 million in the six months ended June 30, 2020 and June 30, 2021, respectively, representing a year-over-year growth rate of 406%.

Its revenue was $(845) million and $469 million in 2019 and 2020, respectively, representing a year-over-year growth rate of 155%.

According to Grab's final Form F-4, its revenue growth in 2020 and the six months ended June 30, 2021 was driven by an increase in GMV. Its GMV was $5.9 billion and $7.5 billion in the six months ended June 30, 2020 and 2021, representing a YoY growth rate of 28%.

The revenue growth in 2020 was also driven by a decrease in partner and consumer incentives from $2.4 billion in 2019 to $1.2 billion in 2020.

Its net loss was $(1.5) billion and $(1.5)billion in the six months ended June 30, 2020 and 2021, respectively. Net loss in 2019 and 2020 was $(4.0) billion and $(2.7) billion, respectively, representing a year-over-year growth of 31%.

AGC SPAC: Sponsored by institution with notable VC investments

Altimeter Growth Corp.(AGC.US) is a newly formed blank check company, an affiliate of Altimeter Capital Management which is a technology-focused investment firm.

Altimeter Capital has a proven track record of successfully investing in leading technology companies in both the private and public markets. According to its Form F-4,some of its prior investments include Expedia, Zillow, Facebook, Uber, AirBnB, ByteDance, AppDynamics, MongoDB, Okta, Twilio, Unity, and Snowflake.

Through the business combination, Grab could leverage Altimeter Capital’s investment team's capabilities, relationships, network, and deal pipeline to support it in the identification and diligence of potential targets.

Related:

Final F-4 Registration Statement of Grab

$Altimeter Growth Corp(AGC.US$

According to Form F-4, an extraordinary general meeting will be held on November 30, 2021 to consider and vote upon the business combination proposal.

Upon completion of its merger, the SoftBank-backed company will trade on the Nasdaq under ticker symbol GRAB.

Grab will receive about $4.5 billion in cash, which includes $4 billion in a private investment in public equity arrangement.

Grab: Southeast Asia's ride-hailing and delivery giant

SoftBank-backed Grab, founded in 2012, is a Southeast Asia's leading superapp based on GMV in 2020 in each of food deliveries, mobility and the e-wallets segment of financial services, according to Euromonitor.

The company enables millions of people each day to access its driver- and merchant-partners to order food or groceries, send packages, hail a ride or taxi, pay for online purchases or access services such as lending, insurance, wealth management and telemedicine, all through a single “everyday everything” app.

Grab operates across these service sectors in over 400 cities in eight countries in the Southeast Asia region – Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

The company is the dominant player in the region of about 650 million people, though competition is intensifying from rivals such as Gojek, which merged with e-commerce company PT Tokopedia to bulk up.

It is also competing against Delivery Hero SE’s Foodpanda and Deliveroo Plc as well as new entrants such as AirAsia Group Bhd. in the region.

The company started out as a taxi-app, but it has been extending its services over time and expanding into grocery deliveries and financial services, as the pandemic accelerated the adoption of e-commerce and other digital platforms.

Earlier this month, GrabMart signed partnerships with supermarket and grocery chains across Indonesia, Malaysia, the Philippines, Thailand and Vietnam.

At the same time, it tied up with e-commerce firm Lazada to provide same-day delivery services to consumers in Singapore via GrabExpress.

Grab generated revenue of $78 million and $396 million in the six months ended June 30, 2020 and June 30, 2021, respectively, representing a year-over-year growth rate of 406%.

Its revenue was $(845) million and $469 million in 2019 and 2020, respectively, representing a year-over-year growth rate of 155%.

According to Grab's final Form F-4, its revenue growth in 2020 and the six months ended June 30, 2021 was driven by an increase in GMV. Its GMV was $5.9 billion and $7.5 billion in the six months ended June 30, 2020 and 2021, representing a YoY growth rate of 28%.

The revenue growth in 2020 was also driven by a decrease in partner and consumer incentives from $2.4 billion in 2019 to $1.2 billion in 2020.

Its net loss was $(1.5) billion and $(1.5)billion in the six months ended June 30, 2020 and 2021, respectively. Net loss in 2019 and 2020 was $(4.0) billion and $(2.7) billion, respectively, representing a year-over-year growth of 31%.

AGC SPAC: Sponsored by institution with notable VC investments

Altimeter Growth Corp.(AGC.US) is a newly formed blank check company, an affiliate of Altimeter Capital Management which is a technology-focused investment firm.

Altimeter Capital has a proven track record of successfully investing in leading technology companies in both the private and public markets. According to its Form F-4,some of its prior investments include Expedia, Zillow, Facebook, Uber, AirBnB, ByteDance, AppDynamics, MongoDB, Okta, Twilio, Unity, and Snowflake.

Through the business combination, Grab could leverage Altimeter Capital’s investment team's capabilities, relationships, network, and deal pipeline to support it in the identification and diligence of potential targets.

Related:

Final F-4 Registration Statement of Grab

$Altimeter Growth Corp(AGC.US$

+3

83

8

absolutemocha

liked

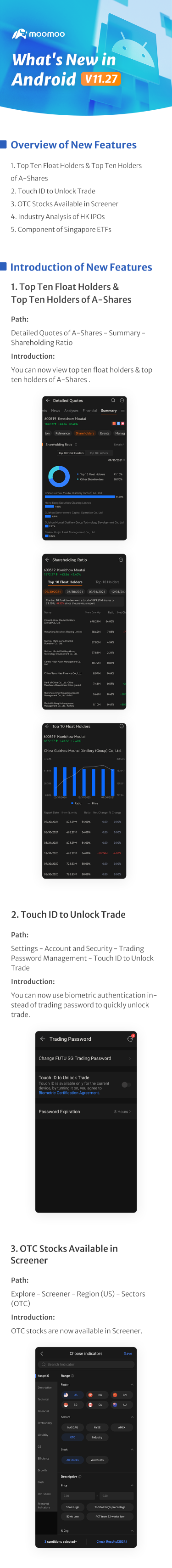

Hello mooers~

Welcome back to "What's new in moomoo"!

Spoiler: you can have the chance to win reward points in the end. Don't miss it!

This time we have brought you the new features from Android v11.27, including face ID (or touch ID) to unlock trade, OTC indicator added in screener, industry analysis viewable in HK IPOs, and even more. Why don't you scroll down to have a quick look? More new features await!

![]() Let's vote! And here comes the question:

Let's vote! And here comes the question:

In a relatively long run (within 3-5 years), which industry of stocks do you most bullish and will HODL?![]()

Leave your comment before Nov. 29th 24:00 ET and win 66 points! (at least 30 words to qualify)

Welcome back to "What's new in moomoo"!

Spoiler: you can have the chance to win reward points in the end. Don't miss it!

This time we have brought you the new features from Android v11.27, including face ID (or touch ID) to unlock trade, OTC indicator added in screener, industry analysis viewable in HK IPOs, and even more. Why don't you scroll down to have a quick look? More new features await!

In a relatively long run (within 3-5 years), which industry of stocks do you most bullish and will HODL?

Leave your comment before Nov. 29th 24:00 ET and win 66 points! (at least 30 words to qualify)

290

18

absolutemocha

liked and commented on

Candlestick patterns, which are formed by either a single candlestick or by a succession of two or three candlesticks, are some of the most widely used technical indicators for identifying potential market reversals or trend change. ![]()

![]()

![]()

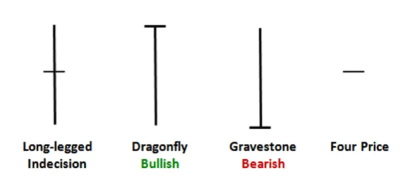

Doji candlesticks, for example, indicate indecision in a market that may be a signal for an impending trend change or market reversal. The singular characteristic of a doji candlestick is that the opening and closing prices are the same, so that the candlestick body is a flat line. The longer the upper and/or lower "shadows", or "tails", on a doji candlestick – the part of the candlestick that indicates the low-to-high range for the time period – the stronger the indication of market indecision and potential reversal.

There are several variations of doji candlesticks, each with its own distinctive name, as shown in the illustration below:![]()

![]()

![]()

The typical doji is the long-legged doji, where price extends about equally in each direction, opening and closing in the middle of the price range for the time period. The appearance of the candlestick gives a clear visual indication of indecision in the market. When a doji like this appears after an extended uptrend or downtrend in a market, it is commonly interpreted as signaling a possible market reversal, a trend change to the opposite direction.![]()

![]()

![]()

The dragonfly doji, when appearing after a prolonged downtrend, signals a possible upcoming reversal to the upside. Examination of the price action indicated by the dragonfly doji explains its logical interpretation. The dragonfly shows sellers pushing price substantially lower (the long lower tail), but at the end of the period, price recovers to close at its highest point. The candlestick essentially indicates a rejection of the extended push to the downside.![]()

![]()

![]()

The gravestone doji's name clearly hints that it represents bad news for buyers. The opposite of the dragonfly formation, the gravestone doji indicates a strong rejection of an attempt to push market prices higher, and thereby suggests a potential downside reversal may follow.![]()

![]()

![]()

The rare, four price doji, where the market opens, closes, and in-between conducts all buying and selling at the exact same price throughout the time period, is the epitome of indecision, a market that shows no inclination to go anywhere in particular.![]()

![]()

![]()

There are dozens of different candlestick formations, along with several pattern variations. It's certainly helpful to know what a candlestick pattern indicates – but it's even more helpful to know if that indication has proven to be accurate 80% of the time.![]()

![]()

![]()

Doji candlesticks, for example, indicate indecision in a market that may be a signal for an impending trend change or market reversal. The singular characteristic of a doji candlestick is that the opening and closing prices are the same, so that the candlestick body is a flat line. The longer the upper and/or lower "shadows", or "tails", on a doji candlestick – the part of the candlestick that indicates the low-to-high range for the time period – the stronger the indication of market indecision and potential reversal.

There are several variations of doji candlesticks, each with its own distinctive name, as shown in the illustration below:

The typical doji is the long-legged doji, where price extends about equally in each direction, opening and closing in the middle of the price range for the time period. The appearance of the candlestick gives a clear visual indication of indecision in the market. When a doji like this appears after an extended uptrend or downtrend in a market, it is commonly interpreted as signaling a possible market reversal, a trend change to the opposite direction.

The dragonfly doji, when appearing after a prolonged downtrend, signals a possible upcoming reversal to the upside. Examination of the price action indicated by the dragonfly doji explains its logical interpretation. The dragonfly shows sellers pushing price substantially lower (the long lower tail), but at the end of the period, price recovers to close at its highest point. The candlestick essentially indicates a rejection of the extended push to the downside.

The gravestone doji's name clearly hints that it represents bad news for buyers. The opposite of the dragonfly formation, the gravestone doji indicates a strong rejection of an attempt to push market prices higher, and thereby suggests a potential downside reversal may follow.

The rare, four price doji, where the market opens, closes, and in-between conducts all buying and selling at the exact same price throughout the time period, is the epitome of indecision, a market that shows no inclination to go anywhere in particular.

There are dozens of different candlestick formations, along with several pattern variations. It's certainly helpful to know what a candlestick pattern indicates – but it's even more helpful to know if that indication has proven to be accurate 80% of the time.

106

15

absolutemocha

liked

$Alibaba(BABA.US$ I have entered into baba. I bought calls at 145 strike. Expiry 22nd Jan 2022. Based on bollinger band, its out of 2SD and RSI indicator is 28. Very oversold. Lastly, divergence of stock price and volume. This are 3 reasons that made me enter despite it broke a new low today. I believe it will have at least a technical rebound to retest 20SMA as resistance. If it doesn't break, I'll sell at a small profit. If it breaks 20SMA, I'll hold to 178 resistance.

Let's see if we will get a technical rebound soon or even a rebound from here.

As always, trade safe & invest wise!

Let's see if we will get a technical rebound soon or even a rebound from here.

As always, trade safe & invest wise!

17

9

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)